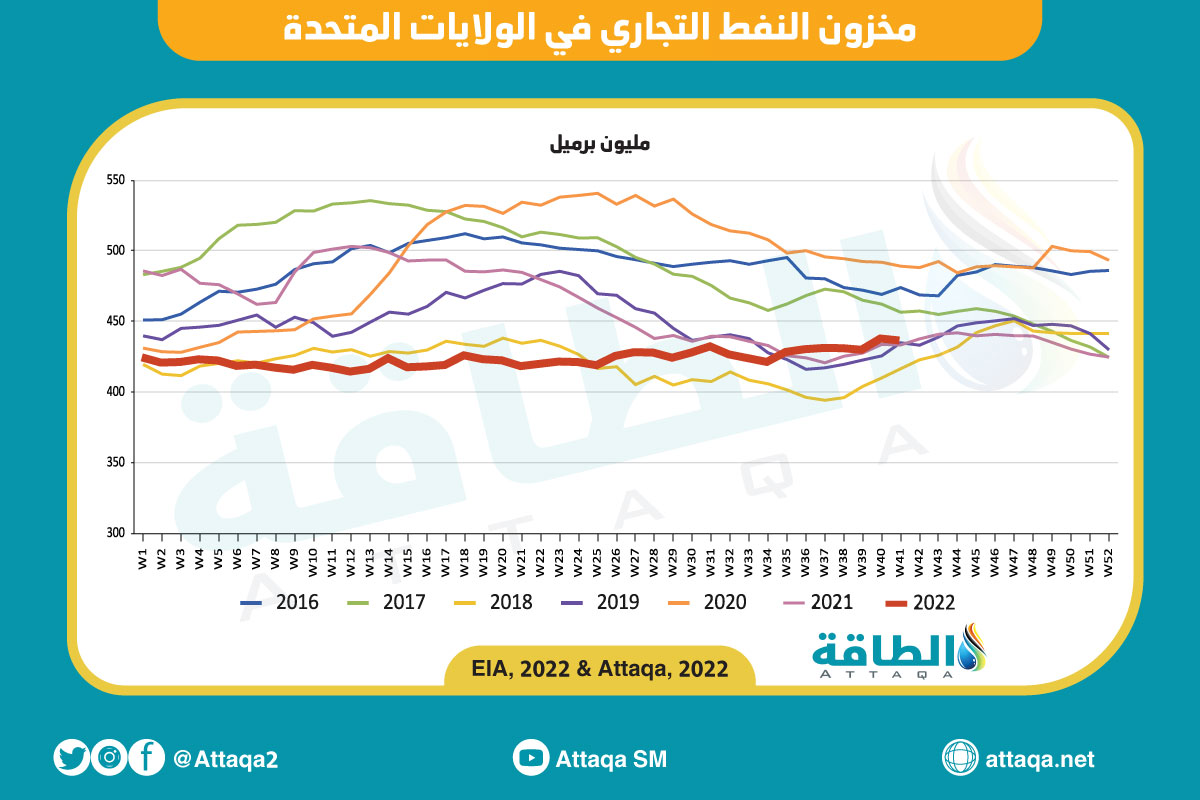

US oil shares fell more than analysts expected last week, as did gasoline shares.

The weekly report released by Energy information management Today, Wednesday (October 19, 2022), US crude oil inventories fell by 1.7 million barrels during the week ending October 14, bringing the total to 437.4 million barrels.

Standard & Poor’s Global had expected US oil inventories to decline by 1.2 million barrels, according to reports. Energy Research Unit.

as it fell strategic reserve Oil inventories increased by 3.6 million barrels, bringing the total to 405.1 million barrels, according to the report.

This means that without the withdrawal from the strategic reserve, commercial oil stocks in the United States would have decreased by 5.3 million barrels, but the effect on the markets depends on the change in commercial inventories, as monitored by the Energy Research Unit.

According to a law passed by the US Congress, withdrawals from strategic stocks usually occur; With the aim of alleviating the budget deficit by covering the sales from the reserve and the operating costs of the same annually.

US oil stocks

Come on, stocks are dwindling oil In the United States, with a sharp increase in crude oil exports and consumption of petroleum derivatives, according to the weekly report.

American oil exports increased by 1,266 million barrels per day over the past week, bringing the total to 4,138 million barrels per day.

By contrast, U.S. oil imports fell by 156,000 barrels per day, to 5.908 million barrels per day.

This means that US net oil imports – which includes the strategic reserve – fell by 1,422 million barrels a day last week, to 1,770 million barrels a day.

The “energy” platform usually ignores US oil production numbers, which are part of the weekly crude oil inventory reports, because they depend on future expectations and do not reflect actual levels.

The chart below shows US crude oil production from early 2019 through July 2022, according to the latest data released by the Energy Information Administration:

US gasoline stocks

The shares went down benzene In the United States, about 0.1 million barrels last week, coming in at 209.4 million barrels.

While stocks have increased distillates – which includes diesel, heating fuels and others – of 0.1 million barrels, for a record 106.2 million barrels.

Analysts had estimated a decline in gasoline and spirits stocks of 2.2 and 2.5 million barrels, respectively.

Consumption of petroleum derivatives

consumption increased petroleum derivatives In America, 1,490 million barrels a day, reaching 20,761 million barrels a day in the last week.

This came with an increase in gasoline consumption of 401,000 barrels per day over the past week, while the consumption of distillates and jet fuel decreased by 298 and 114,000 barrels per day, respectively.

Comparing the last 4-week average year-on-year, total consumption of petroleum products decreased by 2.4%, with gasoline consumption down 6.4%, according to the report, followed by the Research Unit on power.

While the consumption of distillates and jet fuel in America has increased by 1.1 and 7.5% year on year, in the last 4 weeks year on year.

Import details

U.S. oil imports fell from 6.063 million barrels per day to 5.908 million barrels per day in the past week.

The decline in US oil imports came from 5 countries, led by Saudi Arabiawhere it has seen a decrease of around 140,000 barrels a day, followed by Libya of around 51,000 barrels a day.

Imports of oil from America, Colombia and Mexico also decreased by 28 and 12 thousand barrels per day, and also decreased, from Ecuador.

While US crude oil imports from Canada, Brazil and Nigeria increased by 72, 47 and 29,000 barrels per day, respectively, and from Iraq by about 21,000.

Related topics.

Read also ..