It is often said that real estate needs trust. This anxiety-provoking period only underscores a triple impact: health, economic and psychological.

Construction in slow motion

The construction sector alerts the government and asks for a temporary stop of construction sites to organize. The National Federation of Public Works, Capeb (building craftsmen) and the FFB are categorical: “Faced with protective measures that are still not provided for employees, in particular in the absence of protective masks, in the face of contractors, who shut down certain worksites, faced with major supply difficulties, faced with certain interventions by the police to interrupt worksites, the BTP is confronted with disorganization, health risks and concern business leaders and employees, ”said the press release. The construction industry, which employs 2 million people, is asking to temporarily stop work, except for urgent interventions, and to give it ten days to organize itself.

Read also >> Partial unemployment and mortgage: in which cases can you adjust or postpone your monthly payments?

–

Residential markets in pause mode

In the new, for individuals, acquisition projects are postponed one after the other. Between the time of booking an accommodation and the handing over of the keys, it takes on average between one and a half and two years (apart from any recourse). To project into the future, it is currently difficult to embark on an off-plan purchase (sale in the future state of completion). Especially since the new sector keeps repeating that it is necessary to build affordable housing.

Falling ad prices in recent days

In the former, the market is also in pause mode. We do not note an influx of new goods put on the market, but on several professional ad portals, there are price reductions on goods put on sale. It is the only novelty and it is of size, very many advertisements see their price down. Is this the start of a turnaround? Is it just a temporary effect if transactions are suspended?

