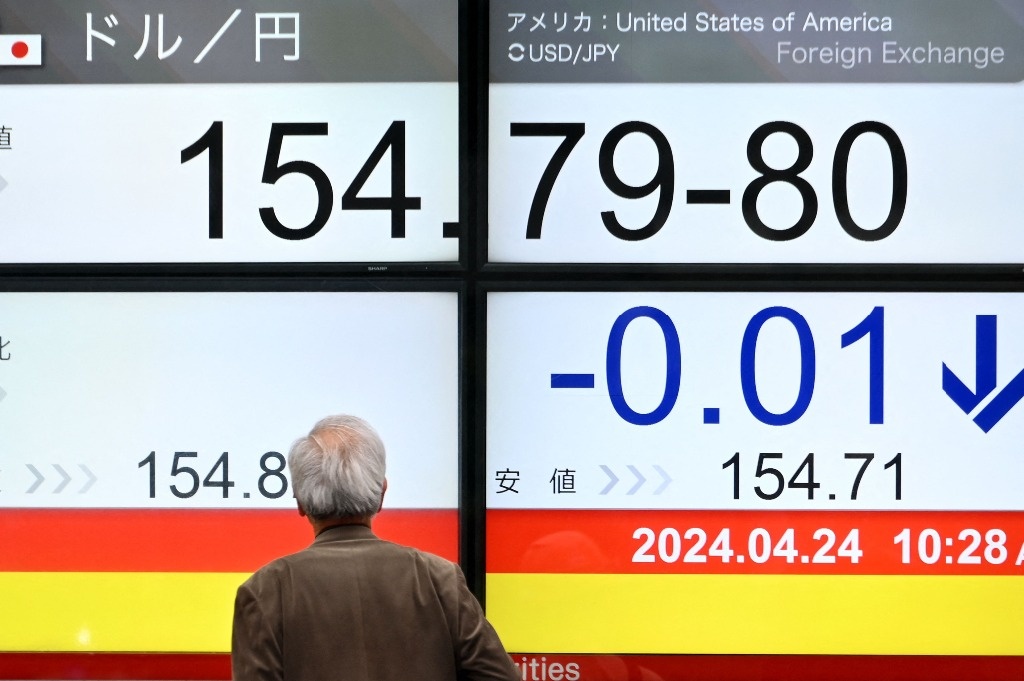

New York/London. The yen fell against the dollar on Wednesday to its lowest level since the mid-1990s, as markets watched for any signs of intervention by Japanese authorities to shore up its currency.

For its part, the dollar rose, recovering against most currencies from declines caused by Tuesday’s data showing that U.S. business activity slowed this month.

The dollar hit a high of 155.17 yen JPY=EBS, its highest level since the mid-1990s, before retreating slightly, a sign of nervous markets around the 155 yen level. In its last quote, the greenback advanced 0.2 percent, to 155.08 units.

The weakness of the yen has stoked market anxiety over possible currency intervention. Japanese Finance Minister Shunichi Suzuki said on Tuesday that last week’s meeting with his counterparts from the United States and South Korea had laid the groundwork for Tokyo to act against excessive movements in the Japanese currency.

The market expects the Bank of Japan to leave monetary policy and bond purchase amounts unchanged at the end of its two-day meeting on Friday, after raising interest rates last month for the first time since 2007.

The yen’s slide comes after a series of strong U.S. inflation data pushed the dollar to five-month highs and reinforced bets against the Federal Reserve cutting rates this year.

The dollar index =USD, which measures the performance of the greenback against a basket of six major currencies, rose 0.1 percent to 105.82 units, after previously touching its lowest level since April 12, at 105.59.

The euro EUR=EBS was trading almost steady at $1.0698 after Tuesday’s 0.4 percent rally, and the British pound GBP=D3 was also little changed at $1.2445.

#Yen #Sinks #Lowest #Level #hits #dollar

– 2024-05-01 10:01:37