Posted Apr 11, 2022, 7:33 PM

Impossible war, improbable peace? No need to re-read Aron’s “The Great Schism” to understand that Twitter’s situation changed in a weekend. The renunciation of Elon Musk to enter its board of directors, contrary to the initial intention, tilts the microblogging network into a much less peaceful relationship with its first shareholder.

Its managing director, Parag Agrawal, assured that the decision of the first billionaire on the planet was “for the best” but without believing in it. He also expects “diversions” and “noises” that will shake the blue bird. After the Texan “Cyber Rodeo” of the inauguration of Tesla’s sixth factory, Elon Musk continued the show with a series of provocative tweets, asking if the platform was not “dying”.

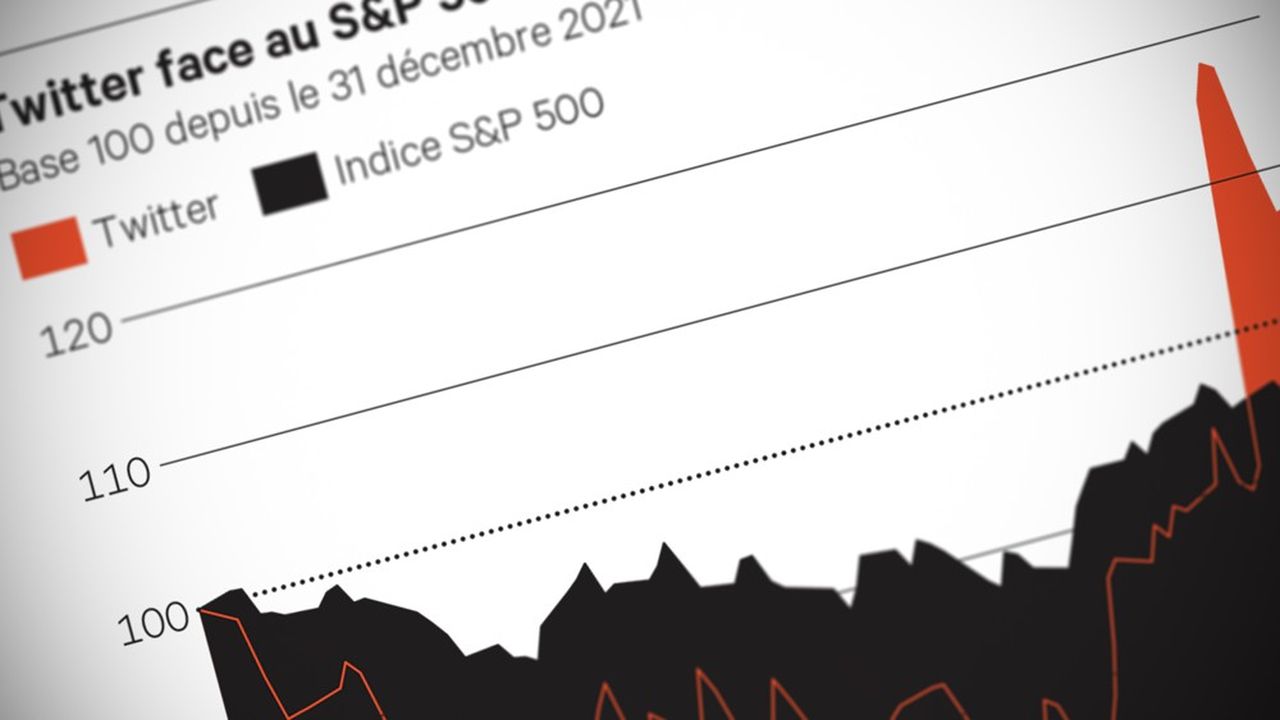

His about-face theoretically allows him to continue his stock purchases, but Wall Street is not betting on it. Compared to its profits, the title is better valued by more than 55% compared to Facebook, while analysts consider its objective of 315 million users unattainable by the end of 2023.

The profile of Musk’s rise to 9.2% of the capital – very gradual since the end of January – is more akin to that of a financial activist than that of a takeover raider, with the exception that the heart of the battle is over “free speech”. A “responsible investment” in a way…

To note

Elon Musk has changed the registration with the stock market authorities of his participation in the capital of Twitter, declaring it as that of an active shareholder. This reveals that the capital increase began at the end of January, but that he has no immediate plans to continue his purchases, even if he reserves the right to change his mind at any time. .

About 98% of the Twitter shares he owns (71.7 of 73.11 million) were acquired at an average price of $34.97. By extrapolating it to all of its shares, these would therefore have cost it 2.56 billion dollars (a little more than the estimates during the revelation of last week).

During Monday, its potential capital gain would amount to just over $820 million.

—

Facing uncertainty

In an unprecedented geopolitical and economic context, the editorial expertise of Les Echos is invaluable. Every day, our surveys, analyses, columns and editorials accompany our subscribers, help them understand the changes that are transforming our world and prepare them to make the best decisions.