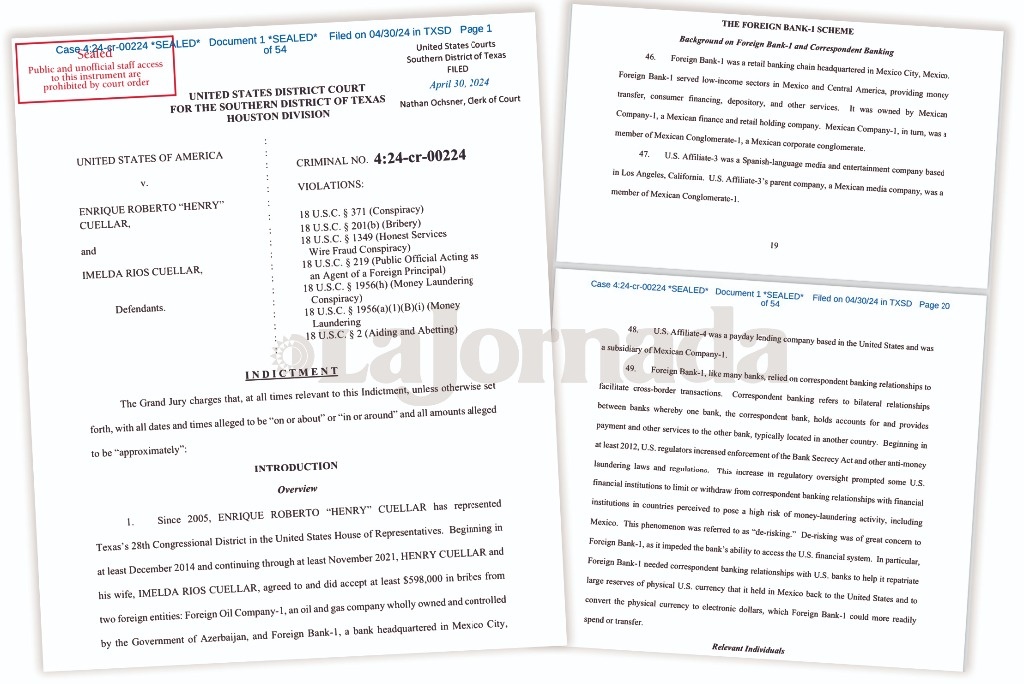

The Texan congressman, Henry Cuellar, along with his wife, Imelda Cuellar, were accused by the United States government of receiving bribes from a Mexican bank to favor it in the financial regulation of that country, the Department of Justice reported this Friday.

In the lawsuit, the US government does not identify by name the Mexican bank that paid the bribe. It does describe it as a retail banking chain based in Mexico City”, focused on serving “low-income sectors in Mexico and Central America, providing money transfer, consumer financing, deposit and other services” and also related with media.

The lawsuit, to which he had access The Conferencepoints out that the legislator received bribes of $600,000 from an Azerbaijani oil company and the bank that is “owned by a Mexican financial and retail conglomerate.”

The congressman, considered one of the most conservative Democrats in the House of Representatives, is seeking an eleventh two-year term. He represents a district bordering Mexico that includes Laredo and parts of San Antonio.

Photo Ap

The document indicates that the Mexican bank that paid the bribe “needed correspondent banking relationships with US banks to help it repatriate to the United States large reserves of physical US currency that it maintained in Mexico and convert the physical currency into electronic dollars, which the Foreign Bank I could spend or transfer more easily.”

This is because in 2012, US regulators insisted on greater enforcement of the Bank Secrecy Act and other anti-money laundering laws, which led some US financial institutions to limit or withdraw from correspondent banking relationships. with financial institutions in countries with a high risk of money laundering, such as Mexico.

The lawsuit states that “de-risking” was “a major concern for the foreign bank, as it impeded the bank’s ability to access the U.S. financial system.”

Two institutions related to retail sales chains currently operate in Mexico. They are BanCoppel and Banco Azteca, except that the former does not have banking correspondents in the United States and the lawsuit also indicates that the conglomerate related to bribery has a media firm.

The lawsuit notes that the bank that paid the bribe, like many others, relied on correspondent banking relationships to facilitate remittance transactions.

The document indicates that the negotiation to receive the bribes, which involved false contracts, undone consultancies and a shell company owned by Cuéllar’s wife, began in 2014.

An executive from the Mexican bank is involved in the case, who was vice president between 2014 and 2024, as well as other intermediaries such as a politician who represented Nuevo León in the Chamber of Deputies and whose names are not mentioned.

The document indicates that Cuellar acted in the best interest of the bank, “to establish correspondent banking relationships, legislation to block regulations harmful to the payday lending industry, and legislation related to cross-border electronic transfers, among other matters.”

The last payments were made in 2019, according to the lawsuit.

Although it is not mentioned in the lawsuit, months after that date, in Mexico, Senator Ricardo Monreal presented an initiative to reform the Bank of Mexico Law (BdeM), so that the Mexican central bank would acquire the dollars that the institutions finances in the country could not change in the United States.

President Andrés López Obrador expressed his opposition, maintaining that the autonomy of the central bank should be respected, while the institution itself warned in November 2020 that if the reform to the Central Bank Law was approved, the door would be opened for the entry of “ cash flows from illicit activities.

“There are quite a few arguments against the reforms to the BdeM law. One of the most important is that it is not worth reforming a law to favor a single company,” Jonathan Heath, deputy governor of the central bank, said in a tweet in December 2020.

In that same month, the Association of Banks of Mexico (ABM) also warned that the proposed changes put the country’s entire financial system at risk, due to a potential increase in money laundering and terrorist financing. Although the initiative was approved by the Senate committees, it was finally not presented in the plenary session and was therefore discarded.

The lawsuit stated that Cuellar and his wife “used the proceeds from the bribery schemes to satisfy their debts, pay family expenses, and make purchases.”

Until now, no Mexican authority has expressed a position.

#congressman #accused #receiving #bribes #Mexican #bank

– 2024-05-12 13:08:28