–

–

You are interested in Samsung Electronics and SK Hynix, which are heating up the stock market these days. Both companies’ stock prices have risen rapidly in recent years due to the expectation that the semiconductor industry will be good. But did you know that Samsung Electronics and SK Hynix will be okay, so buying a semiconductor ETF will make you invest differently than you thought? This is because Samsung Electronics is missing from the semiconductor ETF. Today, we will look at how to properly invest in the semiconductor industry without being fooled by the ETF name.

Why will semiconductor stocks rise?

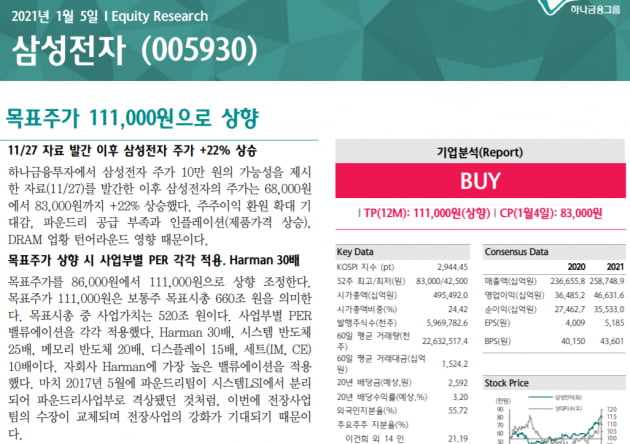

First, let’s look at why the semiconductor industry is getting so much attention recently. The recent rise of Samsung Electronics is scary. It is the age of 80,000 electrons following the 6man electrons and 7man electrons. In Yeouido, a report that raised the target price to W111,000 has been released. SK Hynix also surged by 50% in the last 3 months. The biggest reason is the expectation that the semiconductor industry will be good.

–

–

–

Semiconductors are largely divided into memory semiconductors and non-memory semiconductors. Memory semiconductor is memory. It means to remember. Think of it as a storage device that stores files on your computer. This memory semiconductor is tightly held by three companies of Samsung Electronics and SK Hynix Micron worldwide. The typical memory semiconductor they produce is DRAM. Non-memory semiconductors are semiconductors used to process information. It is also called a system semiconductor. You can think of it as a semiconductor used in the CPU that acts as the brain of a computer. Globally, the non-memory semiconductor market is more than twice as large as the memory semiconductor market. That is why Samsung Electronics aims to expand its presence in the non-memory semiconductor market in the future.

![Why Samsung Electronics is not in the semiconductor ETF [나수지의 쇼미더재테크]](https://img.hankyung.com/photo/202101/01.24936827.1.jpg) –

–

–

Anyway, the main focus of domestic semiconductor companies so far is memory semiconductors. This is why Samsung Electronics and SK Hynix have soared that DRAM prices are bottoming out and rebounding. In fact, the outlook for the memory semiconductor industry was very positive even at the beginning of last year when the Corona had just started. People communicate with them untouched, the game population has increased, and the demand for servers storing data in various sectors has increased. In addition, smartphone and notebook manufacturers are probably closing their semiconductor production plants due to corona. I bought the product in advance because I was worried about a disruption in production. As demand increased like this, DRAM prices also increased.

But in the second half of the year, the atmosphere changed a bit. As companies that had previously stocked up DRAM delayed additional orders, the price began to drop. To make matters worse, server companies are also starting to reduce their investments in worrying about what to do if the economy slows further. As demand declined, DRAM prices had to fall, and Samsung Electronics and SK Hynix’s stock prices were relatively flat in the second half of last year. For those of you who remember the situation right after the coronavirus last year, the situation was very different from now. There was a story about everything going up except Samsung Electronics.

But from the end of last year, the atmosphere has changed again. DRAM prices are starting to rebound. The reason can be found in both supply and demand. On the supply side, as the semiconductor process advances, it is the logic of the upwardists that the number that can be produced relatively decreases. If you want to work very finely, you cannot use the equipment you currently have, and you have to buy expensive equipment called extreme ultraviolet exposure equipment that costs more than 100 billion won per unit to make a semiconductor. This equipment is expensive, so it will not be possible to increase investment in other facilities. . Also, in terms of demand, I have lived with semiconductor stocks accumulated by server companies for a while, but this stock is gradually decreasing, so I have to shop again.

![Why Samsung Electronics is not in the semiconductor ETF [나수지의 쇼미더재테크]](https://img.hankyung.com/photo/202101/01.24936785.1.png) –

–

–

In addition, if you look at this graph, when a company sells DRAM directly to a consumer, the price is the spot price of the DRAM, and the fixed price of the DRAM is the transaction between companies. Somehow, companies do not trade more often than individuals, so the spot price moves before the fixed price. There are properties. Although the fixed price is currently low, the spot price of DRAM soared in December, so we can expect the fixed price to rebound in the first quarter of this year.

Which ETFs are listed in Korea that invest in semiconductors?

