Table of Contents

Recently, income came artificial intelligence (AI) to the messaging app WhatsApp promises to transform the way people deal with their personal finances.

Through virtual assistants, the device offers answers to questions about it investments and practical guidance. Despite innovation, common sense is required.

Technology can change access to financial education, but it does not replace critical analysis. Experts warn that it is important to understand the limitations of AI in providing personalized recommendations.

Reinvent co-founder Heucles Del Bianco clarifies that automated information should be seen as a starting point.

Although the advances are promising, it is imperative that users keep a close eye on the recommendations and use AI as a supplement to traditional financial education, always seeking human assistance when needed.

Benefits of AI for Investors

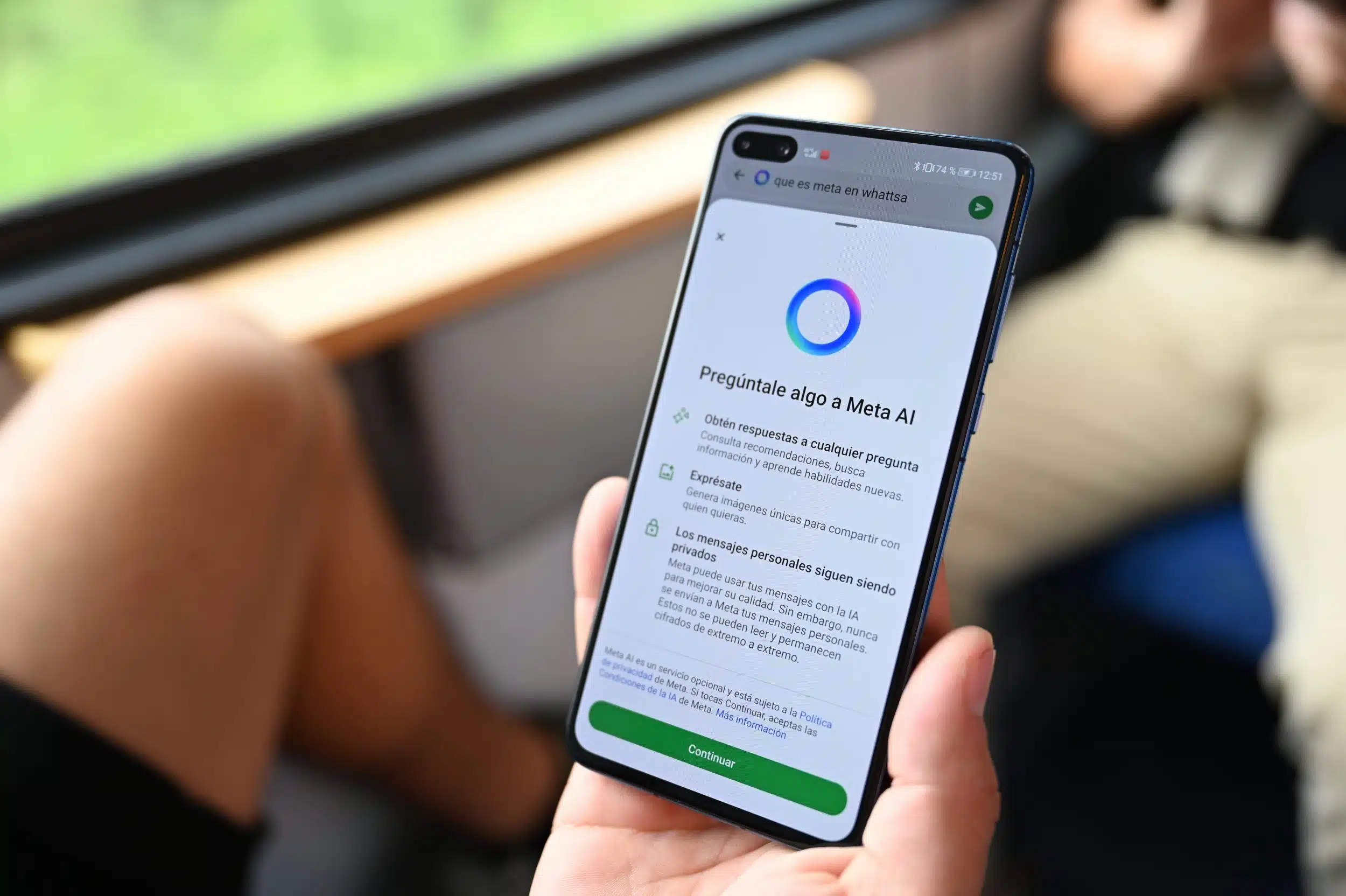

Photo: Camilo Concha/Shutterstock

The new WhatsApp tool is a powerful friend for anyone who wants to learn about the financial market. By delivering educational content, the AI helps create monthly budgets and answer common questions about investments, improving your relationship with money.

Another benefit is the ability of AI to send financial alerts and reminders. Financial educator Gean Duarte, from Me Poupe!, highlights the usefulness of AI for long-term investors. He notes that the tool helps track data and change records based on the image of the an investor.

Check out a summary of the available features below:

- posting content about financial education;

- creating monthly budgets;

- Answers to common questions about investments;

- Sending financial alerts and reminders.

Be careful when following automatic suggestions

Despite the advantages, AI WhatsApp does not replace the critical and personal analysis of a consultant. Automated responses can be general and do not explain investment details well, such as the differences between CDB, LCI and LCA.

Heucles Del Bianco points out that the specialization of responses depends on the context provided by the user and that sudden changes in the financial market may not be adequately explained by AI.

Therefore, careful analysis is recommended before following the recommendations of the virtual assistant.

Promoting financial education

The great potential of AI in WhatsApp lies in its ability to improve financial education. Virtual assistants teach basic investment concepts, compound interest and risk management, making knowledge accessible and practical.

