–

Karlsruhe Insider: Company is insolvent.

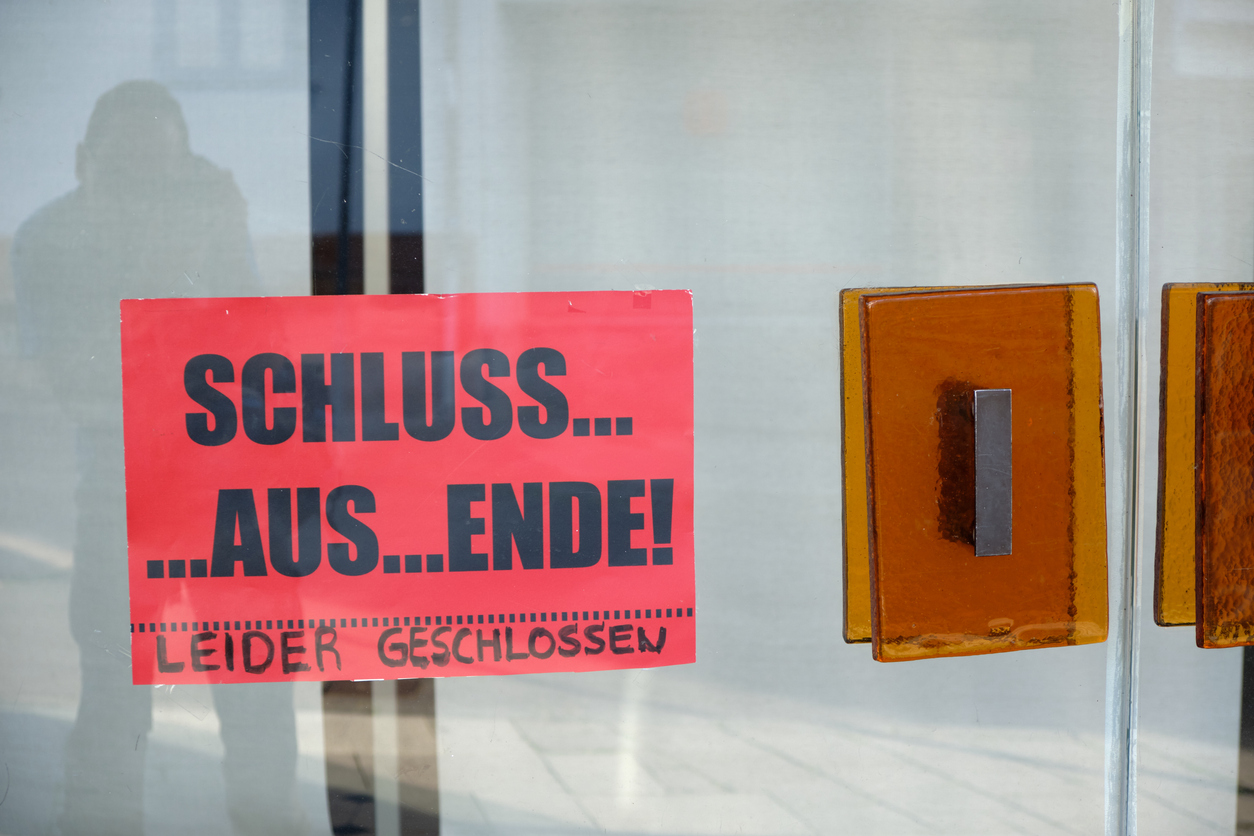

Another German financial company files for bankruptcy. As the startup Vantik has now confirmed, the costs cannot be covered by the income.

The Berlin FinTech Vantik is insolvent. The startup Vantik speaks of a round of financing that burst completely surprisingly. As a result, the income from the Vantikcard and the Vantikfonds is not sufficient to cover the costs. For this reason, a provisional application for insolvency has now been filed.

At least for the time being, business operations will be maintained. At the same time, Vantik cannot pay out new cashback in favor of customers at the moment.

The team around Vantik founder Til Klein wants to pursue the goal and achieve a joint takeover of the company through the participation of a financial investor.

Vantik offers its customers digital pension provision in the form of a cashback system. The company’s website states: “Get a one percent cashback with every payment with Vantik’s free MasterCard. We invest the money for you sustainably and profitably until you retire”.

In recent years, Vantik has funded support from Atlantic Labs, Seedcamp, STS Ventures, N26 Founder Max Tayenthal and most recently Family Office Custos

–

–