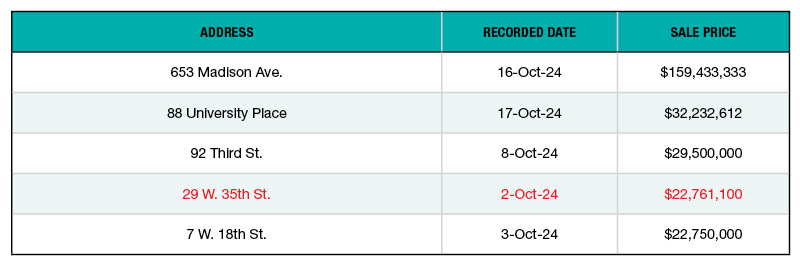

Sale Price: $159.4 million

Extell Development Co. bought the 198,347-square-foot office building in Manhattan’s Lenox Hill neighborhood from Williams Equities, at a sale price of $803.8 per square foot. The acquisition was financed with a $150 million consolidated mortgage provided by Tyko Capital. Dating back to 1951 and rising 24 stories, the office building’s tenant roster includes Knotel, Tisch Financial Management Co., Garnet Group Inc. and Trinity Place Holdings Inc., among others. Fried Frank represented the seller and advised the lender in securing the financing package.

Sale Price: $32.2 million

CIM Group foreclosed on the 70,642-square-foot office building in Greenwich Village. The seller was Arch Cos., which defaulted on a nearly $71 million refinancing package secured in 2022 and backed by the property. The building dates back to 1906, rises 11 stories and had previously traded in 2015 for $70 million, when WeWork and its partner acquired it.

Sale Price: $29.5 million

Charitable organization Pearl Foundation Inc. purchased the 72,700-square-foot office asset in Brooklyn’s Gowanus neighborhood from Samson Management. The seven-story property was built in 1968 and last upgraded in 2014. The asset previously changed hands in 2015, when Samson Management acquired it for $73 million. Since the start of the year, occupancy at the property has posed issues, especially with long-time tenant Bond Collective leaving and freeing up 50,000 square feet, according to The Real Deal.

Sale Price: $22.8 million

The 71,180-square-foot building in the borough’s Koreatown area traded between Starwood Property Trust and Empire State Equities. Starwood Property Trust bought back the property via its affiliate, LNR Partners, that acted as a loan servicer through a foreclosure auction deal. The seller defaulted on a $41 million loan originated in 2019 after it owned the 1911-built, 12-story asset since 2007.

Sale Price: $22.8 million

Built in 1987, the 43,307-square-foot office building changed hands between Tarsat Properties and ASB Real Estate Investments. The Maryland-based seller owned the property in partnership with George Comfort & Sons since 2015, when it purchased the nine-story building for $43.8 million. The Flatiron District property includes 4,000 square feet of retail space and is currently occupied by Harmony Partners, Uppercut Edit and Data Courier Systems, among others.

—Posted on November 26

articol editat:

New York City Office Market Sees Significant Transactions in October 2024

In a bustling month for real estate, October 2024 witnessed several noteworthy office building sales in New York City, as firms navigate a shifting market landscape. Here are the highlights from the recent transactions that have caught the industry’s attention:

Extell Development Co. Expands Portfolio with Historic Manhattan Purchase

Sale Price: $159.4 million

Extell Development Co. has made a significant acquisition in Manhattan’s Lenox Hill neighborhood, purchasing a 198,347-square-foot office building from Williams Equities for $803.8 per square foot. This 24-story asset, constructed in 1951, boasts notable tenants such as Knotel, Tisch Financial Management Co., and Trinity Place Holdings Inc. To finance this strategic investment, Extell secured a consolidated mortgage for $150 million from Tyko Capital. Legal representation for the seller came from Fried Frank, which also advised on the financing.

CIM Group Takes Over Foreclosed Greenwich Village Property

Sale Price: $32.2 million

The CIM Group has successfully foreclosed on a 70,642-square-foot office building located in the vibrant Greenwich Village. Originally owned by Arch Cos., which defaulted on a refinancing loan of nearly $71 million, this 11-story building dates back to 1906 and was previously sold in 2015 for $70 million to WeWork and its partner.

Pearl Foundation Invests in Gowanus Office Space

Sale Price: $29.5 million

The Pearl Foundation Inc. has expanded its holdings by acquiring a 72,700-square-foot office asset in Brooklyn’s Gowanus neighborhood from Samson Management. Built in 1968, this seven-story building faced occupancy challenges in 2024, especially following the departure of a long-term tenant. The property previously changed hands in 2015 for $73 million.

Koreatown’s Starwood Property Trust Reclaims Asset

Sale Price: $22.8 million

Starwood Property Trust successfully acquired a 71,180-square-foot property in Koreatown through a foreclosure auction. The property owner defaulted on a $41 million loan taken out in 2019. Starwood took ownership of this 12-story building, which has been in the seller’s portfolio since 2007.

Flatiron District Property Changes Hands Again

Sale Price: $22.8 million

In another transaction, Tarsat Properties sold a 43,307-square-foot office building, built in 1987, to ASB Real Estate Investments. The asset, located in New York’s Flatiron District, includes 4,000 square feet of retail space and has seen various tenants, including Harmony Partners and Data Courier Systems.

As these sales unfold, they reflect the ongoing evolution of New York City’s commercial real estate landscape, providing insights into future trends amidst the overarching challenges of the post-pandemic recovery phase.

—Posted on November 26

![[오늘의 운세] November 28 | JoongAng Ilbo [오늘의 운세] November 28 | JoongAng Ilbo](https://pds.joongang.co.kr/news/component/htmlphoto_mmdata/202411/28/7643c616-2f25-4af5-bcad-36a85adbd47d.jpg)