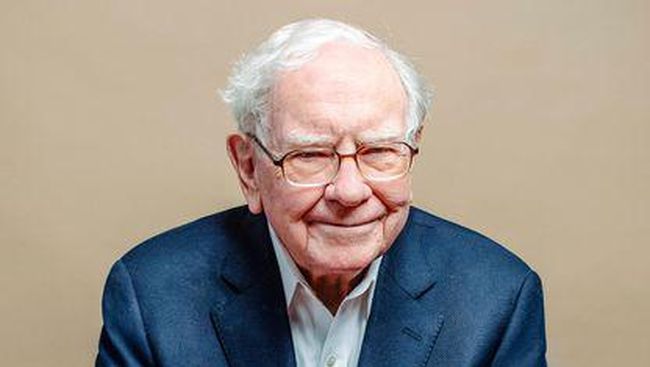

Jakarta, CNBC Indonesia – Tech stock prices, which have fallen since the beginning of the year, have been used by veteran global investor Warren Buffett to buy up Apple shares.

The investor, dubbed the Oracle of Omaha, has reportedly bought up Apple shares when the price was depressed throughout the first quarter of 2022.

Launch CNBC InternationalWarren Buffett said he had bought $600 million worth of Apple shares when technology stocks experienced massive selling pressure for three straight days at the end of the first quarter of 2022.

To note, of the many shares owned by Warren Buffett through his investment company Berkshire Hathaway, Apple’s share is the largest, reaching US$159 billion at the end of March 2022, equivalent to 40% of his total portfolio in stocks.

The man who is now 91 years old also said that if Apple’s stock price did not reboundmost likely it will continue to buy Apple shares that are dropping.

Warren Buffett through his company is known to have started buying Apple shares since 2016. Investors who are famous for their strategy value investingThe man also said he was a fan of Apple CEO Tim Cook.

Buffett says that strategy buyback what Apple does is a smart way because usually a company’s stock price will rise when it is announced buyback.

Throughout 2021, Apple is reported to have spent US$ 88.3 billion on buyback.

Apple’s stock price was indeed depressed by various issues such as the tightening of monetary policy that may be carried out by the US Federal Reserve Bank (The Fed).

In addition, Apple’s stock price was also depressed after its CFO, Luca Maestri, said the company’s sales could be depressed by US$ 4-8 billion due to the current global supply chain disruption due to Covid-19.

However, in the first quarter of 2022, Apple reported a more solid financial performance than expected. Apple’s revenue rose 8.6% year on year (yoy) to US$ 97.28 billion.

Apple’s reported profit margin ratio reached 43.7% or higher than analyst estimates of 43.1%. On the bottom line, Apple also reported a more solid performance than analysts expected.

Apple’s earnings per share (EPS) in the first quarter of this year was reported at US$1.52 and higher than analyst projections of US$1.43.

Apple’s consistency in terms of business growth is one of the factors that makes Warren Buffett like Apple shares and continue to buy these shares.

For information, every year on average, Berkshire Hathaway enjoys dividend payments from Apple of US $ 775 million.

CNBC INDONESIA RESEARCH TEAM

(vap/vap)

–