Real Estate Rental Scams Surge Across U.S.Cities: Expert Advice on Protection

Table of Contents

- Real Estate Rental Scams Surge Across U.S.Cities: Expert Advice on Protection

- A New Wave of Rental Scams Targets unsuspecting Renters

- Rental Scam Alert! Expert Reveals How to Spot and avoid Housing scams Across the U.S.

- Protecting Yourself: A Summary of Key Steps

- Additional Resources

- Expert Insights on Avoiding Scams

- Rental rip-Offs: Safeguarding Yourself in Today’s Housing Market

World-Today-News.com | March 24, 2025

A New Wave of Rental Scams Targets unsuspecting Renters

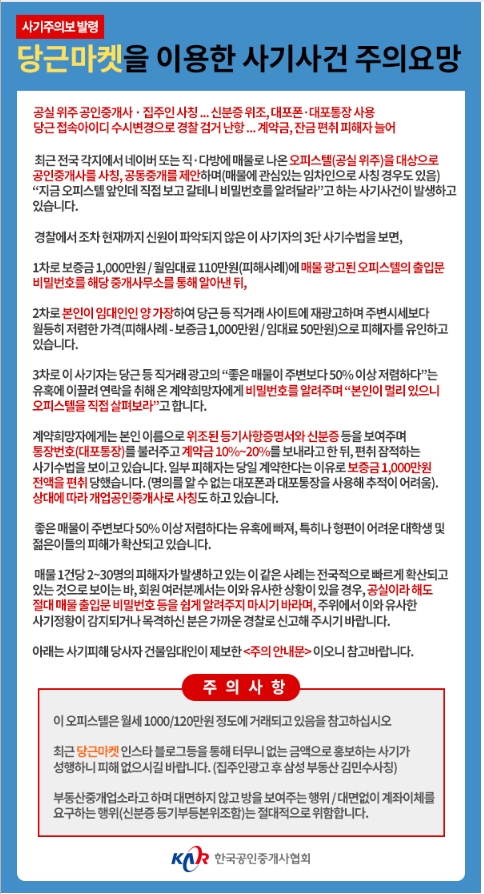

A troubling trend is sweeping across the united States: rental scams are increasingly targeting individuals seeking affordable housing. These scams often originate on online marketplaces, where fraudsters impersonate landlords and list properties they neither own nor control. On March 24, 2025, the National Association of Realtors (NAR) issued a stark warning following a series of incidents mirroring a recent case in Seoul, where a scammer known as “A” defrauded multiple victims of deposits for an apartment in the Seongdong-gu district.

The NAR emphasized that these scams can affect individuals across all income and education levels. The rise of online rental platforms has provided scammers with increasingly complex methods to deceive potential renters. Vigilance is paramount for anyone seeking housing in today’s market.

Rental Scam Alert! Expert Reveals How to Spot and avoid Housing scams Across the U.S.

World-Today-News.com Senior Editor, Alex Park, spoke with Real Estate Fraud Prevention Specialist, Sarah Chen, to uncover the latest rental scams and offer advice on protecting yourself.

Alex Park: Sarah, it’s alarming to learn that a new wave of rental scams is hitting U.S. cities. Are these scams really as widespread as they seem, and how do they work?

Sarah Chen: “Absolutely, Alex. Rental scams are unluckily becoming increasingly common.These scams prey on the desperation of people looking for housing. Fraudsters pose as landlords, list fake properties online, and steal deposits and first month’s rent from unsuspecting victims. Often, these scammers will use stolen photos and even fake property addresses to give the illusion of legitimacy. Onc they receive the money, they disappear.”

Chen highlights the emotional vulnerability scammers exploit.The urgency to secure housing, especially in competitive markets, can cloud judgment and make individuals more susceptible to these schemes.She further elaborated that scammers often target major metropolitan areas with high rental demand, such as New york City, Los angeles, and Chicago, but are increasingly active in smaller cities and even rural areas.

Alex Park: That sounds incredibly elegant. What are some of the red flags that potential renters should watch out for when they’re searching online?

sarah Chen: “There are several warning signs, Alex. Here’s what to watch for:

- Unusually Low Rent: If the rent seems substantially below market value for the area, be very cautious. It might very well be a scam to lure in potential renters.

- Refusal to Meet in Person: scammers often avoid in-person meetings. If a ‘landlord’ is always unavailable to show the property or meet you, that’s a major red flag.

- Pressure to Pay Immediatly: Scammers often pressure you to send money quickly, often before you’ve even seen the property or signed a lease.

- Requests for Wire Transfers or Unusual Payment Methods: Legitimate landlords typically don’t request money via wire transfer, prepaid debit cards, or digital payment platforms.

- Vague or Missing Facts: Be wary of listings with missing details, such as the property address or the landlord’s contact details.

- Poor Grammar and Typos: Scammers often use poorly written listings, as they aren’t native English speakers.”

chen emphasized the importance of cross-referencing information. For example, potential renters should verify the listed address on Google Maps and compare it to the photos provided. Discrepancies can be a meaningful warning sign.

Alex Park: The article mentions that these scams can affect people at all income and education levels. How can renters, nonetheless of their background, protect themselves?

Sarah Chen: “Absolutely, anyone can be a target. Prevention is key. Here are some crucial steps:

- Verify the Property’s Ownership: Check public records to confirm the person listing the property actually owns it.

- See the Property in Person: Always view the property before sending any money. If you can’t visit in person, ask a trusted friend or relative to do so in your place.

