US Inflation Expected to Moderate in April, Providing Hope for Price Pressures to Ease

Introduction

US inflation is anticipated to have moderated in April, marking the first decline in six months. This offers a ray of hope for a potential easing of price pressures, which have been persistently on the rise. The latest figures from the Bureau of Labor Statistics are expected to show a reduced increase in the core consumer price index (CPI), excluding food and fuel, compared to the previous months.

Lower Increase in Core CPI

The core consumer price index, excluding food and fuel, is projected to rise by 0.3% in April, compared to the previous 0.4% increases seen in the first quarter. This moderation in inflation is a positive sign, but it still falls short of the Federal Reserve’s desired pace for inflation deceleration. The projected annual increase in core CPI for April is 3.6%, which is the smallest in three years. However, policymakers at the Federal Reserve are seeking more consistent evidence of inflation slowing down to determine the appropriate timing for interest-rate cuts.

Resilient American Consumers Hold Inflation Up

While core goods prices have been gradually declining, underlying services costs remain elevated, causing inflation to remain stubborn in the first quarter. The Federal Reserve has encountered difficulties in bringing down inflation due to the resilience of the American consumer. Retail sales in February and March showed solid advancements, and economists’ projections for April suggest a temporary slowdown in household spending.

Impending Reports and Speeches

Economists will closely examine the government’s report on producer prices to assess the impact on the Federal Reserve’s preferred inflation gauge, the personal consumption expenditures price index. Housing starts and industrial production for April will also be reported in the coming week. Furthermore, Federal Reserve Chair Jerome Powell, along with regional Federal Reserve Presidents Loretta Mester and Raphael Bostic, are scheduled to deliver speeches, which will be closely watched by market participants.

Global Economic Outlook

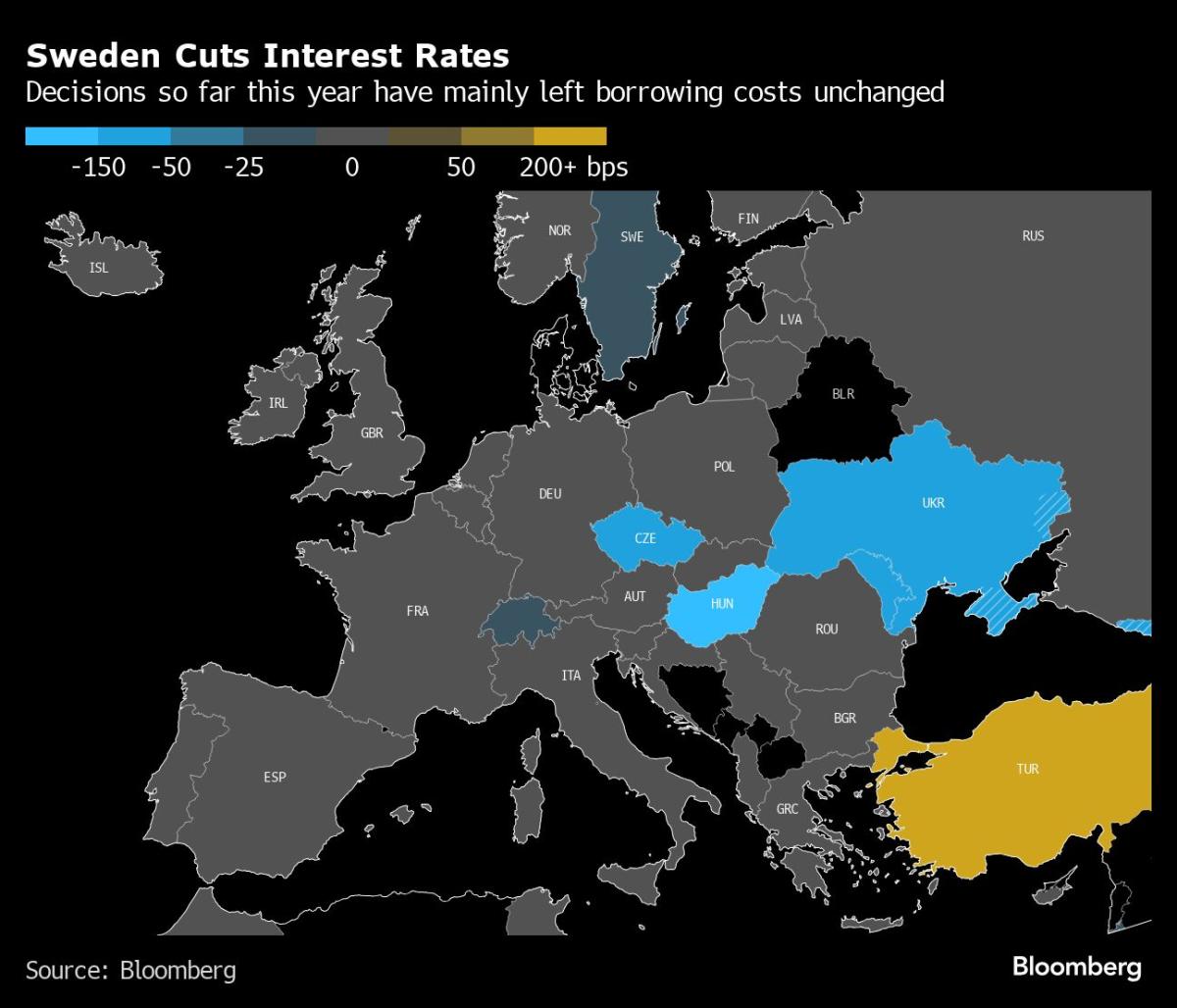

Various economic indicators and reports from around the world deserve attention. China is expected to release data showing acceleration in industrial output, retail sales, and fixed asset investment in the second quarter, despite risks posed by a housing slump. In Japan, the economy is estimated to have contracted in the first quarter due to falling consumption and business investment, along with negative contributions from net exports. However, the economy is expected to bounce back in the second quarter. Economic reports and data releases are also expected from other countries including the UK, the Eurozone, Sweden, Norway, Poland, Russia, Israel, Nigeria, Colombia, Brazil, Peru, Uruguay, and Argentina

Conclusion

The predicted moderation in US inflation for April provides a hopeful sign for the easing of price pressures. However, the Federal Reserve still awaits consistent evidence of inflation slowing down to make informed decisions regarding interest-rate cuts. Economic reports and data releases from around the world are also key factors influencing the global economic outlook. Investors, economists, and policymakers will closely analyze these indicators to anticipate future trends in the world economy.