Jakarta, CNBC Indonesia – Capital market participants were surprised by the circulation of documents mini exhibit owned by PT Bukalapak.com in connection with the initial public offering (IPO) plan to be submitted on the Indonesia Stock Exchange. Mini exhibits usually presented by prospective issuers when they want to go to the IDX.

In the mini-exposure document obtained by CNBC Indonesia from market sources, the IPO schedule (timeline), along with legal consultants and global and domestic securities underwriters, is revealed.

It is stated that Bukalapak will offer shares of a maximum of 25% of the company’s issued and paid-up capital.

In addition, along with the IPO, Bukalapak will also offer allocation shares for employees alias employee stock allocation (ESA) of a maximum of 0.1% of the total IPO shares offered.

|

Photo: Bukalapak.com IPO Timeline Timeline IPO Bukalapak.com- – |

Not only that, Bukalapak will also allocate shares for management in the program management and employee stock option plan (MESOP) up to a maximum of 4.9% of the total offering and paid-in capital after the IPO.

Interestingly, the company submitted a stock code to be approved by the IDX, namely OPEN.

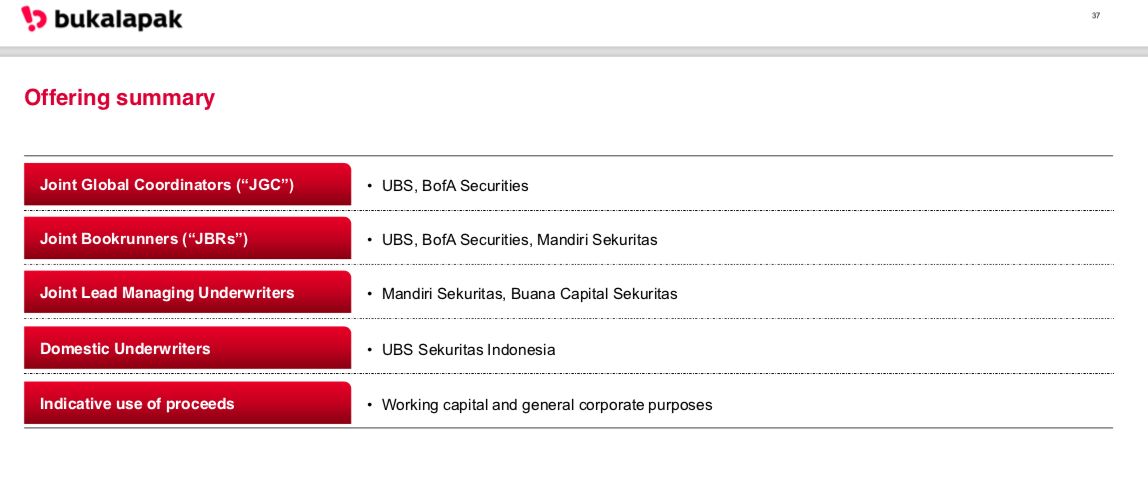

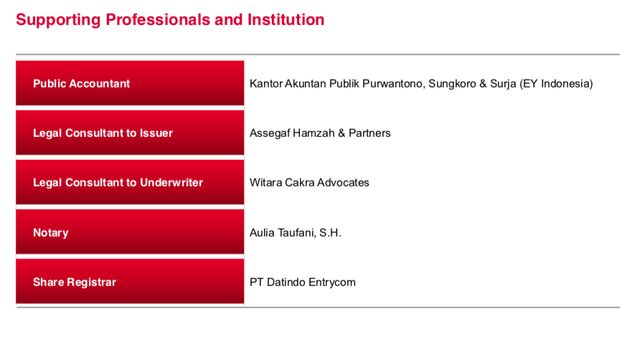

The Company appoints at least 5 underwriters which are divided into: joint global coordinator: UBS (global), BofA Securities. Lalu joint bookrunners: UBS (global), BofA Securities, and Mandiri Sekuritas. Then joint lead managing underwriters: PT Mandiri Sekuritas, PT Buana Capital Sekuritas. Then domestic underwriters: PT UBS Sekuritas Indonesia.

Photo: Bukalapak IPO Data Photo: Bukalapak IPO DataBukalapak IPO Data- – |

CNBC Indonesia tried to confirm this Bukalapak document to IDX management. However Director of Corporate Appraisal AT, I Gede comfortable Yetna has not yet given a definite answer.

Previous party AT mentions that there is already an incoming document, although it has not been confirmed that the document belongs to it Bukalapak.

“Regarding e-commerce in the pipeline, there is e-commerce that has submitted documents. For names of prospective listed companies, the Exchange has not been able to submit until OJK has given approval for the issuance of the initial prospectus to the public as stipulated in OJK Rule Number IX.A.2,” said big comfortable Yetna, Tuesday (8/6/2021).

Photo: Bukalapak IPO Data Photo: Bukalapak IPO DataBukalapak IPO Data- – |

Meanwhile, the management of PT Elang Mahkota Teknologi Tbk (EMTK), a shareholder of Bukalapak, in a public presentation, stated that EMTK’s subsidiary, namely PT Kreatif Media Karya, does have shares in PT Bukalapak.com.

“Which one [Bukalapak] is in the process of submitting an application for an initial public offering at the Financial Services Authority (OJK) and the Indonesia Stock Exchange (IDX). Regarding the amount of shares and the acquisition of funds, it will be discussed and determined by BukaLapak’s internal management,” wrote EMTK management.

Previously, the plan to offer shares of one of the Indonesian e-commerce giants, Bukalapak, had been widely discussed by the market.

As quoted by Reuters, Wednesday (16/6/2021), the IPO plan is estimated to be worth US$800 million or equivalent to Rp. 11.40 trillion, according to two sources familiar with the plan.

Bukalapak’s IPO is one of two big technology companies that are planning this year and is being awaited by domestic market players besides GoTo.

This IPO is expected to be the largest in Indonesia in 10 years and the largest ever in a country, by a startup. After that, the possibility of GoTo’s IPO being the next biggest milestone after Bukalapak.

Capitalizing on the sharp increase in investor interest in Southeast Asia’s fast-growing technology sector, Bukalapak, Indonesia’s fourth largest e-commerce company, will sell 10% to 15% of the company’s shares from a valuation of around US$ 4 to US$ 5 billion, sources said that.

The listing prospectus is said to have been submitted to the IDX. IPO proceeds range between US$ 500 million and US$ 800 million, depending on investor demand and market conditions.

(bag bag)

– .