Jakarta, CNBC Indonesia– The Indonesian currency weakened again against the United States (US) dollar. So far this week, the rupiah fell 0.17% to Rp 15,015/US$. So, who benefits?

Now, the rupiah is trading above the level of Rp. 15,000/US$. The weakening of Garuda’s currency occurred after the US central bank (Federal Reserve / The Fed) raised its benchmark interest rate aggressively. So far this year, the Fed has twice raised its benchmark interest rate by a total of 75 basis points (bps) until June.

On July 26-27 local time, the Fed is scheduled to hold a meeting to discuss its monetary policy. The market predicts that the Fed will again raise its benchmark interest rate by 75-100 bps to curb inflation which soared 9.1% in June.

ADVERTISEMENT

SCROLL TO RESUME CONTENT

–

Unlike the Fed, Bank Indonesia (BI) has instead chosen to be a ‘pigeon’ to maintain its benchmark interest rate at 3.5%. BI assesses that Indonesia’s inflation rate at 4.35% is still relatively lower than other countries in the world. In addition, core inflation, which stands at 2.63%, is considered still within BI’s target range of 2%-4%.

Thus, the urgency of BI to raise its benchmark interest rate is not considered necessary. Meanwhile, some analysts predict that BI will start raising its benchmark interest rate at the meeting in August and September.

As a result, the rupiah was depressed against the US dollar. By year to date, the rupiah has even corrected 5.2% and 2.1% of it comes from its performance in June. After BI announced monetary policy, the rupiah immediately weakened to Rp 15,030/US$, but managed to cut the correction to Rp 15,015/US$ on Friday (22/7).

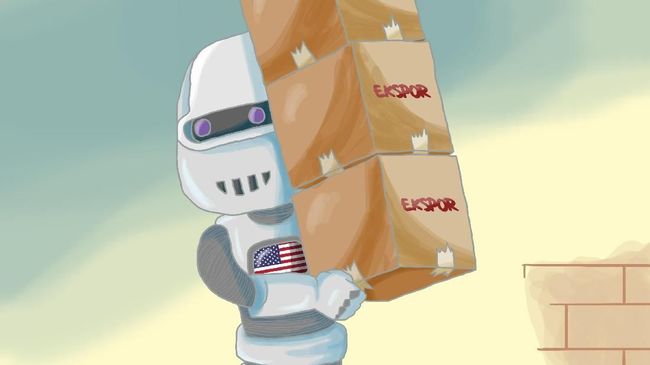

The weakening of the rupiah does not always have a negative impact. As the saying goes ‘there is day and night’, if there is a loss, there must be someone who gains.

Then, who will benefit from the weakening of the rupiah?

The correction in the rupiah has made the prices of Indonesian products more competitive abroad so that domestic industries have the opportunity to boost exports. But remember, not all things related to exports benefit, only exporters who still rely on domestic raw materials.

The sectors that will benefit include marine products, agricultural and plantation products, and Indonesia’s main export commodity, namely mineral fuels.

If referring to data from the Central Statistics Agency (BPS), Indonesia’s trade balance managed to record a surplus of US$ 5.09 billion, supported by the export value which increased by 40.68% compared to last year and 21.3% on a monthly basis. However, the import value also rose 21.98% YoY and 12.87% MoM. However, the import value was relatively lower so that Indonesia managed to record a surplus.

Non-oil and gas exports (oil and gas) contributed as much as US$17.31 billion to the export value, while oil and gas exports were only worth US$1.24 billion.

Non-oil and gas exports include exports of mineral fuels which include coal, oil and natural gas, contributing to Indonesia’s exports of US$ 5.11 billion or equivalent to Rp. 76.7 trillion (assuming an exchange rate of Rp. 15,015/US$). Meanwhile, exports of fats and oils amounted to US$ 3.38 billion or equivalent to Rp 50 trillion and iron and steel commodities contributed US$ 2.24 billion or equivalent to Rp 33.5 trillion.

Not only that, exports of vehicles and parts thereof contributed US$ 0.97 billion or Rp 14.5 trillion.

Therefore, the weakening of the rupiah in July, of course, will provide even greater benefits to the value of exports. Thus, it is expected to have a positive impact on the trade balance next month.

–