- Annabelle Liang

- Commercial editor

—

8 hours ago

photo released, Getty Images

—

–

The World Bank has said that rising interest rates by central banks around the world could trigger a global recession in 2023.

–

He pointed out that central banks have raised interest rates “with a degree of synchronicity we have not seen in the past five decades” to counter the rise in prices.

–

The goal of rising interest rates is to make loans more costly in an attempt to slow the pace of price increases. But the measure could slow the pace of economic growth.

–

The World Bank alarm comes ahead of the US Federal Reserve and Bank of England monetary policy meetings, which are expected to raise key interest rates next week.

–

The World Bank said Thursday that the global economy is experiencing its slowest period since 1970.

–

He noted that a study found that “the three largest economies in the world – the US, China and the eurozone – are slowing dramatically.”

–

“Under these circumstances, any moderate blow to the global economy over the next year could push it into recession,” he said.

–

The World Bank has also called on central banks to coordinate their actions and “clearly detect political decisions” in order to “reduce the degree of tightening required”.

–

In recent months, inflation has hit a 40-year high in the United States and the United Kingdom.

–

This has been driven by rising demand with the easing of restrictions imposed by the epidemic and rising energy, fuel and food prices due to the war in Ukraine.

–

In response, central bank policymakers raised interest rates to cool demand from households and businesses.

–

However, sharp price increases increase the risk of a recession, as they can cause the economy to slow down.

–

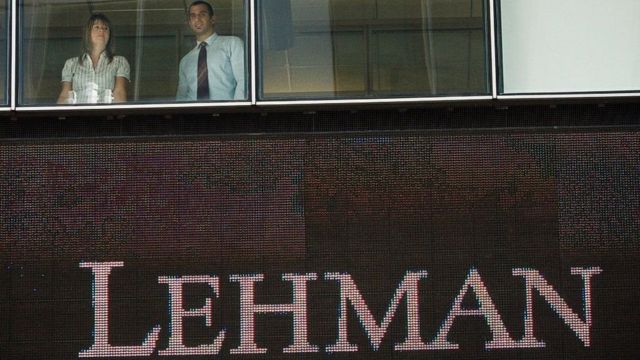

photo released, JAMES LEYNSE

—

Employees take a look at Lehman Brothers’ bankruptcy office in New York

–

Normally, central banks do not look to their peers in making their decisions, but have coordinated their actions in the past to support the global economy.

–

In 2007, a global financial crisis emerged due to the mortgage crisis in the United States.

–

And the issue developed and reached a complete collapse after the collapse of Lehman Brothers in September 2008.

–

A month later, the US Federal Reserve, along with the European Central Bank and the central banks of Canada, Sweden and Switzerland, jointly cut key interest rates.

–

These banks said in a statement that “the deepening of the financial crisis has increased downside risks to growth and thus reduced upside risks to price stability.”

–

“Some easing of global monetary conditions is justified,” he added.

—