Here we are: the market has not retraced. If you look at the chart below of the Ftse All Share index you will notice how the prices of the index have remained sticky and have not moved from the breaking point. It only means one thing: more people who buy at those prices than those who sell. The risk was to see a flight of investors who, taking advantage of the prices on the maximum of the last 10 years, sold by hand, causing prices to collapse suddenly. This was not the case. After the initial shock of seeing the rupture to the maximum, investors started buying and kept buying. Moral: let’s expect a further upward pull in the coming days.

–

So let’s skip every preamble and let’s go straight to the point, let’s start playing our game with the analysis of the six titles selected for you today by the ITI ranking that you can find for free every day at 19.30 clicking here.

But what is the ITI indicator? What is the main difficulty of anyone approaching stock trading? Both a simple investor and a professional trader? Consistency: every day it is necessary to analyze 400 Italian stocks by scanning by hand or automatically for the more experienced. And it is necessary to subscribe to a fundamental news and balance sheet service to understand the news. It is several hours of work each day when the sun rises over the horizon. Not everyone can do it, not only “part time” traders but also “full time” ones. This is where the algorithms for automatic stock scanning come into play. Whether they are as simple as a normal ADX or more complex, the algorithms serve to make the trader’s work more efficient, to save time and to identify in a few clicks those actions on which it is most profitable to focus attention and energy. The Independent Trend Index (ITI) serves precisely for this purpose: it is an algorithm invented by Emilio Tomasini and originally applied to investment funds and therefore adapted for stock trading.

What is the logic of the ITI? Let’s do a reverse engineering exercise and ask ourselves what is the “magic” chart for each trader.

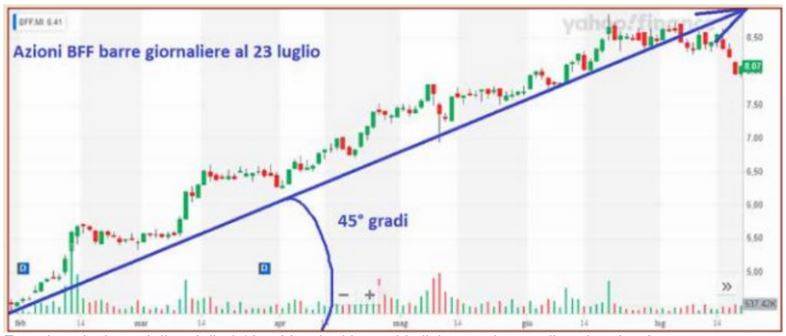

The magic graph of an action shows: 1) a steep slope 2) a momentum that is neither excessive nor fluctuating but constant in the progression. Basically we are talking about an action that faithfully replicates a straight line at 45 degrees. In short, an action like this which on 23 July 2021 turns out to be second in the ITI ranking:

–

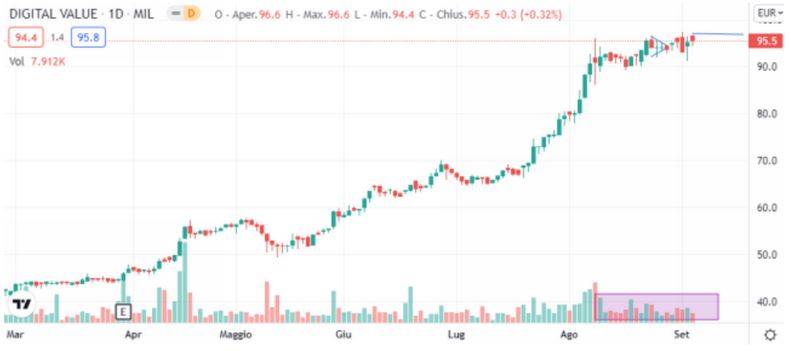

Or again on 23 July in fifth position we find an exemplary case of growth at 45 degrees:

