This means that inflation is here to stay at least until next year. Fed Chairman Jerome Powell expects it to decline in 2022 and return to pre-pandemic levels in 2024. The Federal Reserve has therefore decided to double the reduction in bond purchases to close them by March next year and consider three interest rate hikes in 2022.

As the US begins to limit its high inflation, the party continues in Europe, at least for eurozone countries. The ECB does not yet intend to close the PEPP – Pandemic Emergency Procurement Program or raise interest rates. But with inflation rates of 9.2% in Lithuania, 8.8% in Estonia, 7.8% in Romania and Poland or 7.4% in Hungary, 7.3% in Bulgaria and 6% in the Czech Republic, banks non-eurozone countries have already begun to raise interest rates. Some shy, such as 0.25% – last month’s increase in Romania and 0.5% in Poland, others more aggressive, such as the 1.25% increase in the Czech Republic.

Outside the EU, the European inflation champion is Turkey with 21.31%, followed by Moldova with 12.44%, Belarus and Ukraine with 10.3%. The world champion in inflation is Venezuela with an impressive rate of 1575%, followed by Sudan with 351% and Lebanon with 174%.

In the United States, inflation reached 6.8% in November, the highest level since June 1982. This was compounded by a disappointing retail sales report, which rose by only 0.3% in November. , compared to the expected 0.8%. The data suggests that Americans are burdened by rising prices. In the last month, there has been a slight decrease in sales to car dealers, which represents 20% of total retail sales. Department stores saw their sales drop sharply by 5.4% from the previous month, and they were stable at online retailers. This shows that events like Black Friday and Cyber Monday may not have been very successful this year. Sales at electronics stores also fell 4.6% and at pharmacies. However, sales at bars and restaurants increased by 1%. Higher spending on food outside the home is generally seen as a sign that consumers are confident in the economy.

In addition to inflation concerns, Fed Chairman Jerome Powell said the economy has made enough progress to justify removing the incentives the bank put in place at the start of the pandemic to prevent a major economic downturn.

The spread of Omicron has been highlighted as a risk by the Fed, despite initial assessments showing that this variant is highly transmissible but less severe and that existing vaccines and immunity from a previous infection provide some protection against severe forms of the disease. . Jerome Powell noted that the unknown is how it will affect the economy, “how much demand inhibits, as opposed to supply suppression. It is not clear how big the effects will be on inflation, growth or employment.” “The Delta variant has slowed down employment and affected the recovery of supply chains. But wave after wave, people will learn to live with this pandemic, Powell believes. “Going forward, completing the purchase cut is right, and Omicron has little to do with it,” Powell added.

The expected series of increases will bring interest rates up to 2.5% (currently, the key interest rate is 0-0.25%). This means a series of smaller and slower increases than in the past, when rates rose by 3 percentage points over a 15-month period. Powell made it very clear that interest rate hikes will not begin until bond purchases are completed. “It would not be ‘appropriate’ to raise interest rates while still increasing asset purchases.” “Basically, we’re two sessions away from completing the gradual reduction in procurement,” Powell said.

Markets reacted positively to the remarks of Powell, the Nasdaq and the S&P 500 rising during the press conference. S&P Futures is also on the rise.

–

For the most important news of the day, broadcast in real time and presented equidistantly, LIKE our Facebook page!

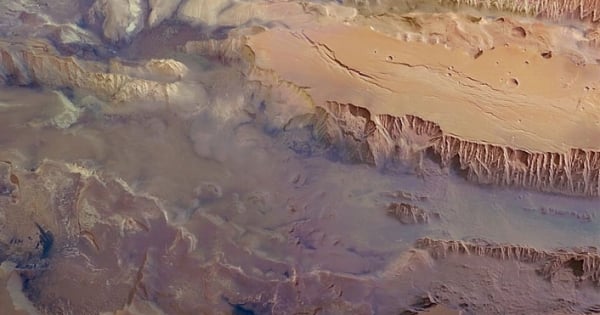

Follows Mediafax on Instagram to see spectacular images and stories from around the world!

The content of the website www.mediafax.ro is intended exclusively for your personal information and use. It is prohibited republishing the content of this site in the absence of an agreement from MEDIAFAX. To obtain this agreement, please contact us at [email protected].