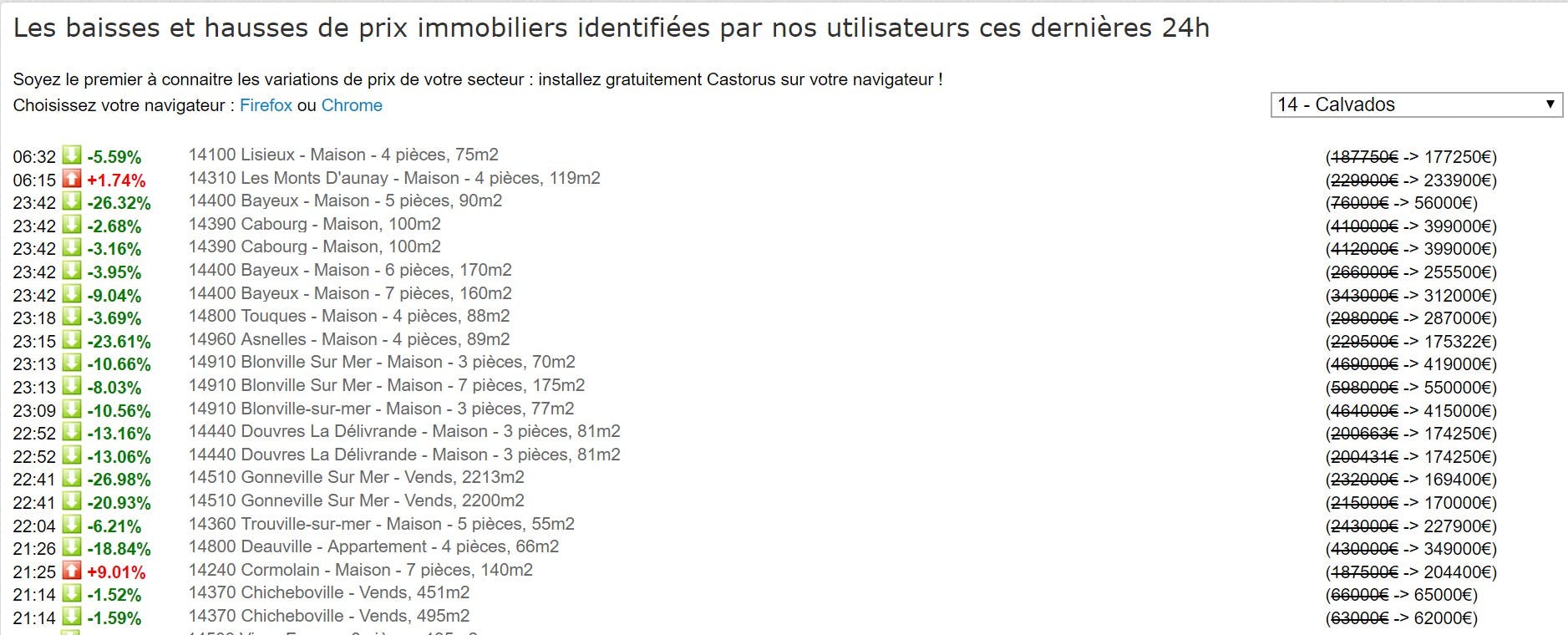

Examples here with the Castorus site which gives in real time (day and time) the evolution of the prices of the advertisements on various real estate portals. Prices are going down (in green), rather than up (in red). This reflects the concern of those who want to recover money, need cash and say to themselves, if we wait too long, it will drop even more. Thus, in recent days, some have been rushing to change their prices.

Examples of price changes displayed in Paris

Examples of price changes displayed in Calvados

Psychological factors

For Guy Marty, founder of pierre papier.fr, specialist in investments and questions relating to savings, the real estate market could have a difficult future. “The psychological effect cannot be controlled. However, the health of the real estate market is highly dependent on purely psychological factors. If a sufficient number of potential buyers put themselves in a waiting position, the sellers can no longer sell. The market is seized up. Buyers expect even more. The number of transactions is falling, and so are the prices. »Warns Guy Marty. “If the coronavirus epidemic continues, and the real estate market is seized up. There will inevitably be fewer buyers. This will be felt after a while, on housing prices, ”he adds.

Franck Vignaud, of the Real Estate Laboratory anticipates a slowdown: “If the epidemic continues, it will inevitably have an impact on the production of new housing and on the volume of transactions, especially if quarantine measures are imposed. It is hard to imagine a collapse in prices but rather a market that would idle, sellers and buyers waiting for a return to normal to put their goods on sale or to resume their research. It is also not excluded that there is a form of post-crisis runaway to catch up with mobility or purchasing needs which may be thwarted if the crisis takes hold.

A drop in transactions and prices depending on the size and duration

Philippe Crevel, director of the Cercle de l’Epargne is categorical: “Central banks are condemned to keep rates low throughout the crisis in order to fight against the deflationary spiral. Real estate could benefit from this, but the current situation marked by a shock in supply and demand against the backdrop of an epidemic is by nature very anxiety-provoking. The potential loss of income and the precariousness of the situation should lead households to favor precautionary savings to the detriment of long-term investments. Real estate could suffer from the situation with a slowdown in transactions in the coming weeks. The possible fall in prices will depend on the duration and extent of the crisis.

Between expectations and opportunities?

Guy Marty urges people to remain calm: “These periods of drama and uncertainty are high risk in asset management. These are indeed the moments when: A few take advantage of this type of period to accelerate the constitution of their heritage. Fewer people are keeping a cool head, maintaining their savings discipline, and will then rejoice when the markets rise, as they always do. Many people are actually making bad decisions, damaging their long-term wealth, by interrupting what they started doing. “

As for Philippe Crevel, he militates in favor of waiting “In a crisis of this nature, haste is a bad advisor. For buyers, there may be some good deals appearing in the coming weeks, some people may be in need of cash. For sellers, it is always difficult to put a good on the market when buyers are rare and have their minds elsewhere. It is wiser to wait for the situation to stabilize. “

We don’t buy a product, we buy a home

In these uncertain times, it is better to wait. Do not rush, even if it means postponing your purchase or sale plan. One thing is certain, at the end of the crisis, the value of goods may be reviewed and corrected. There has probably been too much abuse. This may be an opportunity to get back to basics. You don’t buy a product, you buy a home.

Olivier Marin

To read, the point of view of Laurent Vimont, president of Century 21

the point of view of Sandrine Allonier, Vousfinancer

–

/data/photo/2020/09/14/5f5f6ab9ec90b.jpg)