Six members of #A’s daily conspired with each other in the first half of this year and intentionally caused a car accident. They made about 950 million won in insurance money from the three insurance companies in the name of settlement after the accident, hospital treatment expenses, vehicle repair expenses, and long-term insurance after-disability insurance.

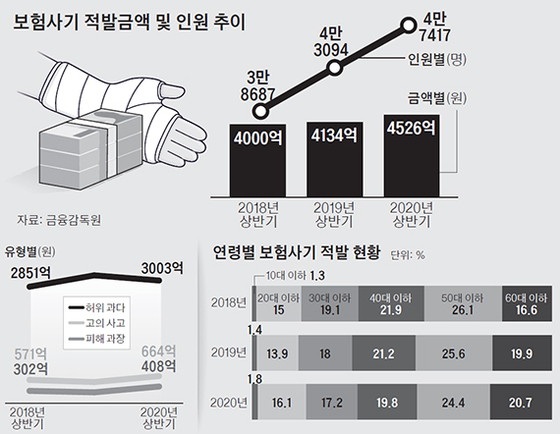

Amount and number of people caught in the first half of this year

71% of total 4526 billion won or less than 5 million won

Increased proportion of livelihoods such as unemployed and daily workers

– #Foreign car maintenance company B, after wearing the accident vehicle, decorated it as if it had repaired the undamaged part and made a false claim to the insurance company for related parts, paintings, and tires. The insurance money they got by tricking 12 non-life insurers is about 1 billion won. In this insurance fraud, not only maintenance companies but also parts companies systematically participated in the competition.

It is a representative insurance fraud caught in the first half of this year. According to the Financial Supervisory Service on the 22nd, this type of insurance fraud surged 9.5% from the same period last year during the first half of the year when the spread of the novel coronavirus infection (Corona 19) continued. Both the amount of caught and the number of people caught are the largest ever. In the aftermath of Corona 19, the “livelihood insurance fraud” of the catering business and daily workers, whose lives have been deteriorated, has risen remarkably.

Changes in insurance fraud detection amount and number of people

– The amount of insurance fraud detection in the first half of the year was 4526 billion won. It increased 9.5% (392 billion won) from the same period last year (4134 billion won). The number of people caught as insurance fraud was 44,417, an increase of 10% (4323) from the same period last year (43,094). It is the largest ever, and has continued to increase significantly for the second year since 2018.

71% of the insurance frauds caught were small amounts of less than 5 million won. The average amount detected per person is 9.5 million won. The FSS interpreted that false hospitalizations decreased due to the corona 19 pandemic, but the increase in single-shot insurance scams, such as false obstacles that are easy to deprive of insurance money.

The occupations of those who were caught by insurance fraud were similar to those of the previous year in the order of office workers (18.5%), unemployed and daily workers (10.4%), and full-time housewives (10.4%). However, as the economic downturn continued due to Corona 19, the participation in insurance fraud among food service workers in business difficulties increased by 137% (1144 people) from the same period last year, and unemployed and daily workers who lost their jobs also increased by 22.9% (921 people). An official from the Financial Supervisory Service explained, “Insurance fraud for professional workers such as insurance planners has decreased, and the proportion of livelihood-type insurance frauds such as unemployed, daily workers, and food service workers has increased.”

By age, the percentage of middle-aged people in their 40s and 50s was the most at 44.2% (2,958 people). However, insurance fraud among young people in their teens and twenties increased by 28.3% compared to the same period last year, and insurance fraud among the elderly in their 60s and older increased by 14.7%.

Reporter Jeong Yonghwan [email protected]

–