Bitcoin is heading for $100,000, but the KryptoWährung Handel community is very quiet. After Trump was elected, everyone was looking forward to the influx of liquidity. However, apart from the meme hype activated by Binance, all altcoins were far behind BTC. Why? Why is it that when Bitcoin rises recently, altcoins fall, and when Bitcoin falls, altcoins also fall?

The answer may lie in $MSTR stock.

MicroStrategy buying Bitcoin is not new in the cryptocurrency circle. It has become a BTC index in the US stock market since the last cycle. However, in September this year, MSTR attracted the attention of the market again. This time, it was because MSTR was launched in advance before the rise of Bitcoin price, and maintained a continuous premium to Bitcoin in the subsequent market.

So many people started discussing Why is MSTR at a premium? In fact, MicroStrategy quietly started a new coin buying strategy called premium issuance in the middle and late last year.

Further reading: The strategy of issuing bonds to buy coins has not changed, why did the MSTR premium suddenly soar?

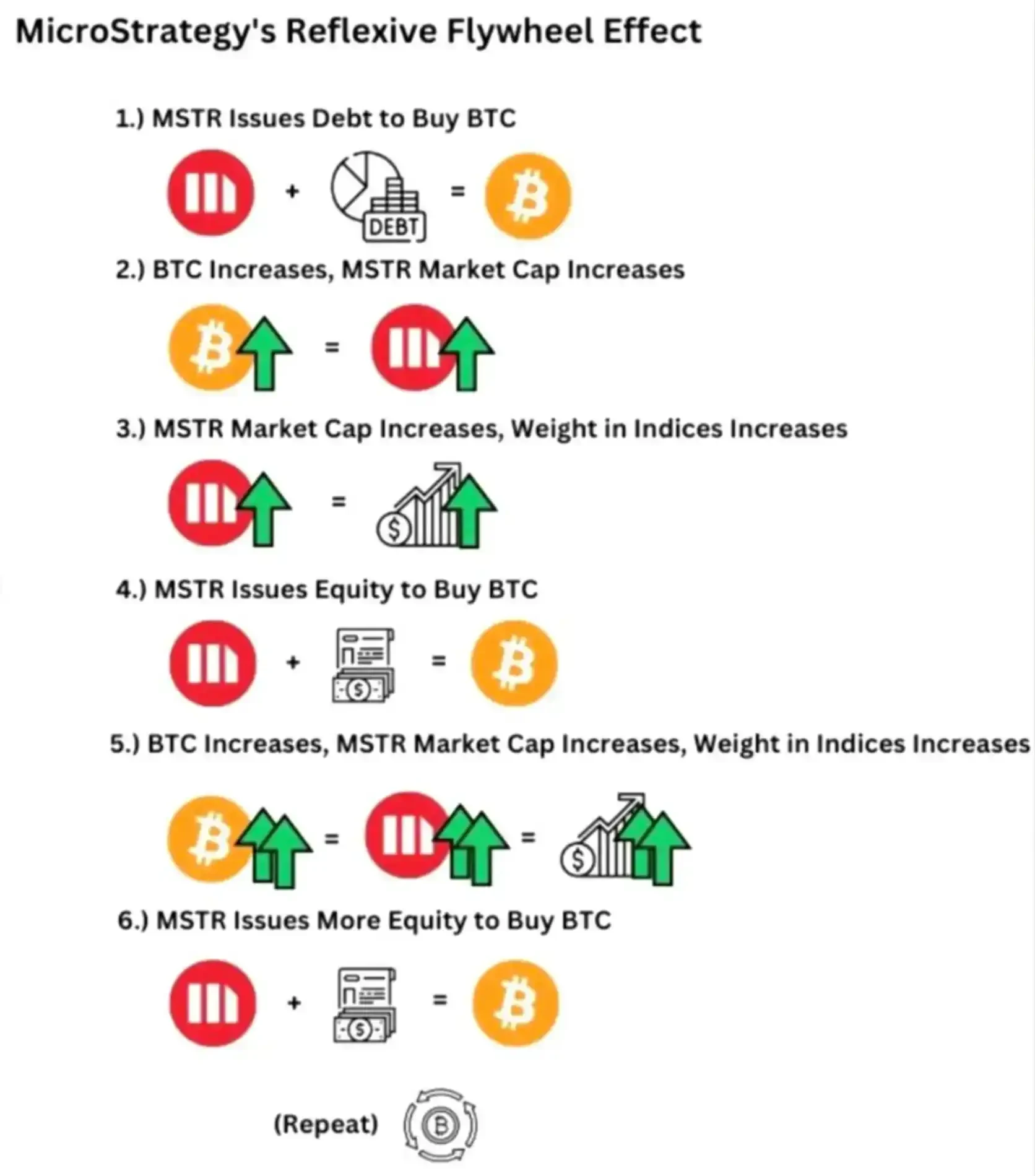

Simply put, MicroStrategy has been raising funds to purchase BTC by issuing bonds, which means that each share of MSTR represents a certain amount of BTC (which is also the reason why it is regarded as the US stock BTC index). However, the premium issuance model is simpler and more immediate: when the price of Bitcoin rises and the companys market value rises, the exchange rate of MSTR to Bitcoin will generate a premium.

At this time, the company issues additional MSTR shares and buys more Bitcoin at a premium than the corresponding amount of shares. In this way, the BTC corresponding to each share of MSTR will further increase, which means that the companys market value and the value of MSTR will also increase, and then the cycle will continue.

