In a shortened week

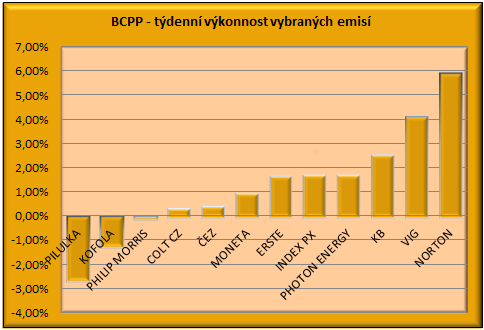

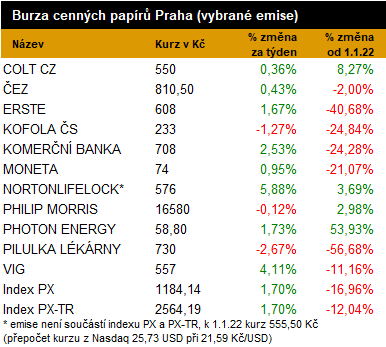

Actions already Prague Stock Exchange they continued their previous positive direction, when support was continued optimism on Western European markets, and thus on Wall Street.

PX index it improved 1.7% to close at 1,184 points on Thursday. That is, at the latest from 22 September. In any case, investors seem to have taken advantage of the Friday holidays vacation throughout the week when the volumes shops they have fallen to a significantly below average level. On average, they closed every day shops for only 335 mil.

CZK.

The winner of the week’s course was actually a beginner Prague Stock Exchange

– Actions Norton Life Lockbut they are not included PX index. In its domestic market in United States of America are experiencing a boost in October, as the article “NortonLifeLock stock at a minimum?“they added roughly one-tenth. Investors are starting to take into account the expected positives from the merger with the company Avastwhich should show the first “common” economic results. You business declassified the following week, November 8th. However, he has won the title here, just like in the past Actions Avast, relative to the domestic market, the trend is trading at a fairly significant premium. In addition, it also plays its part in development volatile crown k dolarurespectively, as if the expectations of some investors strengthened American currency.

Z PX index in any case, they added more in the week

Actions VIG, which has actually already written off September losses in their home country, Vienna. With your weight PX index in the week they actually supported the second event in a comparative way KB, whose weight remains at record levels (currently 24.3%). Vision dividends

as if the title helped to overcome the technicalities resistencewhen it closed at 713.50 on Wednesday CZK, that is, at the highs of almost 5 months. He will probably be technically opening the title the way above, the routing should however also determine the expected Friday

economic results/news.

From the banks the first swallow a Prague Stock Exchange the season of early results was CURRENCYwhich showed a significant year-over-year increase profit. On the other hand, management has actually indicated a deteriorating environment, or the bank has already begun to prepare for a possible deterioration in payment morale. loans as an expected result recession. He also mentions the planned further increase in capital requirements and a possible adjustment

dividends bearish policy. Investors didn’t seem to want to trade at all after the company’s report on Thursday. Mostly they reacted in a neutral way, or for someone a positive tone from results indicated only by the final auction, which led the stock to equal the previous October closing high of 74 CZK. This was revealed in a regulatory filing this week American banking group Highway reduced the holding in the bank to below one per cent border, respectively at 0.97%. At the same time, she has been a qualified shareholder for over 5 to allow. For the first time, and simultaneously for the last time, in February 2017 he brought back 1% ownership Actions CURRENCY. Meanwhile, its share was to be between 1 and 3%.

Development can be integrated Actions FIRSTwho have returned to their home Vienna in the reports to the several times mentioned significant technical border you 25 EUR. The latter should decide on further routing, when the impulse can also be corporate messages, or Friday’s report

economic results. In general, banks can influence the final form luck fee (maybe a lower rate for 2024 years/ 25), which could be acquitted in Friday.

The main title Prague Stock Exchange not just in terms of

liquid assetsbut also volatility remain lately Actions OVER. Following the so-called manna

the tax was trading in the 765 range in the shortened week CZK up to nearly 820 CZK. However, actually in the latter part of the week, a certain calm began to be felt when all the negativity related taxation excessive profits he should already be acquitted. The tax packages discussed / approved in the House of Representatives next week are unlikely to bring negative surprises for the title. It should therefore begin to apply in our stated article “ČEZ shares offer the highest dividend yield on the Prague Stock ExchangeThe stock could support the inflow of new funds from the disbursement dividends.

It is also possible to mention the persistent intraday volatility a

shares CZGhowever this time for the weak liquid assets. The slight decline towards the new has continued for almost 2 years minimum

Actions KOFOLA did not bring a raise

shops. On the contrary, which suggests that the peak of the drop in the exchange rate may not have happened yet. From the breath of the middle moon further south they also descend Actions PILLwho ended the week with the new ones minimallyrespectively at least from mid-January 2021.

From the point of view of adverse investors, we can finally mention the START market Actions Filament. They were already below border 200 CZK, that is, compared to the price of the primary issue in 2018, not even a quarter. Despite the fact that the presentation last October companies

he did not point to more fundamental problems. On the START market, this is probably the least liquid stock, lacking demand, or upside business brings a sharp drop in price. In this month actually two unusual commercial the sessions led to a gradual decline from the previous 550 CZK to the current 199 CZK. Even in early June Actions PHILAMNET

at the same time they remained at 850 CZKor above the price in IPO.