Per today we waited a bullish acceleration and then a retracement tomorrow. It appears that the path has changed and that with today’s retracement, an acceleration to the upside will likely follow from tomorrow morning onwards. If the opposite occurs, we will have to worry but at the moment we give this hypothesis a low probability.

Indeed, the strength of the markets sees no obstacles and today is a retracement before further rises.

At 5:08 pm on the trading day on October 27th we read the following prices:

Dax Future

15.696

Eurostoxx Future

4.209,5

Ftse Mib Future

26.640

S&P 500 Index

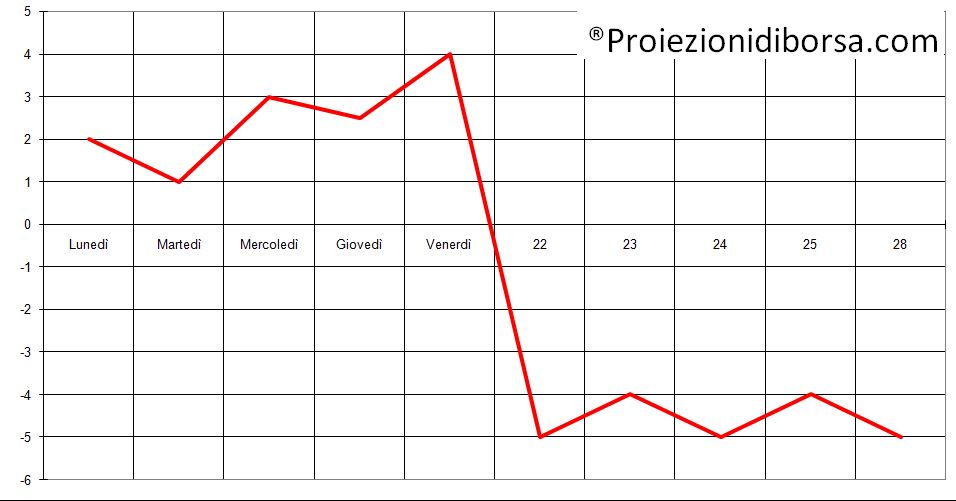

The annual forecast has been bearish since the beginning of August

In red, our annual forecast on the world stock index on a weekly scale for 2021.

In blue the chart of the American markets up to 22 October.

The charts, on the other hand, continue to move upwards and must be followed until their reversal.

What were the expectations for the current week?

Side and minimum phase between Monday and Tuesday and then rise until Friday. Today’s retracement has not changed the structure of the weekly forecast.

Below are the areas of minimum / maximum expected for this week

Dax Future

15.380/15.540

15.856/15.989

Eurostoxx Future

4.140/4.180

4.276/4.325

Ftse Mib Future

26.300/26.455

26.865/27.000

S&P 500 Index

4.501/4.543

4.600/4.659

The strength of the markets sees no obstacles and today is a retracement before further rises

Dax Future

Bullish trend until we see a daily close below 15,513.

Eurostoxx Future

Bullish trend until we see a daily close below 4.173.

Ftse Mib Future

Bullish trend until we see a daily close below 26.410.

S&P 500 Index

Bullish trend until we see a daily close below 4.524.

Which multidays trading positions to hold for Thursday and the following days?

Keep Long trades open on Tuesday 19 October and you could take advantage of this retracement for further upside entry

What might tomorrow’s trading day look like?

Opening on the lows and closing around the highs of the day.

–