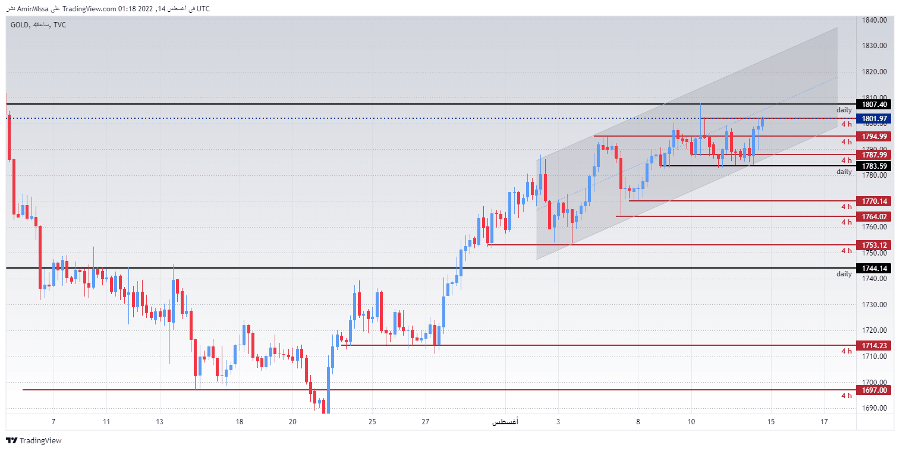

Recommendation of the week gold against the dollar

- The risk is 0.35%.

- Last week’s sell trade was activated and the stop loss was reached

strong:first-child { color: #c0c0c0; } .advbox > strong:first-child { background: none repeat scroll 0 0 white; float: left; font-size: 11px; font-weight: lighter; right: 11px; line-height: 18px; margin: 0 0 -9px !important; padding: 0 10px; position: absolute; top: -10px; } .superbox{ border-radius: 15px; background-color: #ebf8f3; padding: 30px; } .superbox li, .superbox p { font-size: 1.1em; letter-spacing: .1px; line-height: 1.6em; } .btn-inverse { border-radius: 5px; color: #ffffff; border: 1px solid currentColor; display: inline-block; font-family: “PT Sans”,HelveticaNeue-Light,”Helvetica Neue Light”,”Helvetica Neue”,Helvetica,Arial,sans-serif; padding: 0 1.5rem; height: 40px; line-height: 38px; text-align: center; letter-spacing: .5px; text-decoration: none; cursor: pointer; transition: all .1s ease;} .btn-inverse:hover{ box-shadow: 0 3px 3px 0 rgba(0,0,0,.14), 0 1px 7px 0 rgba(0,0,0,.12), 0 3px 1px -1px rgba(0,0,0,.2); color:#FF862E;}

]]>