- Check the Landlord’s Identity: Ask for identification and verify their identity.

- Review the Lease Carefully: Before signing, make sure you understand all the terms of the lease.

- Use Secure payment Methods: Never send money via wire transfer or untraceable methods. Use checks or online payment platforms that offer protection.

- Trust Your Instincts: if something feels off, it probably is. Don’t ignore your gut feeling.

- Report Suspicious Activity: If you suspect a scam, report it to the online platform where you found the listing and local law enforcement.”

Chen added that renters should be wary of landlords who are overly eager to rent the property without proper screening. Legitimate landlords typically conduct background checks and credit checks on potential tenants.

Alex Park: With so many online rental platforms, how can renters navigate these sites safely?

Sarah Chen: “Online platforms are where the scams are prevalent. Always do your due diligence before responding to any listings.

- Use Reputable Websites: Stick to well-known and trusted rental websites.

- Be Skeptical of New Listings: Scammers often post fake listings to sites that are less moderated and that get a lot of traffic.

- Communicate Directly: Try to contact the landlord directly through the platform’s messaging system, if possible.

- Research the Address: Use Google Maps or other tools to confirm the property exists and that the photos match the address.”

Chen suggested using reverse image searches to check if the photos used in the listing are genuine or stolen from other websites. This can help identify fake listings that use stock photos or images of properties located elsewhere.

Alex Park: What recourse do renters have if they fall victim to a rental scam?

Sarah Chen: “It can be challenging to recover money lost to a rental scam, but there are steps you can take.

- Report the Scam: File a report with the online platform where you found the listing and local law enforcement. They may be able to investigate and potentially recover your funds.

- contact Your Bank: If you paid with a check or credit card, contact your bank immediately. They may be able to help you dispute the charges.

- Consider Legal Action: If the amount of money you lost is significant, you may want to consult with a lawyer to explore your legal options.”

Chen noted that the sooner a scam is reported, the better the chances of recovering lost funds. She also advised victims to keep detailed records of all communication with the scammer,including emails,text messages,and payment confirmations.

Alex Park: sarah, this has been incredibly informative. Thank you for helping our readers stay safe and informed regarding the ongoing rental scam epidemic.

Sarah Chen: “My pleasure, Alex. It’s crucial to always be vigilant and protect yourself. By staying informed and following these tips, you can significantly reduce your risk of becoming a victim.”

Alex Park: Do you believe there are any other major scam or fraud risks individuals are facing right now?

Sarah chen: “Yes, there are, but they all share common traits. Always be sure to never share account information or passwords. Also, be aware of charity scams, which notably increase after events like natural disasters.”

Chen warned against clicking on suspicious links or opening attachments from unknown senders, as these can contain malware or phishing scams designed to steal personal information.

Alex Park: If you suspect you’ve been the subject of a scam, where do you go for help next?

Sarah Chen: “To make a report and get help, visit consumerfinancial.gov,the official website of the Consumer Financial Protection bureau.”

Alex Park: Thank you again, Sarah. This is a conversation that’s critically important for all of our readers.

Protecting Yourself: A Summary of Key Steps

To help readers quickly access the most important advice, here’s a summary of key steps to protect yourself from rental scams:

| action | Description |

|---|---|

| Verify Ownership | Check public records to confirm the landlord’s ownership of the property. |

| In-Person Viewing | Always see the property in person before sending any money. |

| Secure Payments | Avoid wire transfers and use secure payment methods like checks or online platforms with protection. |

| Trust Your Gut | if something feels wrong, it probably is. Don’t ignore your instincts. |

| Report Suspicious Activity | Report any suspected scams to the online platform and local law enforcement. |

Additional Resources

For more information and assistance, consider these resources:

- Consumer Financial Protection Bureau (CFPB): consumerfinancial.gov

- Federal Trade Commission (FTC): ftc.gov

- Local Law Enforcement Agencies

Expert Insights on Avoiding Scams

Rental rip-Offs: Safeguarding Yourself in Today’s Housing Market

World-Today-News.com Senior Editor Alex Park: Welcome, everyone.Today,we’re diving deep into the shadowy world of rental scams,a persistent threat that’s costing people their hard-earned money and peace of mind. joining us is Sarah Chen, a Real Estate Fraud Prevention Specialist. Sarah, it’s concerning that rental scams are on the rise despite how easily they can now be avoided. How prevalent are these scams across the U.S., and what tactics are scammers commonly using?

Sarah Chen: Thanks for having me.Unluckily, rental scams are a meaningful and growing problem across the U.S. They exploit the fundamental human need for housing. Scammers are becoming increasingly elegant, often using online platforms to impersonate landlords and list properties they don’t own or control. They lure in potential renters with attractive listings, steal deposits and first month’s rent, and then vanish, leaving victims financially and emotionally devastated. They are particularly prevalent in major metropolitan areas but are expanding into smaller cities and even rural regions.

Alex Park: It’s crucial for renters to be vigilant. What specific red flags should they be aware of when browsing online listings?

Sarah Chen: Absolutely. Potential renters should watch out for the following:

Unusually Low Rent: If the rent seems significantly below market value for the area, it could be a scam. Low prices are often used to bait potential renters.

Refusal to Meet in Person: Scammers avoid in-person meetings. If a “landlord” is consistently unavailable to show the property or meet you, that’s a major red flag.

* Pressure to Pay Immediately: Scammers pressure you to send money quickly, often