The Federal Reserve building in Washington. File / Reuters

On Wednesday, the US Federal Reserve raised interest rates by 0.75 percent after similar sharp increases earlier. Federal Reserve Chairman Jerome Powell did not say whether they have reached the tipping point for rate hikes, although it is speculated that they will be followed by rate hikes of less than 0.50 percentage points.

He said: “The question of when to adjust the growth rate is far less important than the question of how high … and how long to keep monetary policy tight.” He said it was “too early” to discuss when the Fed would hit the pause button on interest rate hikes. It is also not entirely clear whether rising interest rates will have any effect on rampant inflation or whether the Federal Reserve will continue its policy of raising interest rates until inflation reaches a point it considers safe. . The interest rate is now between 3.75 percent and 4 percent. When the rate hikes started, the interest rate was hovering around zero. The FOMC apparently set rates of 4.50 to 4.75 percent at its September meeting. The futures market with high interest rates has set the rate at 5%. The next round should see a less aggressive rate hike.

The US domestic economy looked quite positive, growing 2.6% in the third quarter after two consecutive quarters of growth, following a contraction of 1.6% in the first quarter and 0.6% in the second. A level three drop would technically put the US economy into recession. Consumer prices continued to rise in September. The US economy is expected to enter a mild recession in 2023.

Meanwhile, the Bank of England has raised interest rates by 75 percentage points to 3% from 2.25%. It also announced that the UK economy has entered a recession and will continue until the second quarter of 2024. The pound fell 1.7 percent against the dollar. Inflation in the UK continues to rise as prices rose 10.1% in September. The bank expects inflation to peak at 10.9% by the end of the year, up from 13% previously.

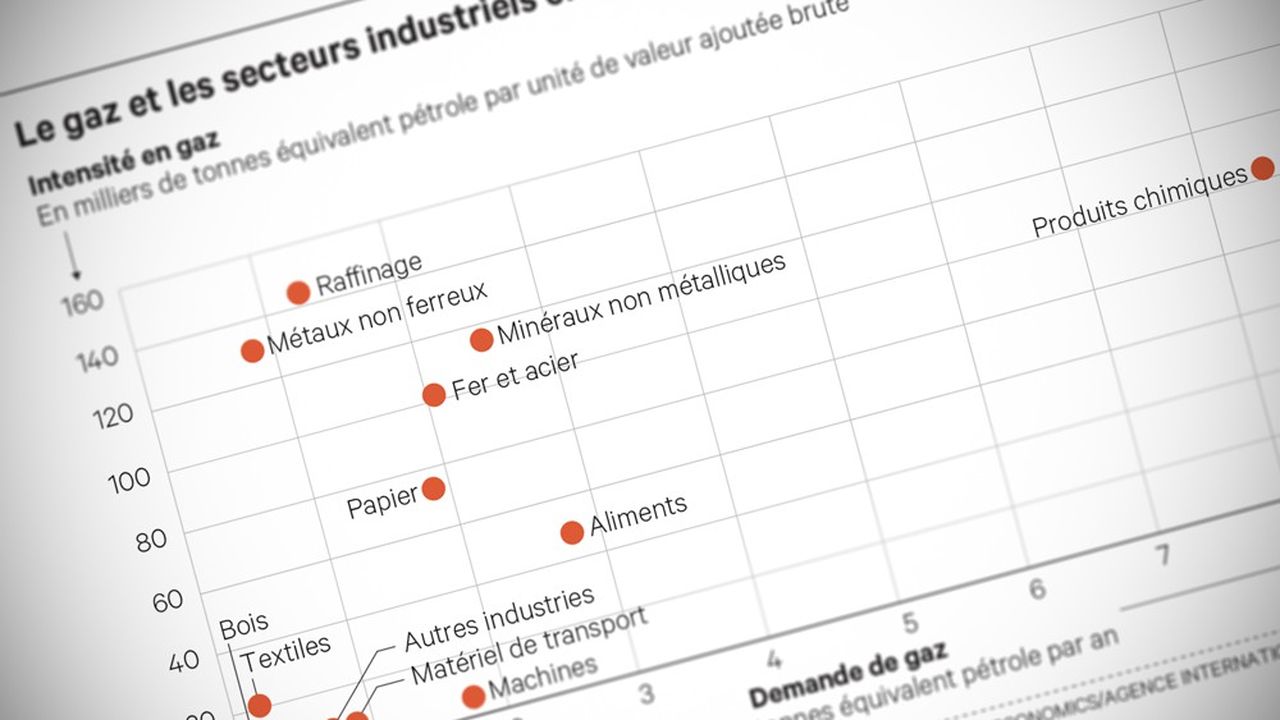

The situation in the European region is not very different, as the war between Russia and Ukraine continues unabated. Fuel prices are constantly rising. Inflation was 10.7% in October compared to 9.9% in September. Food, alcohol and tobacco prices rose 13.1 percent, while fuel prices rose 41.9 percent from last year. In some EU countries, inflation rates were high, with France recording 7.1% and the Netherlands 16.8%. In the Baltic countries, inflation was much higher – in Estonia – 22.4 percent, in Latvia – 21.8 percent and in Lithuania – 22 percent.

There seems to be no certainty as to when the Western world will emerge from the economic bad weather. The war between Russia and Ukraine has certainly exacerbated the situation, but economic vulnerabilities appear to be much deeper. Government support has helped people cope with the coronavirus crisis, but governments appear to have reached the end of their ability to help people with bailouts. Governments and businesses need to find a way to get the economy back on its feet. So far, there are no signs of this.