2021 Economic Policy Direction

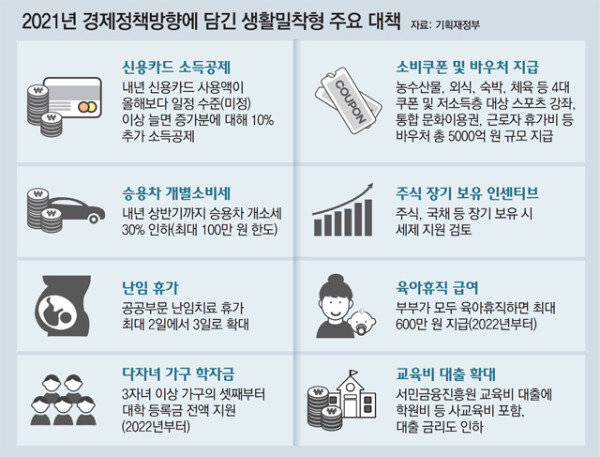

In the’Economic Policy Direction for 2021′ released by the government on the 17th, we introduce a life-oriented policy that is helpful in real life of consumers.

○ Credit card up to 1 million won additional deduction

First of all, if the amount of card or cash receipts used for next year increases by 5% or 10% or more from this year, income deduction will be added to the limit of 1 million won for the increase. As consumption has decreased significantly this year due to the novel coronavirus infection (Corona 19), the intention is to promote consumption by increasing tax benefits next year. The decision to use 5% or 10% will be decided in January next year. Card income deduction is to deduct 15% of credit card and 30% of cash receipt and debit card from the amount of excess usage when the employee uses credit card, debit card, or cash receipt in excess of 25% of total salary. . The plan is to expand this from next year and apply an additional deduction rate of 10% to the increased consumption increase. For example, let’s say that an employee with an annual salary of 70 million spent 20 million won on a credit card this year and 24 million won next year. According to the current regulations, the credit card will receive 975,000 won next year as a deduction. However, if additional deductions are received, the deduction amount will increase to a maximum of 1275,000 won (when deducting an increase of 5% or more). According to the current regulations, the income tax reduction of 90,000 won will increase to 135,000 won. Some point out that it is difficult to be an incentive to save frozen consumption because it saves about 45,000 won in tax.

○ If you hold stock for a long time, you will also receive tax

View larger-Four major consumption coupons, including agricultural and marine products, dining out, lodging, and physical education, and 4 vouchers, including an integrated cultural pass for low-income people, and a sport class pass, will be released to a total worth of KRW 500 billion. Concerned about the spread of Corona 19, online and non-face-to-face use were largely allowed. Eating out coupons can be used in delivery applications (apps), and athletic coupons can be used for online private lessons (personal training).

View larger-Four major consumption coupons, including agricultural and marine products, dining out, lodging, and physical education, and 4 vouchers, including an integrated cultural pass for low-income people, and a sport class pass, will be released to a total worth of KRW 500 billion. Concerned about the spread of Corona 19, online and non-face-to-face use were largely allowed. Eating out coupons can be used in delivery applications (apps), and athletic coupons can be used for online private lessons (personal training).

Cultural and sports activity expenses (integrated cultural use rights) paid to low-income families are increased to 100,000 won, and workers’ vacation expenses of 100,000 won are also provided in the form of vouchers.

In addition, the plan to cut individual consumption tax by 30% (tax rate 5→3.5%) to a limit of 1 million won when a car is purchased is extended until next June.

A’long-term investment revitalization plan’ that provides tax benefits to investors who hold stocks and government bonds for a long time will also be reviewed. This is a measure to stabilize the stock market, which has become more volatile due to the recent rush of liquidity. The specific plan is expected to be announced through the research service next year.

○ Up to 6 million won per month if both couples take parental leave

In order to resolve the low birth rate, support for fertility leave will also be expanded. During next year, leave for fertility treatment in public sectors such as public officials, public institutions, and public enterprises will increase from the current maximum of 2 days to the maximum of 3 days. In the case of the private sector, it was decided to review plans to expand leave for infertility treatment after conducting a survey. In addition, in order to reduce the burden of the initial cost of childbirth, the maternity voucher, which provided 600,000 won for obstetrics and gynecology treatment expenses, was expanded to a’first meeting package’ worth 3 million won.

In addition, starting from 2022, if a couple with children under 12 months of age take parental leave for 3 months, each of them will pay up to 3 million won per month. This is a measure to encourage couples to raise children together as much as possible. In order to benefit multi-child families, families with three or more children will receive full support for college tuition. The plan is also to be implemented from 2022 through a process such as revision of the enforcement ordinance.

Sejong = Reporter Nam Kun-woo [email protected]

Copyright by dongA.com All rights reserved.

—

–