Today, as expected, after the retracement between Monday and Tuesday there was an attempt to rebound. Which our view? The retracement of the markets as per the weekly path may have already ended and now it could rise again. However, further confirmation is needed, which should come from tomorrow’s session.

Let’s proceed step by step.

At 3:39 pm on the trading day on August 18th we read the following prices:

Dax Future

15.909

Eurostoxx Future

4.176,5

Ftse Mib Future

26.290

S&P 500 Index

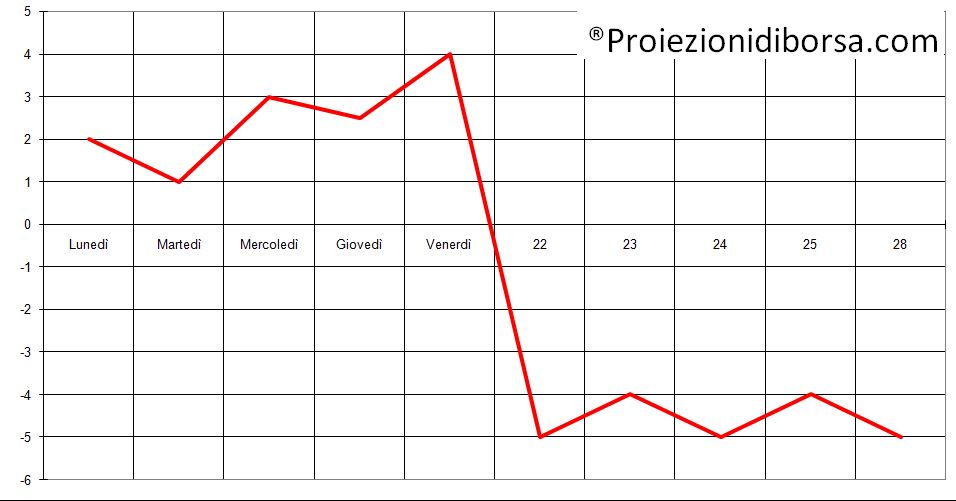

The annual forecast from this week becomes descending

In red, our annual forecast on the world stock index on a weekly scale for 2021.

In blue the chart of the American markets up to 13 August.

The pattern that will form on this week’s bar is therefore important.

Forecast for the week of August 16th

The weekly minimum is expected between Monday and Tuesday and then leaves room for a rise until Friday. Therefore, today the retracement of the markets as per the weekly path could already be finished and now it could go up again.

The levels to be monitored to confirm whether the retracement is over or not

Dax Future

Bullish trend in progress. Short bearish reversal with daily close on August 19th below 15,863.

Eurostoxx Future

Bearish trend in progress. Short bullish reversal with daily close on August 19th above 4.209.

Ftse Mib Future

Bearish trend in progress. Short bullish reversal with daily close on August 19th above 26.425.

S&P 500 Index

Bullish trend in progress. Short bearish reversal with daily close on August 19th below 4,462.12.

What trading operations to keep for Thursday?

Maintain long multidays on Dax and S&P 500. Flat on other indices. Tomorrow should be decisive and could probably clarify the dynamics until the end of the month.

As usual, we will proceed step by step.

–