Twitter continues to bleed into the market. With increasingly deep falls that have come to exceed 20% per year and the reading behind the accounts is less and less favorable for the company. At the moment what we have on the table, after the departure of Jack Dorsey, is the continuity of its new executive president.

The idea is that their projects, on the one hand, speed up, but at the moment the market experts, as we will see in their recommendations, do not see that their projects can add value to the action. And above all because of the words of Parag Agrawal, its new CEO, who, however, dmade it clear that there will be no far-reaching strategic changes in terms of its commercial growth it means.

With scraped accounts meeting expectations, but little else, the market, which is not favorable in its current environment for Big Tech, sees that Twitter just stays the course where it used to and that, in the latter part of last year, growth was not enough for profitability, dammed up during the pandemic, when it comes to advertising.

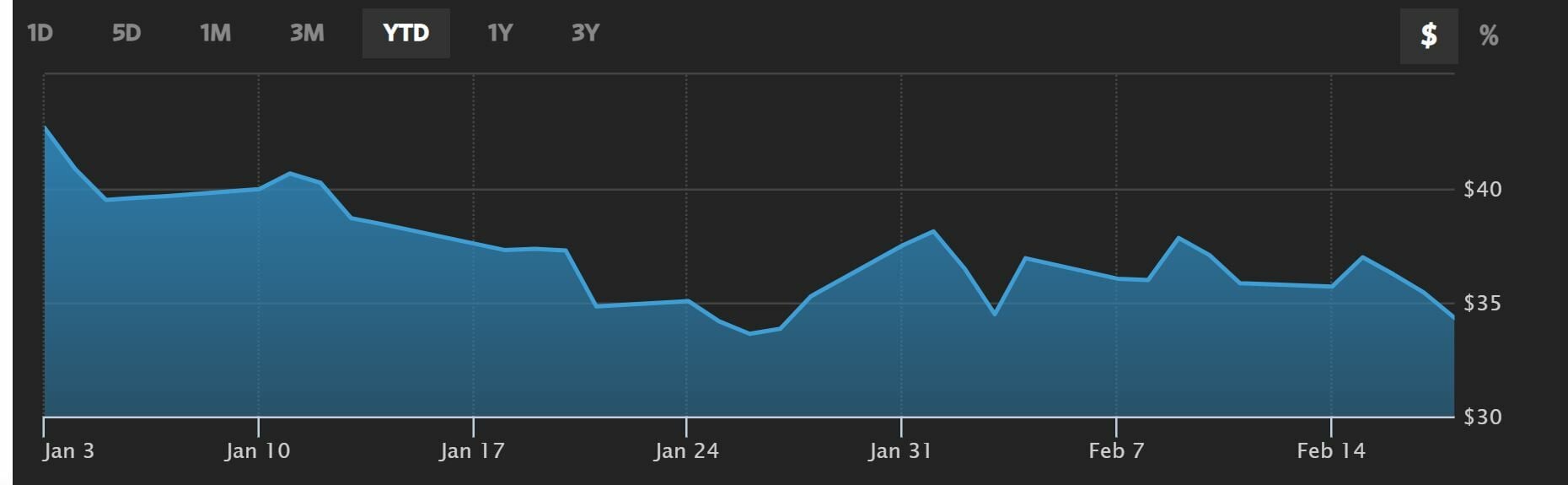

In its price graph we see that Twitter remains at interannual minimum levels, at its worst levels since the end of January, cut 3.84% in the last 20 trading sessions for the value, in the month the fall reaches 2, 11% for value. In the quarter, the decreases reach 27.5% and so far this year it yields 20.6% in the market. In Interannual, the cuts already exceed 51%. And it moves to no less than 133% of its best levels harvested a year ago now.

Also, Agrawal has just announced that he will be taking a few weeks of paternity leave, although with the idea of staying operational, even if it is from home and stay in charge of the company, because he will not appoint a substitute or interim. He is the second child of his.

One of the growth possibilities is to increase its presence in countries like India, a market that until now has not been a priority, after the saturation of its two largest markets, such as the United States and Japan

In terms of recommendations we move in Twitter with just came from Wells Fargo. The entity’s analysts, and specifically Brian Fitzgerald, place his advice on value in equal weight for actions with a target price of $42 per share.

Consider that fourth quarter results were in line with expectations, although it exceeded Wall Street expectations and its orientation was mixed with good and bad news, in the latter it also stands out its operating income guidance which is placed well below the consensus market preview.

In the case of the Wall Street Journal, the consensus for the value is keep the stock with 38 analysts who apply, with 9 who choose to buy, 2 for overweighting the value on the stock market, 24, the vast majority for keeping in the portfolio and 3 for selling.

From TipRanks of the 27 analysts who follow the market value, we see that 8 choose to buy the market value, 17 to hold and 2 to sell, with a median target price of $46.85 per share which gives it an average potential in the market that reaches 36.51%.

According to the technical indicators of Investment Strategies, Twitter barely reaches, in rebound mode, the 2.5 total points of the 10 possible for the value. Among the positives, the volume of business stands out, which moves increasing both in the medium and long term for the value and volatility, the range of amplitude in the long term that is decreasing.

The rest, negative with the long-term bearish trend, as well as in the medium term and the total moment, both slow and fast, is negative, which also adds to the growing volatility of Twitter in the medium-term market.

If you want to know the most bullish values of the stock market, register for free in Investment Strategies.

–