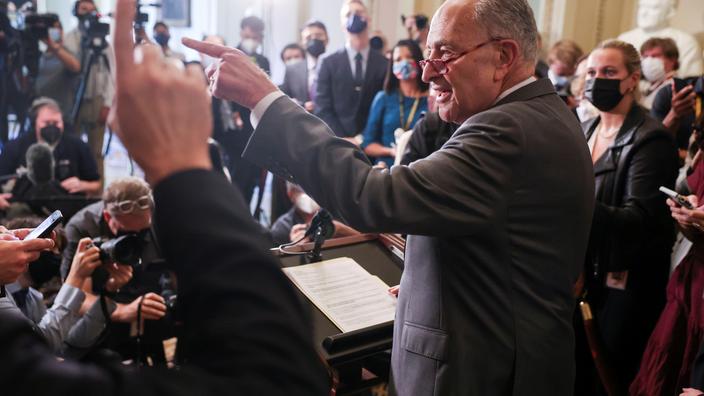

Democratic Senators Leader Chuck Schumer warned on Tuesday October 5 that the very threat of a U.S. default could push financial agencies to cut “very soon” the country’s rating if no agreement is reached quickly to raise the debt ceiling. Republicans and Democrats are engaged in a standoff over a vote to raise the maximum level of indebtedness of the world’s largest power, a procedure usually easy but which this time has become bogged down in Congress under the weight of political divisions.

Read alsoThe Fed fears a cyberattack more than a financial crisis

Faced with the parliamentary impasse, Joe Biden spoke to the press “The real possibility” to change the rules in Congress to circumvent the blocking minority that Republicans have, and thus pass the increase in the debt ceiling. Time is running out: The United States will run out of cash on October 18 if nothing is done by then, according to the US Treasury.

“As of now, the rating agencies are saying that it is possible that they are lowering (the note from the United States, editor’s note) well before the 18th ”, thundered Chuck Schumer in front of reporters. That “Would cost American consumers, American businesses and the American economy tremendously”, he warned, saying that these drops could occur “very soon”.

Read alsoThe Biden plan to rebuild America

The debt ceiling is the maximum amount of debt the United States has. It was suspended in 2019 as part of an agreement between the Trump administration and the then-Democratic opposition, and has been in effect again since August 1, at just over $ 28 trillion. If it is not relieved or suspended, the US government will have to stop living on credit overnight and cut spending.

– .

![This will be the supplement to the pension in November – this will be the fourteenth pension [wyliczenia – 6.10.21] This will be the supplement to the pension in November – this will be the fourteenth pension [wyliczenia – 6.10.21]](https://d-art.ppstatic.pl/kadry/k/r/1/43/ff/6156f12414c3b_o_original.jpg)