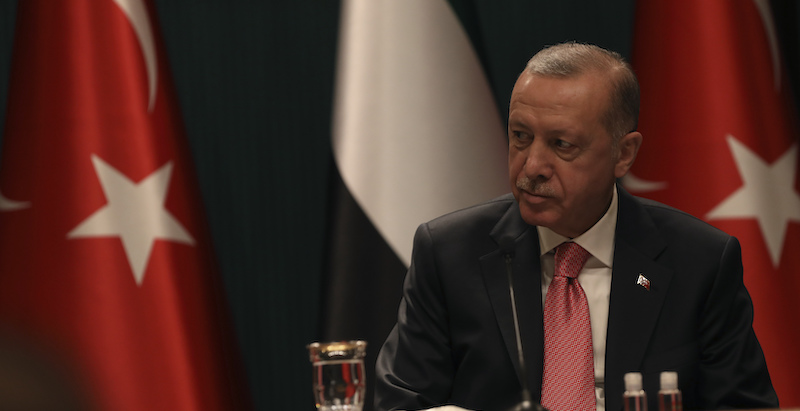

Turkish President Recep Tayyip Erdoğan on Monday announced that his government will reimburse the owners of accounts in Turkish banks who will be damaged by the loss in value of the Turkish lira. The announcement was considered very reassuring by international investors, given that Erdoğan has in fact promised that the money that the Turks have deposited or invested in Turkish lira in national banks and which they will lose due to the depreciation of the lira, will be compensated with funds of state reserve.

Monday’s is just the latest in a series of steps very turbulent for the Turkish economy, a story that has been going on for several months now.

The day before Erdoğan’s announcement, the Turkish lira had reached one of its lowest ever against the dollar: on Sunday it took 18.36 Turkish lira to buy one dollar. After the speech, the exchange fell to around 11 Turkish lira, in what the Financial Times he defined “The most volatile day for the Turkish lira since the 1990s”. In 2019 it took about 6 Turkish lira to buy one dollar.

So by the time markets closed (including in the US) the Turkish Lira saw a huge increase in value, now settled at 13.49, all the way down from 18. Erdogan’s supporters are exclaiming victory. Not sure how it was done, but if this is victory I would not want to see what defeat is. pic.twitter.com/YdYpDxMPPt

– Louis Fishman Louis Fishman (@Istanbultelaviv) December 21, 2021

In recent months, the depreciation of the Turkish lira was caused by the very high inflation, now estimated at around 20 per cent, generated in turn by the huge amount of money circulated by Turkish banks. The latter had been a direct consequence of the decisions of Erdoğan’s government, which has long been convinced that in order to revive the economy, banks must keep interest rates to a minimum, thus making it very easy to apply for loans and mortgages.

Erdoğan justified his decisions with Islamic doctrine, which very severely punishes usury (i.e. the demand for high interest rates for loans).

Several economists have argued that these decisions could raise inflation, that is, the rise in the prices of goods, and put consumers in further difficulty.

According to analysts cited byEconomist, inflation is expected to reach 50 percent in the early months of 2022. But the depreciation of the Turkish lira was also gradually convincing many Turks to withdraw their deposits and investments in Turkish banks to convert them into considered more stable currencies such as the dollar, thus putting the banks in difficulty.

– Read also: Is inflation transient or not?

German wave writes that the hypothesis of several foreign diplomats is that Erdoğan is trying to revive the Turkish economy quickly to arrive with good consensus in the next political elections, scheduled for 2023.

–