In the US stock market on the 16th, the S & P 500 stock index continued to grow. There is widespread observation that US economic policy talks are approaching an agreement. US Treasuries are down.The composition and pace of bond purchases at the US Federal Open Market Committee (FOMC) regular meetingUnchangedInvited some traders to sell disappointingly.

|

After Republican Senate Secretary of State Mitch McConnell said in an economic talks that “it looks like we’ll be able to achieve our goals,” the S & P 500 has risen further. Retail, technology, and finance are leading the rise in thin business. Among the major indexes, the Nasdaq 100 index rose significantly, while the Dow Jones Industrial Average finished slightly lower.

S & P 500 species increased 0.2% from the previous day to 3701.17. The Nasdaq Composite Index rose 0.5%. The Dow Jones Industrial Average is down $ 44.77 (0.2%) to $ 30154.54. As of 4:59 pm New York time, the yield on US 10-year bonds has risen by 1 basis point (bp, 1bp = 0.01%) to 0.91%.

Investors are eagerly awaiting progress in economic policy talks, which continue to be difficult, as the economic recovery shows signs of stalling. Federal Reserve Board of Governors (FRB) chairman Powell said in a press conference after the FOMC that “the rationale is very strong” justifying fiscal support through fiscal policy.

“Investors are clearly welcoming recent reports that the pre-Christmas holiday bill is nearing,” said Daniel Dimartino Booth of Quill Intelligence. Financing US Treasuries to fund comprehensive economic measures. I’m confident that the authorities will buy everything. “

In addition to this, the price of crypto asset (virtual currency) Bitcoin is the first in the financial marketOver $ 20,000。

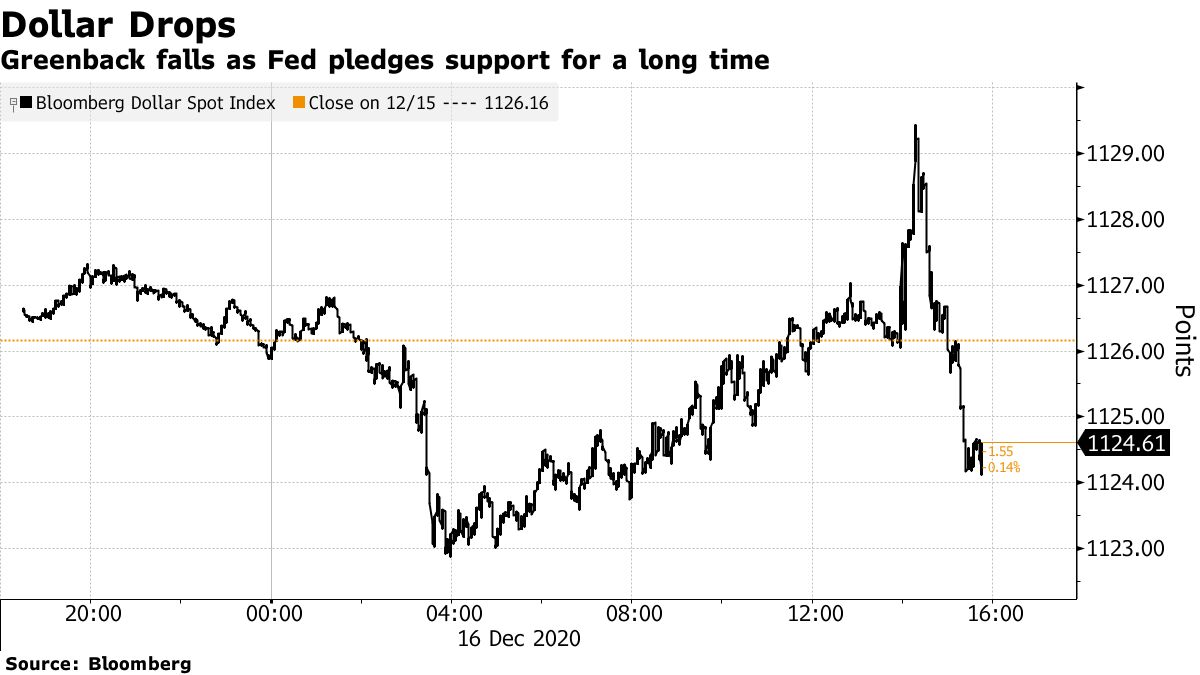

The dollar has fallen against most currencies in the foreign exchange market. The Fed chairman said the US financial authorities needed long-term economic support, and the dollar liquidity swap line was extended.U.S. Treasury takes SwitzerlandCurrency manipulatorThe Swiss franc has risen despite the recognition of.

The Bloomberg Dollar Spot Index, which shows the movement of the dollar against the 10 major currencies, fell 0.1%. The dollar is down 0.2% against the yen at 1 dollar = 103.42 yen. The euro is up 0.4% against the dollar at 1 euro = 1.2199 dollars.

—

—

New York crude oil futures market continued to grow on the 3rd. Crude oil inventories have fallen unexpectedly, according to the Energy Information Administration’s (EIA) weekly statistics. However, the increase was limited as gasoline and diesel inventories increased and fuel demand declined.

The January contract for West Texas Intermediate (WTI) futures on the New York Mercantile Exchange (NYMEX) ends at $ 47.82 a barrel, up 20 cents (0.4%). The February contract for Brent North Sea in London ICE is up 32 cents to $ 51.08.

New York gold futures prices continue to grow. The February contract on the New York Board of Trade (COMEX) gold futures ended at $ 1859.10, up 0.2% to 1 ounce before the FOMC statement was released. After the FOMC statement was released, the gold spot market temporarily fell 0.5% against the backdrop of US Treasury yields and the dollar’s rise to a intraday low of $ 1844.90. However, after that, it turned positive in response to the remarks made at the Fed Chairman Powell’s press conference.

Original title:Stocks Climb on Aid Talks as Bonds Drop After Fed: Markets Wrap(抜粋)、Dollar Falls as Shares Rise, Fed Extends Swap Lines: Inside G-10(抜粋)、Oil Gains With U.S. Crude Supply Drop Countering Fuel Build-Up(抜粋)、Gold Slips as Treasury Yields, Dollar Rise After Fed Meeting(抜粋)、Gold Rebounds With Fed’s Powell Seeing Need for Economic Support(抜粋)

(Add market participants’ comments and update quotes)

– .

![[US market conditions]S & P 500 continued growth, agreement on economic measures optimistic-US Treasuries fall-Bloomberg [US market conditions]S & P 500 continued growth, agreement on economic measures optimistic-US Treasuries fall-Bloomberg](https://assets.bwbx.io/images/users/iqjWHBFdfxIU/i6.oMo9hw3UU/v0/1200x800.jpg)