If so, the semiconductor industry is likely to improve like this, but those who think that it is burdensome to study each business area and select what kind of semiconductor and equipment a company makes by approaching individual companies can approach ETFs. Today, I first talked about ETFs in Korea, so I will start with ETFs listed in Korea.

When you say you are investing in the semiconductor industry, the first thing that comes to mind is the semiconductor ETF. As mentioned earlier, there is no Samsung Electronics in semiconductor ETFs. The semiconductor ETFs listed in Korea are two products, KODEX and TIGER, both of which are the same. As you can see here, when selecting an ETF, it is necessary to check the top of the constituents once at a time. Going back to the product story, both products follow the KRX Semiconductor Index. Looking at the components, SK Hynix is investing 21%, DB HiTek 7% Wonik IPS, 5% Reno Industrial, etc.

The reason why Samsung Electronics was omitted is that although semiconductors account for a large proportion of Samsung Electronics’ earnings, other divisions, including mobile phones and home appliances, have a larger proportion of sales. Therefore, the Korea Exchange classifies Samsung Electronics as an IT industry, not a semiconductor. Therefore, this ETF would not be suitable for diversifying investments in Samsung Electronics and SK Hynix, which are the leaders of semiconductors. Instead, it is an ETF that can expect higher returns when Samsung Electronics and SK Hynix increase their investments as the proportion of semiconductor equipment and material stocks is high. If you simply compare the two products, the fees are almost the same for TIGER at 0.46% and KODEX at 0.45%, and the market capitalization of TIGER is 48 billion won and KODEX is 88.8 billion won, which is the bigger KODEX. Both of them have market caps of less than 100 billion won, so they are small anyway, and their fees are similar.

![Why Samsung Electronics is not in the semiconductor ETF [나수지의 쇼미더재테크]](https://img.hankyung.com/photo/202101/01.24936786.1.png) –

–

–

Then, what would be good for diversifying investments in Samsung Electronics and SK Hynix? IT ETFs can be an alternative in Korea. Representative IT ETFs listed in Korea include TIGER 200 IT, KODEX 200 IT TR, and KODEX IT. All three have similar constituents. Samsung Electronics and SK Hynix Samsung SDI each contain around 20%. It is said that ETF prices will be affected by the movement of the three stocks. Looking at the differences between the three ETFs, the following index is different. Products with 200 are selected and invested in IT companies within the KOSPI 200. Products without 200 are invested in the entire KOSPI company. Therefore, when small and medium-cap stocks stand out, products without 200 will be more advantageous, and when large-cap stocks lead the market, 200 IT can be expected to be more advantageous. It is for this reason that 200 IT is ahead of recent returns.

Among the same 200 IT products, the one with TR and the one without TR is the difference between reinvesting dividends or simply giving dividends in cash. Like stocks, ETFs have dividends. It is called distribution. In addition to the dividend of each stock, the dividend is given by adding a small amount of money, such as a bit more profitable than the index, while operating the ETF. TR products are products that reinvest this distribution without cash. Then what is better. There is nothing absolutely good, but it can vary depending on your investment preferences or whether you have paid comprehensive income tax. I like the stock price going up, but if you want to enjoy the fun of receiving dividends in cash in the middle, distributions come out. So it’s better to choose a product that doesn’t have TR. If you are bothered with getting a lot of cash or want to reduce your dividend income tax, you should choose TR products.

What are U.S.-listed ETFs investing in semiconductors?

![Why Samsung Electronics is not in the semiconductor ETF [나수지의 쇼미더재테크]](https://img.hankyung.com/photo/202101/01.24936788.1.png) –

–

–

Now that we have looked at ETFs listed in Korea, let’s take a quick look at ETFs listed in the US. I mentioned earlier that domestic companies are focusing on memory semiconductors. On the other hand, American companies are strong players in the non-memory semiconductor industry. Representative products containing these companies are SOXX and SMH. First, SOXX is a semiconductor ETF operated by Blacklock. Looking at the stock composition, we are investing in global semiconductor companies such as Broadcom, a semiconductor company for communication, Qualcomm, Texas Instruments, Nvidia, and TSMC. The commission is 0.46% and the fund size is 4 billion dollars. It is about 4.3 trillion won in Korean money. U.S. ETFs are different from the unit of size.

![Why Samsung Electronics is not in the semiconductor ETF [나수지의 쇼미더재테크]](https://img.hankyung.com/photo/202101/01.24936787.1.png) –

–

–

SMH is characterized by a high proportion of TSMC at 13%. The rest of the constituents are similar to SOXX. Nvidia Broadcom, Texas Instruments, Qualcomm Intel, and other stocks you just saw. So, SOXX and SMH have a similar rate of return. The SMH fee is 0.35% and the fund size is $3 billion. It is about 3.2 trillion won in Korean money. The two ETFs don’t differ significantly in their constituents and their yields move almost the same, so basically, there is no big difference between them. SMH is a bit cheaper, and the price per share is about 220 dollars for SMH and 370 dollars for SOXX, so it would be good to choose your own according to the expected investment period, investment scale, and installment plan.

Reporter Na Suji [email protected]

–