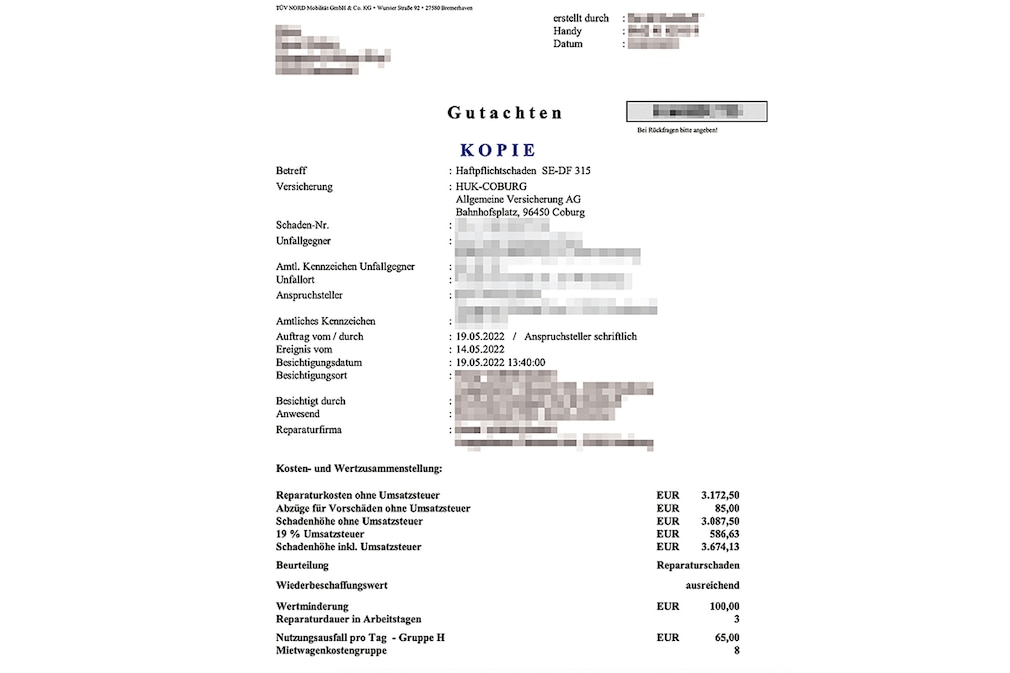

Without a doubt, the subject appeared crystal clear. At 6:00 pm on Could 14, 2022, Daniel Fischer was standing in his Audi A4 Avant (developed in 2016, 70,000 kilometers) in Hamburg’s hurry hour targeted traffic. A Good driver unsuccessful to brake in time and crashed into the rear of the Audi. The human being who brought about the incident reported the hurt to his insurance organization, HUK. –

On May well 19, a TÜV pro inspected the car. The bumper was damaged, in the end the pro approximated the problems at € 3674.13 plus € 752.08 for the appraisal. He mentions several scratches as preceding hurt, which he deducts from the mend quantity at 100 euros. The harm was repaired on 7 June. –

–

–

–

–

–

–