People walk past the New York Stock Exchange (NYSE) at Wall Street.

Photographer: Angela Weiss/Getty Images

Photographer: Angela Weiss/Getty Images

–

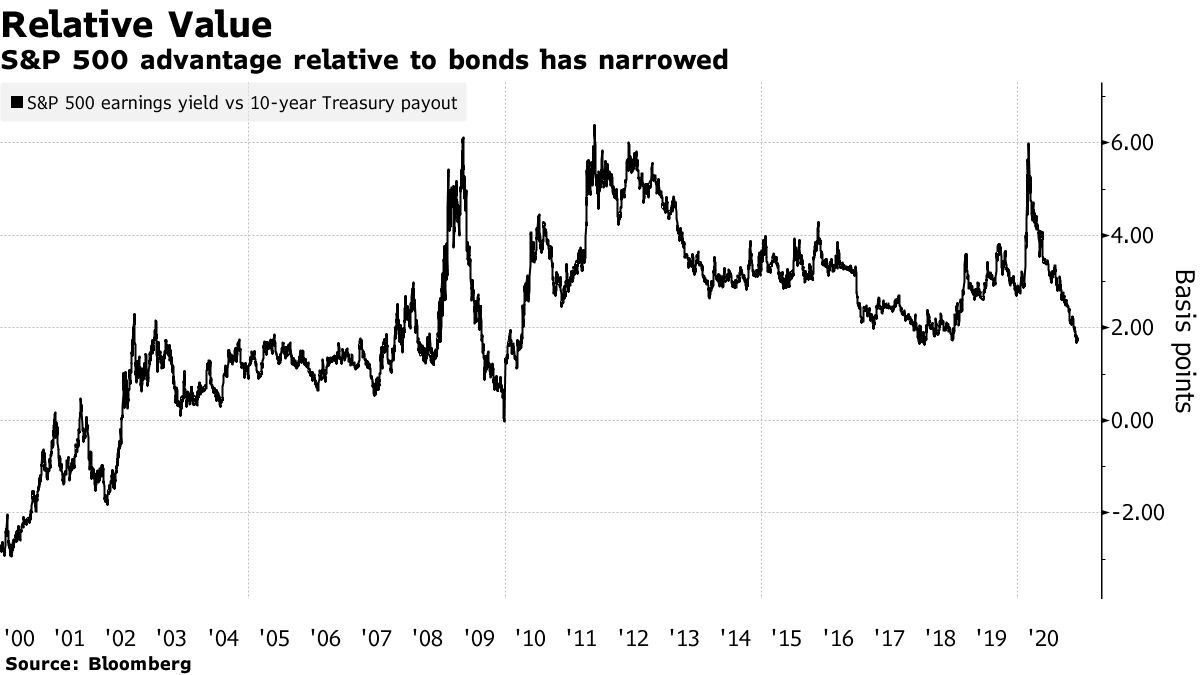

The US stock market on the 3rd continued to fall. The volatility of US Treasuries rose again and yields soared, putting pressure on stock prices. Investors are worried about equity valuation growth.

|

Bank stocks and energy-related stocks rose, but major tech stocks such as Apple and Amazon.com fell sharply. The Nasdaq-100 index, which is centered on high-tech stocks, fell 2.9% to its lowest price in two months.U.S. economic indicatorsThen, it was suggested that the recovery from the bottom of the new corona was slow and mottled.

The S & P 500 stock index was 3819.72, down 1.3% from the previous day. The Dow Jones Industrial Average is down $ 121.43 (0.4%) to $ 31270.09. The Nasdaq Composite Index fell 2.7%.

The US Treasury market has fallen. The heavy sales of British bonds and the refraining from issuing many new corporate bonds were important factors. However, with the speech by the chairman of the Federal Reserve Board of Governors (FRB) on the 4th, stability was restored toward the end of the transaction. As of 4:59 pm New York time, 10-year bond yields have risen 9 basis points (bp, 1bp = 0.01%) to 1.48%. At one point, there were scenes that approached 1.5%. Inflation expectations five years ahead, factored in by bond prices, are at their highest level since 2008.

“Volatility has risen slightly, with some days being significantly higher and some days being lower,” said James Lagan, director of wealth management research at DA Davidson. “There is continued focus on rising interest rates and how they affect valuations in some overpriced sectors,” he said.

—

—

In the foreign exchange market, the dollar has risen against most of the 10 major currencies. The background is the rise in US Treasury yields. The currency of resource-rich countries has fallen due to risk aversion.

The Bloomberg Dollar Spot Index, which shows the movement of the dollar against the 10 major currencies, rose 0.3%, rising for the first time in three business days. The dollar is up 0.3% against the yen to 1 dollar = 107.01 yen. At one point, it was 107.15 yen, the highest price since July last year. The euro is down 0.2% against the dollar at 1 euro = 1.2063 dollars.

New York crude oil futures rebound for the first time in four business days. It was the highest in about a week. Weekly statistics from the Energy Information Administration (EIA) show that gasoline inventories have fallen sharply since 1990 as refineries continued to shut down due to the cold weather that hit the southern United States. Meanwhile, crude oil inventories increased.

The New York Mercantile Exchange (NYMEX) West Texas Intermediate (WTI) futures April contract ends at $ 61.28 a barrel, up $ 1.53 (2.6%). The May contract for Brent North Sea in London ICE is up $ 1.37 to $ 64.07.

The New York gold market has fallen back. As US Treasury yields rose and economic recovery was conscious, gold’s investment appeal declined. Commerzbank analyst Karsten Frich said rising yields and a stronger dollar are “a bad combination for the gold market these days.”

As of 2:27 pm New York time, the gold spot is 1 ounce = $ 1713.74, down 1.4% from the previous day. The April contract for gold futures on the New York Board of Trade (COMEX) ends at $ 1715.80, down 1%.

Original title:Nasdaq Sinks to Two-Month Low as Bond Yields Surge: Markets Wrap(Excerpt)

Treasuries Fall Led by Belly, Gilts; Fed’s Powell Is Ahead(抜粋)

Dollar Rebounds as U.S. Yields Soar, Stocks Drop: Inside G-10(抜粋)

Oil Surges After Record U.S. Fuel Supply Drop From Deep Freeze(Excerpt)

Gold Declines as Treasury Yields Rise and ETF Rout Deepens(抜粋)

(Update quotes and add comments)

– .

![[US market conditions]Stocks continue to fall, selling mainly in high-tech-US Treasury yields soar-Bloomberg [US market conditions]Stocks continue to fall, selling mainly in high-tech-US Treasury yields soar-Bloomberg](https://assets.bwbx.io/images/users/iqjWHBFdfxIU/iRFgK6ZQiLZQ/v0/1200x836.jpg)