Economic Outlook: US Equity Futures Signal Rebound from Wall Street Slump

US Equity Futures Rebound Following Disappointing CPI Data

New York, February 14, 2024

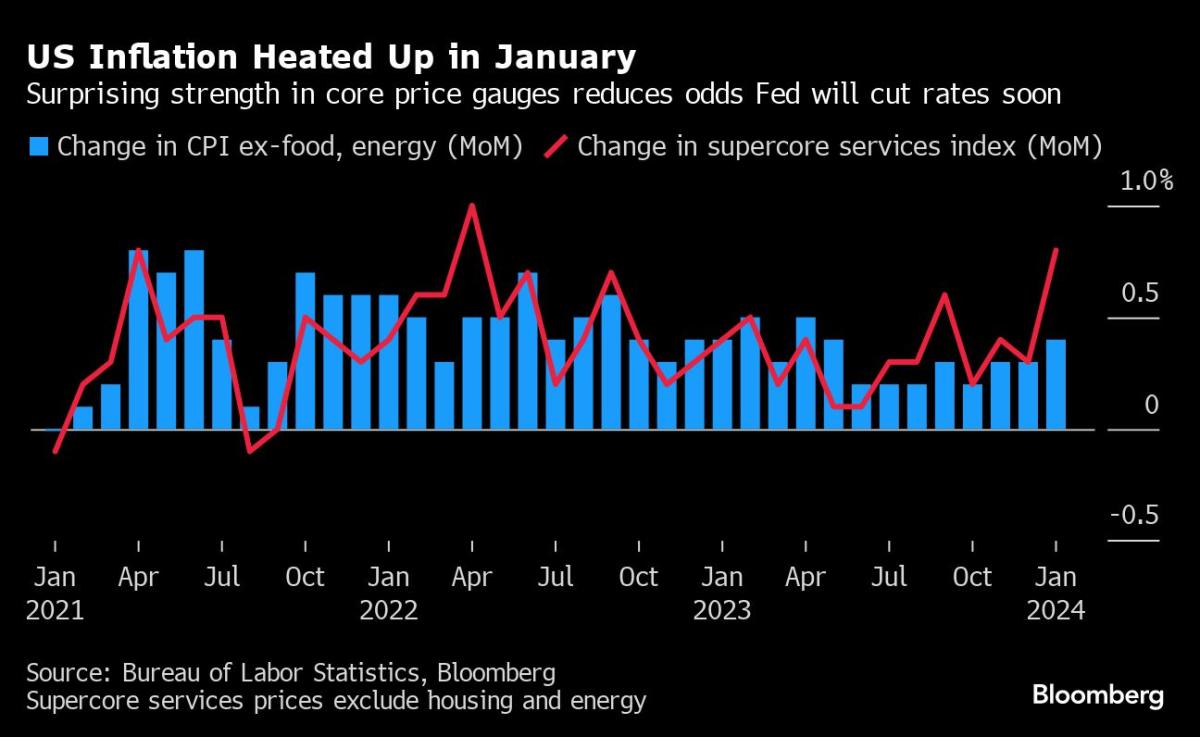

US equity futures indicated a potential rebound from Tuesday’s Wall Street slump, which was triggered by hotter-than-expected US inflation data. This data has fueled speculation that the Federal Reserve may not implement interest rate cuts as soon as expected. Following its worst inflation-day drop since September 2022, contracts on the S&P 500 climbed 0.5%. Meanwhile, benchmark Treasury yields remained near the 4.3% mark as traders adjusted their bets for an early rate cut by the Fed.

Implications for the US Stock Market and Global Bonds

Momentum had been building for US stocks, reaching record levels, and European peers had come close to hitting their own records due to the belief in imminent rate cuts. However, the disappointing American Consumer Price Index (CPI) data acted as a setback, erasing the last remnants of a rally that began in December. Yet, the optimistic perspective of some experts remains. BlackRock Inc.’s portfolio manager, Russ Koesterich, believes this setback is temporary and still expects a potential upside of 6-8% this year for US equities, and even predicts the possibility of up to four rate cuts.

Positive Data for the UK: BOE Enjoys Lower-than-Expected Inflation

While the US faced inflation concerns, the UK experienced a positive scenario. Inflation in Britain came in lower than forecast in January, with underlying price pressures not rising as much as expected by the markets and the Bank of England. Consequently, the pound initially reversed gains after the data release, and UK bonds rallied. Traders quickly adjusted their rate cut predictions, reinstating their wagers on three quarter-point reductions this year.

Insights on Oil and Gold, with an Eye on Bitcoin

Focusing on commodities, oil prices saw a slight increase following a mixed US inventory report. Throughout this year, oil prices have been consistently within a certain range. Gold, on the other hand, experienced a significant decrease, dropping below $2,000 an ounce for the first time in two months. At the same time, Bitcoin continued to trade near the $50,000 mark, maintaining its stability.

Corporate Highlights and Key Events to Watch

Some notable corporate updates include a correction in Lyft Inc.’s earnings margin outlook for 2024 and ASML Holding NV’s statement about a potential market rebound in the semiconductor industry.

Moreover, the Bank of England Governor, Andrew Bailey, has been scheduled to testify to the House of Lords Economic Affairs Panel, along with other notable speakers from different central banks. Traders and investors should also keep an eye on the release of varied US economic data as well as key speeches by ECB President Christine Lagarde and other influential figures.

Market Movement in Stocks, Currencies, Cryptocurrencies, Bonds, and Commodities

As markets open today, the main pre-market movements have been observed:

Stocks:

- S&P 500 futures rose 0.5%

- Nasdaq 100 futures rose 0.6%

- Futures on the Dow Jones Industrial Average rose 0.3%

- The Stoxx Europe 600 rose 0.5%

- The MSCI World index remained relatively stable

Currencies:

- The Bloomberg Dollar Spot Index remained relatively stable

- The euro remained relatively stable at $1.0710

- The British pound fell 0.2% to $1.2561

- The Japanese yen rose 0.2% to 150.57 per dollar

Cryptocurrencies:

- Bitcoin rose 4.3% to $51,671.49

- Ether rose 4.5% to $2,752.84

Bonds:

- The yield on 10-year Treasuries remained relatively stable at 4.31%

- Germany’s 10-year yield declined two basis points to 2.38%

- Britain’s 10-year yield declined seven basis points to 4.08%

Commodities:

- West Texas Intermediate crude rose 0.4% to $78.15 a barrel

- Spot gold fell 0.1% to $1,991.13 an ounce

This article was created by one of our experienced editors and was written with the assistance of Bloomberg Automation Technology. Bloomberg Businessweek subscribers can have further insights on this topic by listening to the Big Take podcast available on iHeart, Apple Podcasts, Spotify, and the Bloomberg Terminal. For further details, consult the transcript provided.

This article includes assets from Bloomberg LP.