08/10/2022 13:34 Last update: 13:45

Under the obstruction of the US government, Japanese semiconductor suppliers such as Murata, Sony, and Kioxia have been unable to conduct normal business transactions with Huawei in the past two years. Now, upstream Japanese semiconductor equipment companies are also beginning to worry that similar encounters may occur to themselves.

Tokyo Electron ranks as the third largest semiconductor equipment supplier in the world.

–

On August 8, an executive of Tokyo Electron admitted that the company was “very worried” about the expansion of high-tech export controls on China by the United States. China is a key market for the Japanese semiconductor equipment giant.

In 2021, Tokyo Electron will be the third largest supplier of semiconductor equipment in the world, ahead of it are Applied Materials in the United States and ASML in the Netherlands, followed by two American companies, Pan-Lin Group. (Lam Research) and Ketian (KLA).

According to Tokyo Electron, the company has not received any request from the U.S. government to stop exports to mainland China. But a Tokyo Electron executive said at the earnings call that he saw reports that the U.S. government was trying to expand export controls to mainland China.

Screenshot of Nikkei Asian Review report

–

Last month, U.S. semiconductor equipment giants Fanlin Group and Ketian revealed on a conference call that they had been notified by the U.S. government to ban the sale of most chips that can make 14nm or more advanced processes to mainland Chinese chipmakers without permission. device of. Prior to this, the scope of US export controls to China was only applicable to 10nm or more advanced processes.

The so-called process refers to the width between the transistors on the chip. Usually, the smaller the process, the more advanced the performance of the chip, which requires more advanced equipment to manufacture. The news of the above-mentioned expansion of export controls comes after the United States passed the “Chip and Science Act of 2022,” which will provide about $52.7 billion in financial support to the domestic semiconductor industry.

“If such restrictions are implemented, our Chinese (mainland) customers may not be able to produce chips, and we are very concerned about this situation.” Hiroshi Kawamoto, general manager of Tokyo Electronics’ financial department, admitted at the earnings conference.

–

Chip manufacturing involves hundreds of processes and numerous suppliers. Tokyo Electron’s products cover almost all processes in the semiconductor manufacturing process. Its main products include: coating/developing equipment, heat treatment film forming equipment, dry etching equipment, chemical vapor deposition equipment, wet cleaning equipment and testing equipment equipment. However, the company’s equipment also needs to cooperate with other companies’ equipment, such as lithography machines, to make the production line work.

“China (mainland) is a very important market for us, accounting for more than a quarter of our sales,” Kawamoto revealed. “We believe the Chinese market will continue to grow. However, the chip production center continues to grow with competition. Changes in the landscape and other factors. No matter where our customers are, we will serve them.”

Source of the internal picture of the chip factory: Nikkei Asian Review

–

Tokyo Electron’s concerns about the expansion of U.S. export controls to China are well-documented.

In 2019, due to the U.S. restrictions on normal trade between Huawei and U.S. companies, Huawei’s procurement of parts and components from Japanese companies in 2019 reached 1.1 trillion yen (about 71.3 billion yuan). Japan has also replaced the United States as Huawei’s largest source of parts and components.

–

But the normal trade between Japanese companies and Huawei did not last long. In 2020, the United States has continuously cut off Huawei’s path to purchase chips, and Japanese companies will inevitably be affected.

“Our purchases from Japan in 2019 were around US$10 billion, and in 2020 it will be around US$8 billion, down 20%. Therefore, Japanese companies are typically treated by unfair trade and non-free trade, because Japanese companies want to sell a Giving a chip or a device to Huawei requires the approval of the U.S. government. This is a typical example of unfairness and a typical obstacle to free trade. And it’s not just Japanese companies that are affected.” In April 2021, Xu Zhijun, the rotating chairman of Huawei expressed at the event.

In addition to geopolitics, the epidemic also affects the performance of Japanese companies. The financial report shows that in the second quarter of 2022, Tokyo Electronics achieved revenue of 473.6 billion yen (about 23.7 billion yuan), a year-on-year increase of 4.8%; operating profit fell by 17.1% year-on-year to 117.5 billion yen; net profit fell by 12.2% year-on-year to 88 billion yen, the company’s first drop in net profit in six quarters.

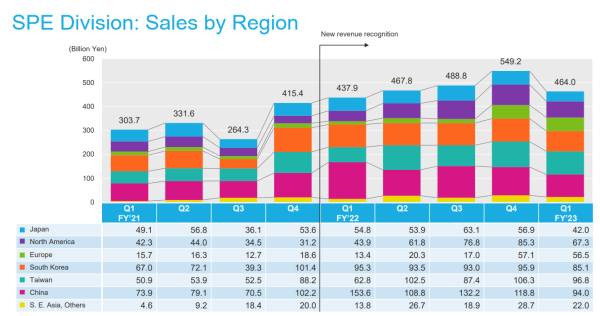

Affected by the local epidemic in mainland China, Tokyo Electronics’ revenue from mainland China in the second quarter of 2022 fell sharply by 39% to 94 billion yen, the largest decline in major markets. However, Hiroshi Kawamoto revealed that shipments to mainland China are returning to normal, and the company is confident to make up for the vacancy from April to June this quarter, so the performance expectations for the entire fiscal year (April 2022-March 2023) remain unchanged. Change.

–

In the first quarter of fiscal year 2023 (the second quarter of 2022), Tokyo Electronics’ revenue in each region accounted for.

–

“We haven’t encountered any order cancellations. There are requests for delayed deliveries, but few.” Kawamoto revealed that Tokyo Electron does not expect to adjust production this year. However, the company lowered its outlook for global semiconductor manufacturing equipment demand this year, forecasting growth of 5-15% this year, down from an earlier forecast of 20%. Meanwhile, industry groups including research firm Gartner have also lowered their demand forecasts for semiconductors this year and warned that demand could decline in 2023.

“If a slowdown in the global economy, heightened geopolitical tensions, and weaker demand for smartphones and PCs are combined, growth (in demand for chip-making equipment) could slow to 5 percent,” Kawamoto said.

Less than a month ago, Dutch lithography giant ASML warned in its earnings report that the global semiconductor supply chain would face disruptions if the United States forced the company to stop selling its mainstream lithography equipment to mainland China.

“I think we need to realize that mainland China is an important player in the semiconductor industry, especially in the field of mature processes and mainstream semiconductors,” Peter Wennink, CEO of ASML, admitted to investors. “Mainland China is a global market. A very important supplier, so we have to be careful.”

–

Peter Wen revealed that politicians from time to time propose plans to restrict the sale of deep ultraviolet lithography machines (DUV) to mainland China, but the world “cannot ignore” the importance of mainland China’s semiconductor production capacity to the global electronics industry.

Chinese Foreign Ministry spokesman Zhao Lijian pointed out in response to relevant reports on July 6 that in the current context of globalization, the United States has repeatedly politicized, instrumentalized, and ideologically oriented on science and technology and economic and trade issues, and engaged in “technological blockade” against other countries. “Technological decoupling” will only make other countries more vigilant. Relying solely on the United States for technology will not work, which will also prompt countries to accelerate the realization of technological independence and self-reliance.

“Attempts to block the road of others will only block the path of one’s own.” Zhao Lijian said that he hoped that the relevant parties would uphold an objective and fair position, and proceed from their own long-term interests and the principle of a fair and equitable market to make decisions independently.

–

deep throat

** Blog articles are at your own risk and do not represent the company’s position**

–

see more articles below

–