Del Bianco emphasizes that AI should be seen as a valuable aid to learning, especially when it is associated with a structured course or guidance from a consultant.

Deeper knowledge still requires traditional teaching sources.

2024-11-20 01:00:00

#money #WhatsApps #capable

Interviewer: Good evening, and welcome to our program! Today we have as guests Reinvent’s co-founder Heucles Del Bianco and financial educator Gean Duarte from Me Poupe!. We will discuss the impact of artificial intelligence (AI) on personal finance management through WhatsApp.

Interviewer: Good evening, and welcome to our program! Today we have as guests Reinvent’s co-founder Heucles Del Bianco and financial educator Gean Duarte from Me Poupe!. We will discuss the impact of artificial intelligence (AI) on personal finance management through WhatsApp.

Interviewee 1: Hello! I’m excited to talk about this topic. AI has the potential to transform how people deal with their finances and make it easier for anyone with a smartphone to access financial education.

Interviewee 2: Absolutely. AI has already come a long way in helping users understand basic investment concepts, create monthly budgets, and answer common questions about investments. This technology can be a powerful ally for anyone looking to improve their relationship with money.

Interviewer: That’s a great point. Can you explain further how AI works on WhatsApp to provide these benefits?

Interviewee 1: Sure. AI-powered tools on WhatsApp provide personalized content, alerts, and reminders that can help users keep track of their finances. For example, the tool can send alerts when it’s time to pay bills or make investments. Additionally, users can ask questions about investments, like stocks, bonds, and mutual funds, and get relevant answers.

Interviewee 2: I agree with Heucles. The virtual assistant can also send articles and videos about financial education, which is very helpful for beginners. It even helps users understand more complex concepts, such as compound interest and risk management.

Interviewer: It seems like AI is doing most of the work in this scenario. But isn’t there a risk in relying too much on automated responses?

Interviewee 1: Yes, we have to be careful. AI can only provide general answers, and some information may not be accurate or complete. For instance, AI might not explain the differences between different types of investment instruments like CDs, LCIs, and LCAs. Users should always do their own research and validate information before making any financial decisions.

Interviewee 2: Absolutely. Critical thinking and personal analysis are still essential when dealing with finances. We can’t rely solely on AI recommendations.