–

Made the selection of the best 10 or 20 stocks in a few clicks at which point the trader can concentrate on understanding which fundamental news has driven the price growth, if any. If there aren’t any, it doesn’t matter and just decide the timing which can be in two ways: you buy at the break of a price horizontalization or on the last relative maximum (breakout mode) or you try to buy on the bottom of a price horizontalization. (mean reverting or counter trend or retracement mode). In both cases, the stop loss is immediately under the horizontalization of prices, which according to technical analysis is called in different ways: triangle, congestion, ledge, hook, pennant, flat, wedge, etc. etc. Obviously the entry mode is the easiest part while that of selecting the action the most difficult. But ITI takes care of this.

–

Here are the best actions according to ITI:

ACTIONS BUILDING CROBATICS

After the closure of the triangle that we reported last week in the article, a descent began that increasingly resembles the beginning of a congestion and therefore there is no need to worry. The volumes have followed the flow and as we can see they have decreased together with the prices signaling that there are not too many sales. If you look back, the stock can only be satisfied: in August, prices increased by more than 70%. Ediliziacrobatica closed the first half of 2021 with revenues exceeding 37 million, an increase of 113.3% compared to the same period last year.

–

REPLY SHARES

Now consolidated in the Olympus of the ITI, Reply shares are continuing its race to the top, breaking the all-time highs. Prices, currently at € 174.5, have started to rise again after the break of the triangle at the beginning of August (we had anticipated the movement here: in an old article). From January to today, prices have increased by more than 82%. The company closed the first half of the year with revenues of more than 712 million euros, an increase of 16%.

–

FINE FOODS & PHARMACEUTICALS SHARES

Breaking of the maximums also for Fine Foods & Pharmaceuticals shares, with the situation that remains similar to that of Reply shares. After a meager early summer in volumes, the situation recovered at the end of July and now these too appear constant and abundant. Prices have increased by 80% since January. The company closed 2020 with revenues of 172 million, up 8% compared to 2019.

–

DIGITAL VALUE SHARES

Again last week’s forecast proved to be correct and the stock, albeit in a stalemate, rose to break the highs. Prices currently reach € 95.5, marking an increase of 151% since the beginning of the year.

–

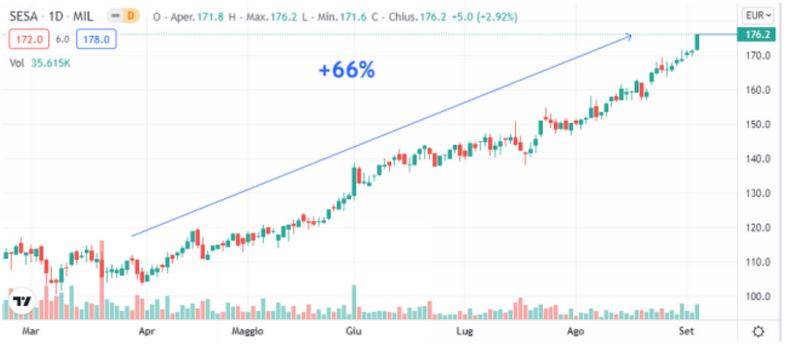

SE.SA SHARES

It is one of our best titles. Prices from April to today have risen by about 66%, even coming, in the session on Friday, to break the all-time highs. Too bad for the volumes that could perform better. At the end of April, the group closed its 2020/2021 financial statements with revenues of 2.04 billion euros (+ 14.7%) and Ebitda at 126 million euros (+ 33.4%).

–

EXPRIVIA SHARES

Price increase of 171.1%, from May to today, for Exprivia shares, which although they do not have a particularly interesting capitalization have made a leap that deserves to be reported. Prices and volumes went crazy in the summer, also thanks to more than reassuring financial results. The company, active in information and communication technology, closed the first six months of the year with revenues of 84.8 million euros (+ 4%) and an Ebitda of 11.54 million (+ 47.8%). the final result was positive for 4.46 million euros compared to the red recorded in the first half of 2020.