Posted Apr 19, 2022, 7:10 PMUpdated on Apr 19, 2022 at 7:20 PM

When the American consumer goes, everything goes! Or at least, not everything can go so wrong. Indeed, Bank of America benefits from the desire to spend and go out of its compatriots. And the increase in the cost of money benefits its interest margin, the difference between interest received and paid.

It’s the simple story that global investors have been hoping to hear from the big banks. And his boss Brian Moynihan was able to decline it well, with his encouraging comments on the size of the economy across the Atlantic – greater than its pre-pandemic level – even if he was careful not to take a position on a possible subsequent slowdown.

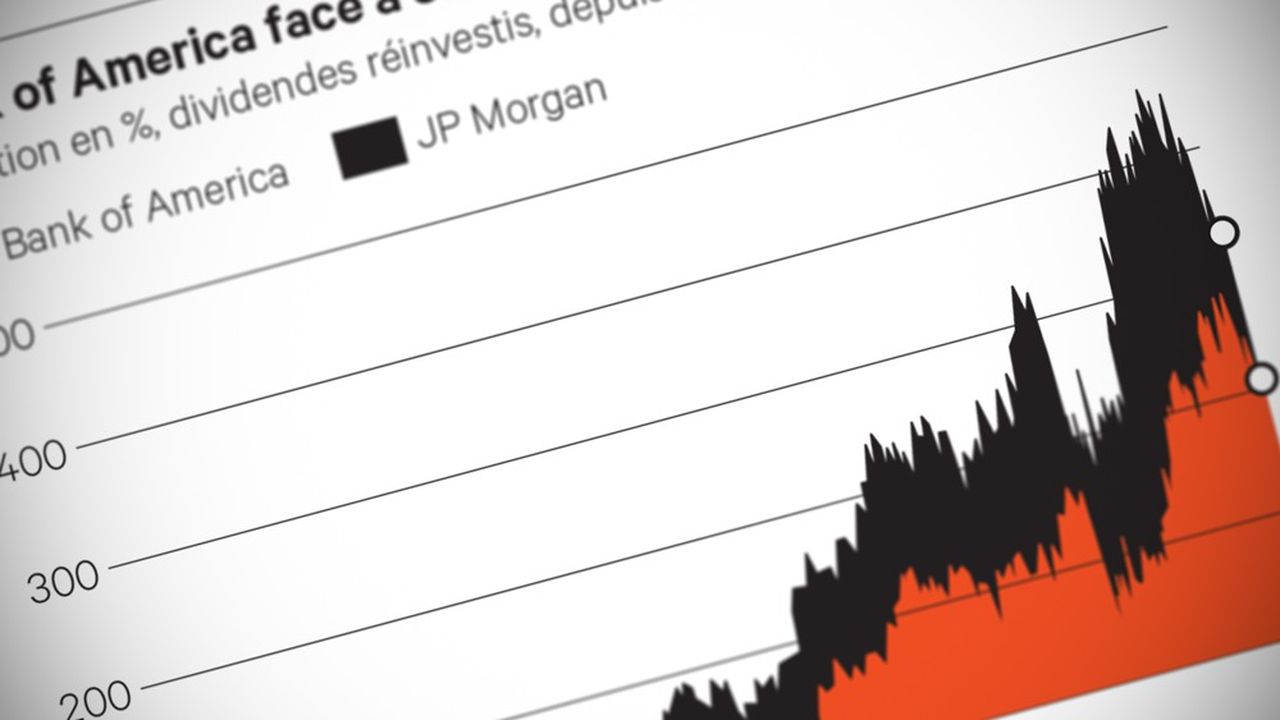

Wall Street was able to salute its quarterly publication, after having been choosy about those of its counterparts a few days earlier. JP Morgan and Citigroup are considered more exposed to the fallout from the war in Ukraine, Goldman Sachs to the financial markets and Wells Fargo to the cooling of mortgage demand.

Bank of America

The second bank of Uncle Sam by the size of its assets, well deserves its name of Bank of America. Its investment and corporate banking division did not do better than the sector oracles expected, but its retail activities confirmed the good provisions of ‘Main Street’.

The cost of risk remained very low – with reversals of provisions – and above all well below forecasts. Carpe Diem.

–

Understand and anticipate

Duel Macron-Le Pen, unprecedented geopolitical context, economic uncertainty, the expertise of the editorial staff of Les Echos is invaluable for better understanding the news. Every day, our surveys, analyses, columns and editorials accompany our subscribers, help them understand the changes that are transforming our world and prepare them to make the best decisions.

I discover the offers-