According to JPMorgan Asset Management (AM), the largest US Treasury sell-off in decades is set to get worse. This is because the Fed’s top priority is to fight inflation.

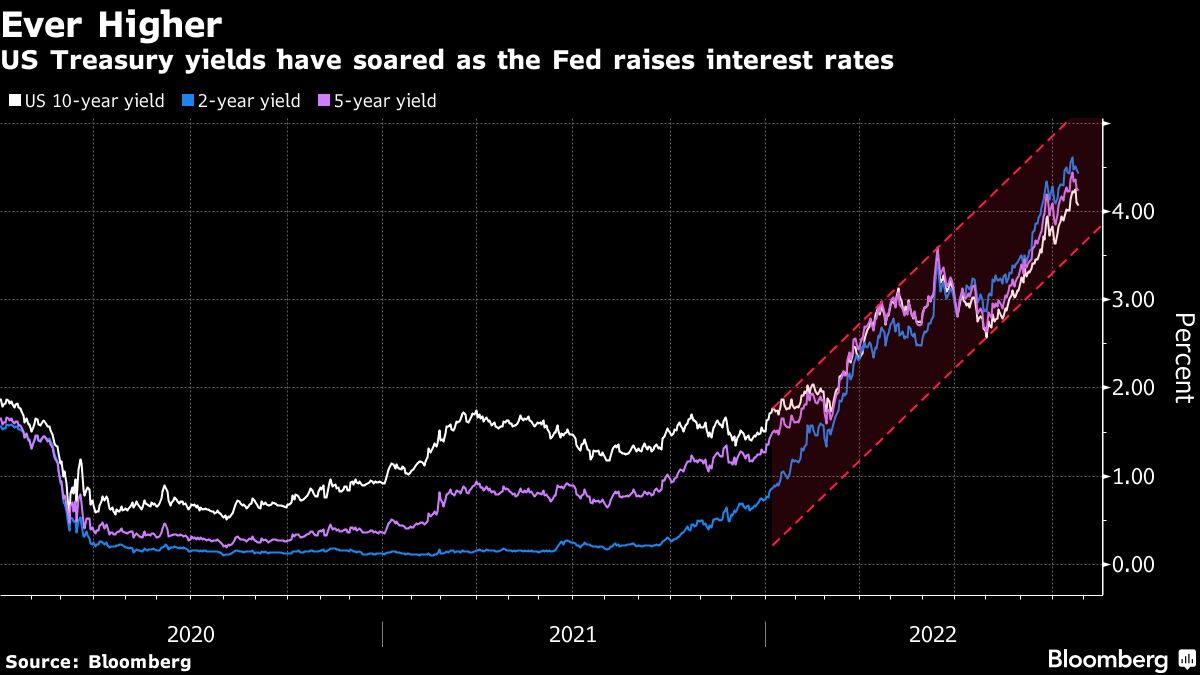

U.S. Treasury yields have risen this year along with U.S. policy rates, but haven’t peaked yet and haven’t fully discounted the risk of an economic downturn, said Ian Steely, who works for the Global Chief Investment JPMorgan AM Fixed Income Officer. He also said that a 10-year bond yield of 4.5% is a “good” entry point.

“When something like the belief that a recession is really on the rise, you want to keep Treasuries,” Steeley said in an interview in Singapore. When the Fed finally stops raising rates, that’s when the Fed will “want to buy” in a big way, she added.

US 10-year return (white), 2-year return (blue), 5-year return (purple)

Source: Bloomberg

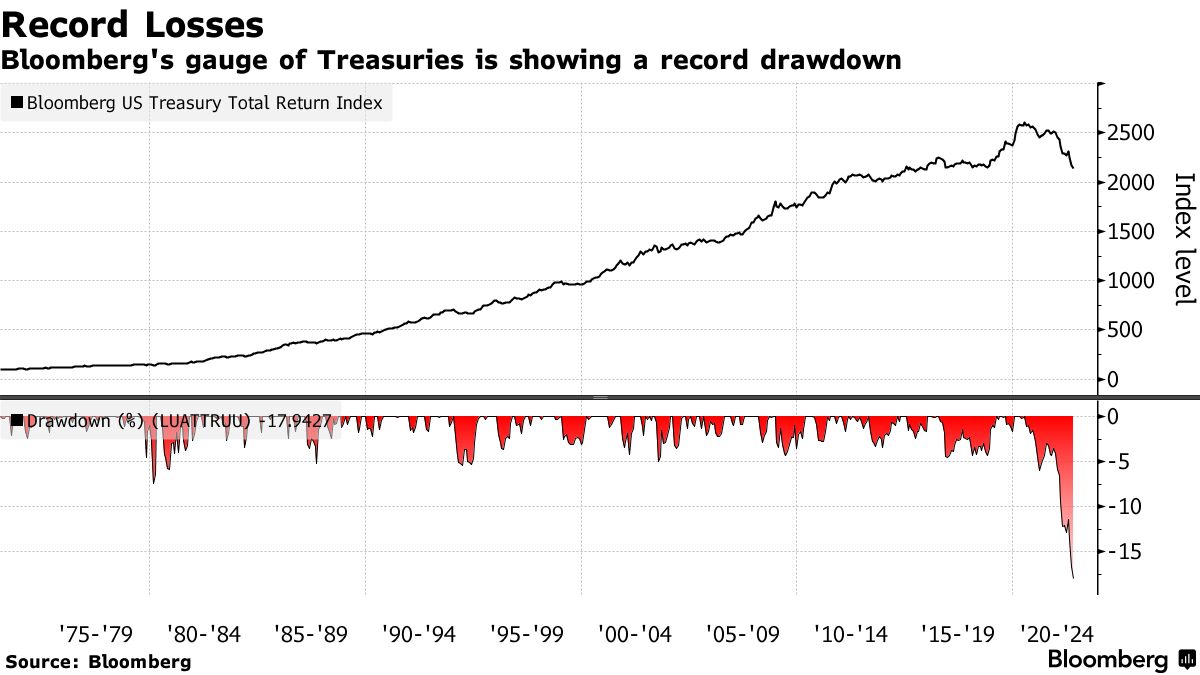

A measure of Treasury prices has fallen by about 15% this year, heading towards its largest annual loss since the 1970s. 10-year yields jumped briefly to 4.34% as investors sold inflation-sensitive bonds. 26 remained around 4.04%.

After a large sell-off, Jupiter Asset Management and Pacific Investment Management (PIMCO) turned bullish on bonds, but Steely wants proof that inflation is definitely under control before making big bets, waiting for a key indicator of inflation.

“Monthly inflation needs to fall for at least two or three consecutive months and the annualized rate needs to reach a level that reasonably allows authorities to say, ‘We’ve definitely kept inflation in check,'” he said. “If the terminal rate goes to 5% or 6%, the 10-year yield could go up to 5%. The whole yield curve will go up together,” she said.

Top: Bloomberg US Treasury Total Litter Index, Bottom: Annual withdrawal

Source: Bloomberg

Steeley believes next year will be a lot brighter than this year for bond investors.

“I think 2023 is actually going to be a very good year for bonds because the initial yields are very attractive,” he said. So the bonds will perform well. “

In an interview, he also touched the yen exchange rate. “The yen will slowly depreciate until the BOJ removes it. At that point, if you are short on the yen, you will suffer greatly from this move. The BOJ.”

Original title:JPMorgan Asset sees the Treasury’s course worsen due to inflation risks(extract)