To sum up in one sentence: The more MSTR is issued, the more valuable it becomes.

What does this have to do with the Bitcoin bull market? In addition to the fact that MicroStrategy accounts for 5% of the total circulation, the current US stock market seems to be experiencing a Paradigm shift. MicroStrategy CEO Michael Saylor has been emphasizing this year that there will be more and more MSTRs in the US stock market, and he also called his model infinite money glitch. Many people did not take it seriously at first, but recently when US stock giants such as Microsoft also began to explore Bitcoin finance, you can feel that the gears of fate have begun to turn.

In other words, if Saylors vision continues to become a reality, more and more US stock companies will adopt the premium issuance of Bitcoin finance, and the price of Bitcoin will be further tied to US stocks. And these huge liquidity will be completely undertaken by BTC alone, and have nothing to do with other altcoins (this is also one of the reasons why the inflow of Bitcoin ETF has surged recently, while the Ethereum ETF has not made any waves).

It is foreseeable that if the crypto industry stops in narrative innovation and practical ability, Bitcoin will gradually drift away from Crypto. In this context, there are only two betas left in the bull market: one is Bitcoin, and the other is Solana, which undertakes the liquidity in the circle.

In todays market, the hype about Asian elements is particularly heated, from the smiling dolphin photo in Japans Miyajima Aquarium to the hype about Korean dolls represented by Loopy. European and American meme players also seem to have a strong interest in Asian culture, and they seem willing to pay for memes with Asian elements. dolphin On the evening of October 9, the account @XData under the X platform released a photo of a smiling dolphin. This was the second time that the official X tweeted about the zoo meme. The whale had three names, $Miharu, $HANBAO, and $TAOTAO, but his exact name was not determined. Later, it was confirmed that the whale was Miharu from Miyajima Aquarium. The SOL version of Miharu attracted the entry of the giant whale…

© Copyright Notice

The copyright of the article belongs to the author. Please do not reprint without permission.

**To what extent do you believe MicroStrategy’s “premium issuance” strategy can be sustained in the long term, and what are the potential risks and rewards for both MicroStrategy and the broader Bitcoin market?**

## World Today News Interview

**Topic:** The Rise of Bitcoin and the Potential Impact of MicroStrategy’s Strategy

**Guests:**

* **Dr. Amelia Chen:** Crypto Economist and Associate Professor at MIT Sloan School of Management

* **Mr. Jason Lee:** Experienced Crypto Trader and Founder of “CryptoPulse,” a popular market analysis website.

**Host:** Welcome to World Today News. Today, we’re diving deep into the intriguing relationship between Bitcoin’s surge, MicroStrategy’s unique investment strategy, and the potential consequences for the broader cryptocurrency market. Joining us are two distinguished guests, Dr. Amelia Chen

and Mr. Jason Lee, both experts in the field of cryptocurrency.

**Section 1: Bitcoin’s Reawakening and the MicroStrategy Effect**

**Host:** Let’s start with the big picture. Bitcoin is seeing a resurgence, seemingly heading towards $100,000. Dr. Chen, what are the key factors driving this renewed optimism? Is it just hype, or are there deeper fundamental reasons behind this upward trajectory?

**Dr. Chen:** Thank you for having me. While market sentiment undoubtedly plays a role, there are several fundamental factors contributing to Bitcoin’s resurgence.

**Host:** Mr. Lee, the article mentions MicroStrategy as a potential catalyst for this bull run. Can you elaborate on their “premium issuance” strategy and how it might be influencing Bitcoin’s price?

**Mr. Lee:**

Absolutely. MicroStrategy has become a fascinating case study. They’ve effectively linked their stock value to Bitcoin’s performance through their unique issuance strategy. This essentially creates a feedback loop where rising Bitcoin prices lead to higher MSTR valuations, allowing them to acquire even more Bitcoin.

**Host:** This sounds like a self-reinforcing cycle. Do you see this pattern continuing, or is there a risk of it becoming unsustainable?

**Section 2: The ‘Bitcoin Only’ Narrative and its Impact on Altcoins**

**Host:** The article raises an interesting point about Bitcoin potentially becoming decoupled from other altcoins. Dr. Chen, what are your thoughts on this “Bitcoin only” narrative? Is it a realistic scenario, and what implications could it have for the broader crypto ecosystem?

**Dr. Chen:** It’s a complex situation. While Bitcoin undeniably holds a dominant position, dismissing the potential of altcoins entirely seems premature.

**Host:** Mr. Lee, from a trader’s perspective, does this shift in focus toward Bitcoin present both opportunities and challenges?

**Mr. Lee:**

Definitely. Bitcoin’s strength attracts attention and liquidity, which can be beneficial for those looking to capitalize on its upward momentum. However, it could also lead to increased volatility and potentially leave other promising projects behind.

**Section 3: Looking Ahead: The Future of Bitcoin and the Crypto Landscape**

**Host:** Looking forward, what are your predictions for the future of Bitcoin and the overall crypto market? Dr. Chen, any insights you can share?

**Dr. Chen:**

The future remains uncertain, but I believe we’re witnessing an evolution of the crypto market.

**Host:** Mr. Lee, any final thoughts or advice for our viewers navigating these turbulent waters?

**Mr. Lee:**

It’s crucial to remember that crypto is still a relatively nascent market. Education, thorough research, and a cautious approach are essential for anyone looking to participate.

**Host:** Thank you both for providing such insightful perspectives. We’ve covered a lot of ground today, leaving us with plenty to ponder about the future of Bitcoin and the wider crypto landscape.