–

The results of a study showed that apartment prices in the Jeju area increased by more than 20%.

The Korea Economic Research Institute (hereinafter referred to as Hankyung-yeon) announced on the 23rd that the house price bubble has reached an excessive level nationwide as house prices have risen by more than 4.6% on average every year over the past five years during the results of the “Housing Price Bubble Dispute and Assessment” announced on 23.

According to data from the Real Estate Agency over the past five years, from July 2018 to July 2022, house prices have risen by 23% nationwide, recording an unprecedented sharp rise.

Although the house price appears to decrease due to the sudden sale transaction that was trading below the market price this year, it is difficult to judge that the house price has changed into a downtrend in a situation where the volume of transactions decreased sharply due to the effect of an increase in interest rates.

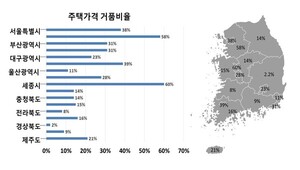

In particular, Hankyongyeon analyzed that the bubble level in the metropolitan area was extreme. It is argued that there is an excessive bubble in the price, as Seoul is overvalued by more than 38% of the current market price and Gyeonggi by more than 58%. It was analyzed that the level of the bubble in the Gangnam-Southeast region, known as the rich, has exceeded 40%.

On the other hand, an average price bubble of 19.7% was found in the provinces. Although it does not reach bubble level in metropolitan areas such as Seoul, it is suggested that normalization is urgent due to uncertainty in the housing market.

The housing price bubble ratio in Jeju was 21%. This was lower than that of metropolitan cities such as Busan (31%), Daejeon (28%), Gwangju (39%) and Daegu (23%), but was lower than that of Chungbuk (15%), Gangwon (14%) . %), Jeonnam (16%) and Jeonbuk (16%), 8%), Gyeongnam (9%) and North Gyeongsang (2%).

Lee Seung-seok, Associate Research Fellow at the Korea Economic Research Institute, said: “It is true that there has been an average bubble of about 10-15% in the price of the housing market due to the high population density of the real estate market. Korea than domestic, but the current housing price bubble is excessive. ” In light of the political cases and the results of the analyzes, the signal on the housing offer should be clearly communicated to consumers “.

–