Markets are expecting a 0.75 percentage point rate hike at Federal Open Market Committee (FOMC) meetings on August 20 and 21 after the U.S. Consumer Price Index (CPI) released on August 13 showed better growth expected. I think it’s almost certain. But Wall Street has begun to consider officials making even more dramatic announcements.

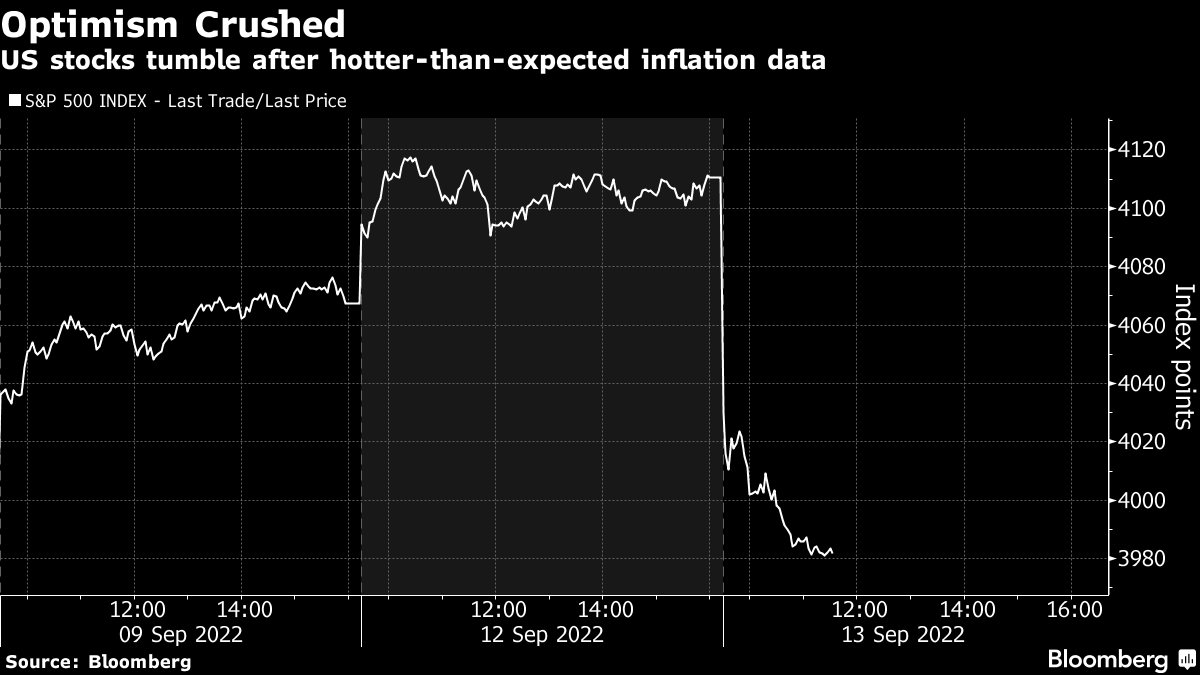

The main CPI for August rose 0.1% from the previous month, accelerating from the stabilization in July. This exceeded market expectations of a 0.1% decline. The market price in the probability of a one-point rate hike has risen by more than 20%. Financial authoritiesreverse postureThe S&P 500 index fell sharply as hopes of a return were dashed.

However, most investment professionals see no change in the 0.75 percentage point rate hike at next week’s FOMC meeting.

“The Fed wants to follow market expectations and will do so because the market expects a 0.75 percentage point increase,” said Tom Digaloma, chief executive officer of Seaport Global.

Meanwhile, economists at Nomura Securities International changed their forecasts for rate hikes at next week’s meeting from 0.75 percentage points to 1 percentage point, stating, “A more aggressive rate hike path will be needed to make in the face of further deep-rooted inflation “.

Former Treasury Secretary Summers said in a tweet that if he were a Fed official, he would choose “a one-point move to increase credibility.”

If the Fed needs to raise rates too quickly, it would be better to move quickly and get carried away, said Scott Buchta, head of fixed income strategy at Breen Capital. “The most likely is 0.75 points, but you should pick 1 point,” he said.

“The market will hate it,” said Steve Sosnick, Interactive Brokers chief strategist. A rate hike would be perceived as a panic move. “

Original title:“Should make 100”: Traders argue about the Fed’s next rate move(extract)

–