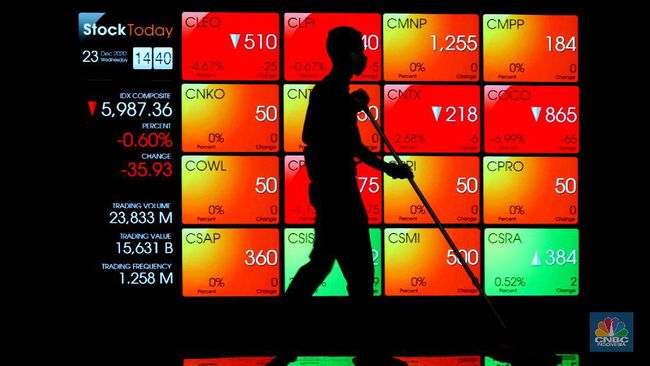

Jakarta CNBC Indonesia – In the midst of the Composite Stock Price Index (JCI) rally this week of 15.28 points (+0.25%) to 6,022,399, these five stocks actually corrected and occupied the position as the stocks with the largest trading losses (top loser).

According to data from the Indonesia Stock Exchange (IDX), three out of 5 stocks that are included in the top loser this week engaged in the transportation and logistics sector. The stock of container services issuer PT Nusantara Pelabuhan Handal Tbk (PORT) became the leader of the correction, dropping 30% in a week to Rp 700/share.

In second place was the chemical goods (fertilizer) issuer PT Saraswanti Anugerah Makmur Tbk (SAMF) which fell 29.9% to Rp 1,055/unit.

The stock of the issuer, which just went public last year, has been corrected since the end of its term cum-dividend which is the last period of registration of public shareholders as dividend recipients.

As is known, dividend-hunting investors buy shares of companies that plan to distribute dividends, and immediately sell their shares after a period of time cum-dividend passed to pursue gains in other stocks. SAMF dividend was paid on June 25 yesterday.

But sometimes market participants take advantage of the sharing momentum dividend for speculation, thus triggering the term dividend trap (dividend trap) where such shares are bought up to attract other investors and prices rise. Furthermore, the shares are released in the short term.

In the third position, PT Bank IBK Indonesia Tbk (AGRS) shares fell 29.5% in a week, following the process of issuing new shares (rights issue). In general, retail investors are less interested in issuing companies rights issue because of the dilution effect.

The bank controlled by the Industrial Bank of Korea (IBK) is holding rights issue with an exercise price of Rp. 170/share, or a discount compared to the current market price of Rp. 244/share. The listing of Preemptive Rights shares, coded AGRS-R, was carried out on June 25 yesterday.

After rights issue, stock exchange data shows that IBK’s ownership of book III banks has not changed from 97.5%. Meanwhile, PT Dian Intan Perkasa’s share ownership as the second largest investor rose from 0.47% to 1.8% and public ownership decreased from 1.68% to 0.52%.

In fourth position is PT Temas Tbk, an issuer engaged in logistics transportation. Just like SAMF, TMAS shares weakened after the company went through a period of cum-dividend last Wednesday.

Finally, the shares of land logistics transportation issuer PT Putra Rajawali Kencana Tbk weakened following the worsening of the Covid-19 pandemic. The Indonesian Truck Entrepreneurs Association (Aptrindo) stated that the pandemic triggered a contraction in the logistics industry with only 40% of the truck fleet operating.

CNBC INDONESIA RESEARCH TEAM

(ags/ags)

– .