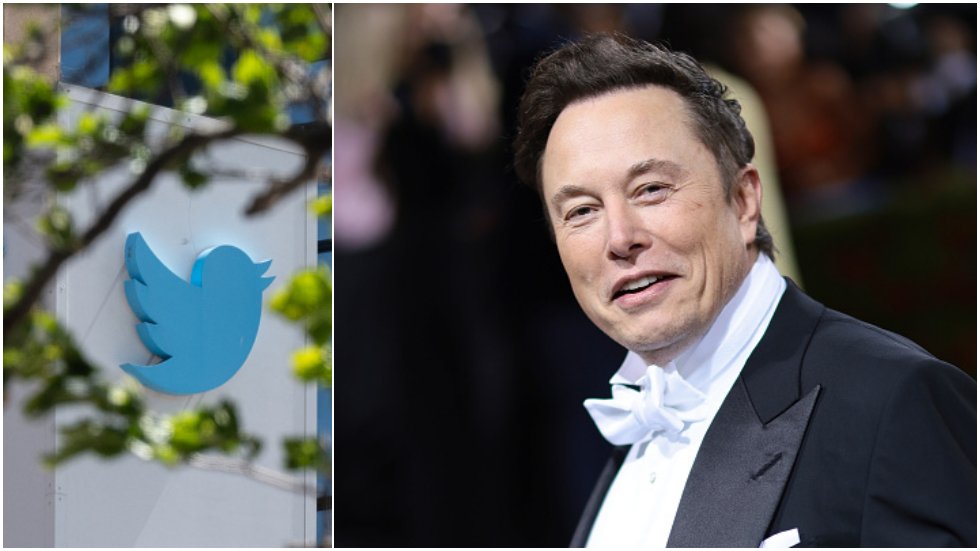

Elon Musk last week put the brakes on Twitter’s takeover process, casting doubt on the claim that fake accounts and spam accounts were less than 5% monetizable daily active users of the platform in the first quarter. The company cares little about his procrastination: it wants to close the deal as soon as possible and is even ready to force his hand.

“The Twitter agreement is temporarily suspended pending details supporting the calculation that spam/fake accounts actually represent less than 5% of users.” By sending this tweet last FridayElon Musk has put a serious halt to the process which should see him get his hands on the blue bird social network.

Since then, the richest man in the world has multiplied the tweets – less serious, but always more suspicious – on the question. On Monday, current Twitter CEO Parag Agrawal attempted to explain the details of the 5% calculation, while acknowledging that his teams weren’t “perfect at catching spam.” Musk replied with a tasteful emoji. Subsequently, he relied on 20%… or even 50%.

Twitter writes to the SEC

Obviously, the doubts expressed by Musk do not shake Twitter. On Tuesday evening, the company issued a new filing with the Securities and Exchange Commission (SEC). Twitter said it “commits to completing the transaction at the agreed price and terms as quickly as possible.”

Additionally, Twitter released the minutes of its negotiations with Musk. The report shows that the potential acquirer, before formulating its offer, seems not to have made any obvious effort to find out more about Twitter’s activities, in particular the number of spam accounts present on its platform. While this is precisely the reason he invokes to suspend the agreement.

The report instead paints the picture of Musk in a hurry to strike a deal with his “best and last” offer, notes Reuters.

Towards legal action?

As reminded Reuters, Twitter and Musk had agreed last month to ensure that both parties stick to the takeover deal. Fixed at 44 billion dollars, it must be concluded in October. However, Musk seems ready to drag out the process, or even renegotiate the agreement at a lower price. Twitter’s stock ended at $38.32 on Tuesday, nearly 30% below the $54.20 per share price set for the deal.

Each side agreed to pay the other a billion dollar penalty if she does not respect the agreement. But Twitter can also sue for “specific performance” to force Musk into a deal and get a settlement from him as a result. In its filing with the SEC on Tuesday, the company rightly mentioned the possibility of suing Musk and obtaining an agreement from him, announces Business Insider.

A priori, the minutes of the negotiations do not plead in favor of Musk, who, if he wants to win justice, will have to prove that Twitter really told him something “wrong” during the negotiations. However, the company always seems to have taken care to indicate that these explanations relating to the number of false accounts were only an “estimate”, therefore likely to be erroneous.

Either way, if the case were to end up in court, no one should come out on top. Any litigation is likely to be lengthy and cast uncertainty on Twitter’s business, experts told Reuters. Generally, even companies that have won their cases in court against their acquirers have ended up negotiating financial agreements.

–