Recommended by Daniel Dubrovsky.

Get your free stock forecast

Market sentiment has improved markedly in the past week, with Wall Street, Nasdaq 100, S&P 500 and Dow Jones futures gaining around 8.4%, 5.7% and 4.02% respectively . Risk appetite also improved globally: the Dax 40, Nikkei 225 and Hang Seng rose by 5.68%, 3.91% and 7.21% respectively.

The key driver of sentiment last week was the October US inflation report. Both stocks and the core CPI rate unexpectedly weakened. Traders are rushing to raise Fed rates in 2023 as the chances of a 75 basis point hike in December all but disappear overnight. The US dollar collapses as gold prices rise

from the point of view of the financial markets These data overshadow the mid-term elections in the United States. where the expectations of the Republican red wave faltered. Cryptocurrencies He was in a prime position last week during FTX’s bankruptcy filing after Binance backed away from a possible acquisition. Despite the stock’s gains, Bitcoin fell about 20% last week.

As for risks from economic events, the US will see more Fedspeak, PPI and retail sales data next week. Unexpectedly strong performances here could have carried a degree of risk in reversing some of the market’s moves towards last week’s CPI print. for British pounds and dollarsCanada The UK and Canada to release their inflation data.

Meanwhile, the G-20 countries will meet in Bali. Indonesia midweek Tensions are running high during the war in Ukraine and inflation continues to run high. Earnings season has begun with major retailers like Walmart and Home Depot. What else is in store for financial markets in the coming weeks?

Recommended by Daniel Dubrovsky.

Get your free predictions on the best trading opportunities.

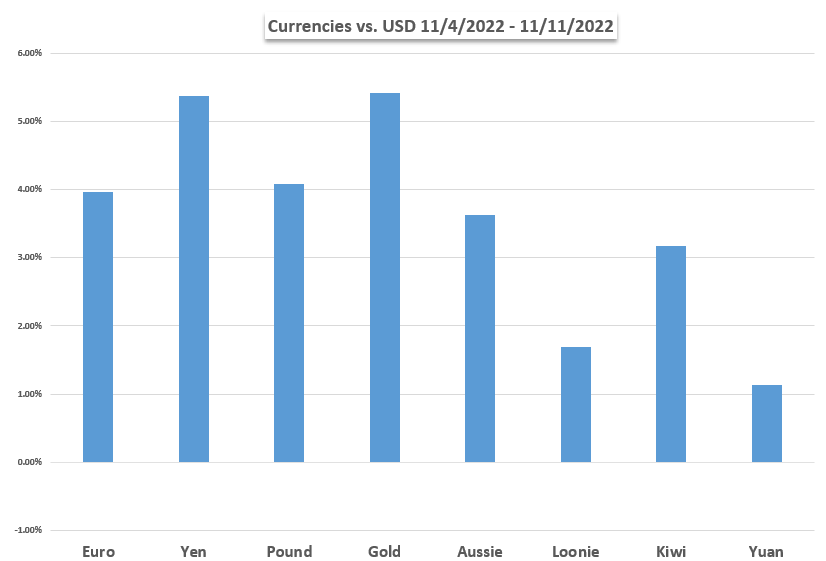

Performance of the US dollar against currencies and gold

Basic forecast:

British Pound Weekly Forecast: A Filling Week for GBP (dailyfx.com)

GBP/USD skyrocketed last week. But with the whole UK economic calendar ahead. Cracks may start to appear.

Aussie Dollar Outlook: US dollar crunch supports Aussie

The Australian dollar strengthened last week. After weak US CPI data sent Treasury and US dollar yields lower on hopes of a Fed pivot, will AUD/USD continue higher?

the fall of Cryptocurrency Pause after the explosion of FTX and Alameda.

Two of the biggest names in the cryptocurrency market, FTX and Alameda, may be worthless right now. After revealing the loss of billions of US dollars.

The outlook for the US dollar is weaker as slowing inflation could weigh on yields.

US Dollar Could Extend A Short-Term Correction Due To Slow US Inflation This could lead to a downward bias in Treasury yields as traders adjust their prices, causing monetary policy to weaken.

Gold Price Forecast: US Inflation data weak, XAU/USD minus Fed Eye

Gold prices soared to their highest level since March 2020 last week. With US inflation reports weaker, Federal Reserve (Fed) traders are less active. Ahead, keep an eye on Fedspeak, PPI and Retail Sales data.

EUR/USD rate high ahead of US retail sales report in August

EUR/USD is testing the August high (1.0369) ahead of the US retail sales report. Amid mounting speculation for a Federal Reserve rate hike in December.

Canadian Dollar Forecast: Trend remains volatile despite USD/CAD decline

The outlook for the Canadian dollar is mixed as the Loonie battles the G10 pairs.

Trade smarter – sign up for the DailyFX newsletter.

Get timely and engaging market commentary from the DailyFX team.

Subscribe to the newsletter

Technical forecast:

Gold Price Forecast: Gold Breakout Amid Silver Eyes Resistance

The gold price breakout is happening, rallying close to 5% despite year-to-year resistance to the downtrend. Key levels on the XAU/USD weekly technical chart

S&P500, Nasdaq, Dow Jones, DAX forecasts for next week

If the stock doesn’t sell because of bad news Something else probably happened. And for the Nasdaq and S&P 500 indices, it could be a continuation of the squeeze after the breakout of the descending wedge.

WTI Crude Oil Technical Forecast: Morning Star Candlestick Pattern Suggests Price Rise

WTI’s price action today doesn’t provide the clearest picture. Any additional profit is likely to be limited by the double top style of play.

GBP Technical Forecast: Sterling drivers remain capped despite USD rally

Sterling could turn against the dollar But broad comparisons confirm that the pound is still under pressure.

Japanese yen technical outlook: success of USD/JPY rally?

Last week’s sharp decline increased the odds of a mid-term high in USD/JPY. What will the short-term trend be? And what are the signs to watch out for?

US dollar technical forecast for next week

Friday’s CPI sell-off sends DXY below its 200-dma.

internal elements

element. This is probably not what you meant to do! Internally load your application’s JavaScript package. replacement item