Marcel Barmeier

In the Oesterreichische Nationalbank (OeNB) blog entry from September 20, 2024, my colleague Stefan W. Schmitz shows how important commercial real estate loans are in Austria. Here I explain why commercial real estate loans pose an increased risk to financial market stability in Austria in the event of a deterioration in the economic environment. The methodologies used and the results of our system risk analysis are also explained. This systemic risk analysis served as the basis for the decision of the Financial Market Stability Board (FMSG) to introduce a sectoral systemic risk buffer for commercial real estate loans of initially 1% recommend.

Why do we need a systemic risk analysis?

Let’s first take a step back and ask ourselves what systemic risk is: Systemic risks are risks that, if they occur, can disrupt the entire financial system or significant parts of it and thus have significant negative effects on the real economy. Systemic risks differ from bank-specific risks, among other things, in that if they occur, a large number of banks would be affected at the same time and there are interactions between market participants: Real estate sales by some market participants can also have an impact on the real estate values of other market participants. In the systemic risk analysis for commercial real estate loans, we therefore determine whether Austrian banks‘ commercial real estate financing can lead to disruptions in the financial system in an unfavorable macroeconomic environment.

How is the systemic risk analysis for commercial real estate financing carried out?

Together with my colleagues Sebastian Rötzer (Financial Market Authority FMA) and David Liebeg (OeNB), I developed a model for systemic risk analysis, which is described in detail in the study “Systemic risks from commercial real estate lending of Austrian banks” in the Financial Stability Report 48.

The basis for this is information on macroeconomic developments, data on balance sheets, profit and loss accounts and the cash flow statements of real estate companies as well as on credit relationships of Austrian banks. When it comes to real estate companies, we differentiate between: Non-profit building associations (GBVs) and profit-oriented real estate companies. Our analysis of company data shows that GBVs generally involve less risk. This can be seen, among other things, in the equity ratios. While real estate companies have an average lower equity ratio compared to companies from other sectors, profit-oriented real estate companies differ from GBVs within the sector primarily in their more frequent negative or comparatively low positive equity ratios. A similar picture emerges when looking at companies’ available liquidity (e.g. bank balances). Due to their lower level of equity and liquidity, profit-oriented real estate companies are relatively more vulnerable to events such as interest rate increases or declines in sales.

Our systemic risk analysis follows the principle of a “what if” approach. The effects on the banking system in an “adverse” macroeconomic scenario are determined. This scenario does not represent a forecast of future developments, but rather represents a serious but plausible deterioration in the economic environment. Our systemic risk analysis simulates the effects of a collapse in real estate prices of around 30%, a decline in gross domestic product of 5% and unchanged interest rates since the end of 2023 on real estate companies and banks.

In this simulation we estimate the effects of the adverse scenario on key company figures. In particular, we determine under which economic conditions real estate companies would find themselves in financial distress due to insolvency or excessive indebtedness. The effects on bank balance sheets will then be examined. We estimate the losses for banks from commercial real estate loans and examine the impact on available capital.

Analysis shows increased systemic risks from commercial real estate financing

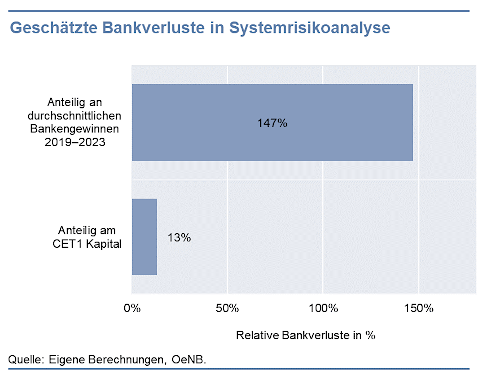

The results show that commercial real estate loans pose an increased risk to financial market stability in Austria. This is particularly evident in the increase in defaulted loans and losses for the Austrian banking system. In the “adverse” scenario, the proportion of defaulted commercial real estate loans (nonperforming loans ratio – “NPL”) increases to a level that was observed in historical commercial real estate crises. This also increases the banks’ expected losses. The losses in this severe scenario amount to 13% of the bank’s capital. A comparison with the average profits of banks in recent years shows that the estimated losses significantly exceed bank profits. The difference in risk between non-profit building associations and profit-oriented real estate companies is also reflected in the model results. The vast majority of 98% of losses in systemic risk analysis are attributable to profit-oriented real estate companies.

Financial Stability Board recommends the introduction of a sectoral systemic risk buffer

Based on the results of the systemic risk analysis for commercial real estate financing, the FMSG recommends that the FMA set a sectoral systemic risk buffer of initially 1% as of July 1, 2025. This means that Austrian banks have to hold additional capital for losses on commercial real estate loans. How much capital needs to be held depends on the amount of commercial real estate loans: the more loans have been granted, the more capital the banks have to hold. Banks that have not granted loans to real estate companies would therefore not have to meet any additional capital requirements. Since non-profit building associations pose a lower risk, it is recommended that they be excluded from the regulation, which means that no additional capital would have to be made available for these loans. OeNB calculations show that the buffer will not restrict economic activities in this segment: most banks have sufficient free capital, even beyond regulatory and supervisory requirements. If the demand for loans cannot actually be met by individual banks with limited capital resources, banks with better capital resources can meet the demand – provided the real estate companies’ creditworthiness is correct.

The views expressed do not necessarily correspond to the views of the OeNB or the Eurosystem.