When it comes to innovation, a company in the market stands out from others, and that is Square (NYSE :SQ).

Source : Piotr Swat / Shutterstock.com

Square is the epitome of innovation – the model company for leveraging innovative business expansions to generate tremendous revenue growth year after year.

The company started in 2009 selling flexible and affordable payment card readers to merchants, so they can accept non-cash payments.

Next, Square created a software services ecosystem that provided payroll support and management tools to merchants and retailers.

Then the company expanded into the e-commerce channel, developed banking-like services, created a cashless consumer app called CashApp, jumped into the cryptocurrency world by allowing CashApp users to ” trade Bitcoin, and more.

The sum of these innovations transformed Square from a small, little-known cashless point-of-sale payment processor in 2009, to a All-in-one fintech giant worth $ 120 billion today …

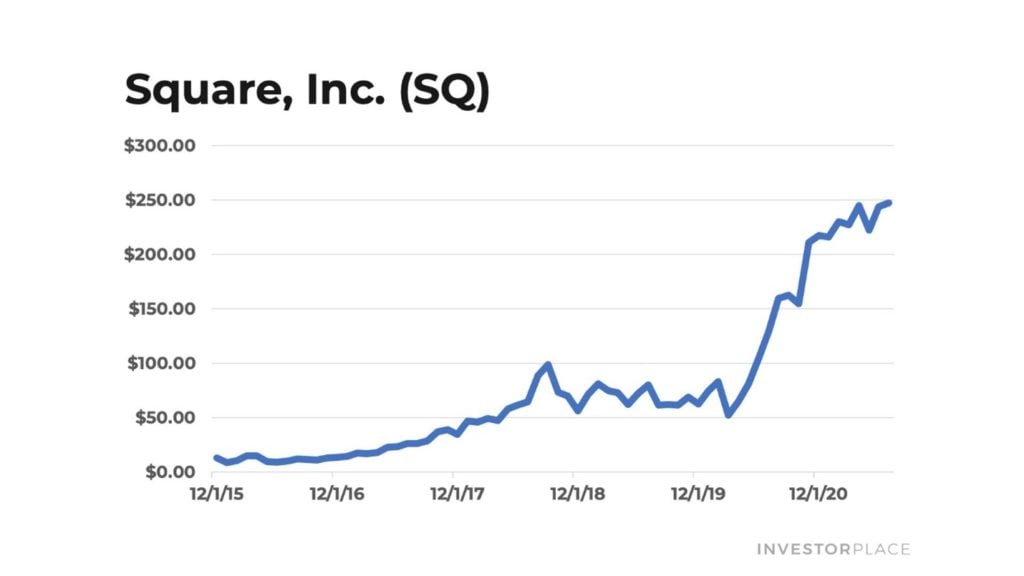

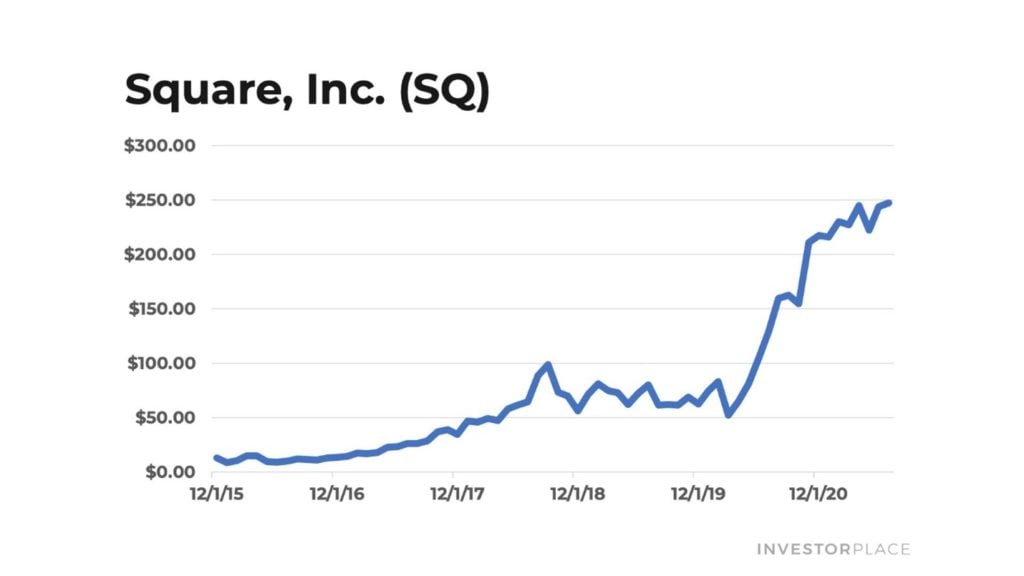

The results of this transformation can be found in the share price, which has risen more than 30 times from its initial public offering (IPO) at the end of 2015.

Today, the most innovative company in the world is starting over. This time, they’re innovating through acquisitions and making a $ 29 BILLION bet on an entirely new and booming industry that most people probably haven’t even heard of yet … an industry that Square believes in (and that we we agree) could be the next big thing in fintech.

Industry? Buy now, pay later – or BNPL, to shorten it.

The BNPL market is simple. It’s a multitude of services that allow people to buy a product today and pay for it in regular installments in the future. Does it sound like a credit card? He is. Except BNPL services normally do not charge interest, as BNPL service providers do not earn their money on these interest payments – instead they earn their money from a commission on the initial transaction.

In short, BNPL’s services are essentially interest-free credit cards.

Of course, there are pitfalls. The maximum payment amount on a BNPL service is usually only a few thousand dollars, at most, while you can charge infinitely more on a credit card. At the same time, credit cards incorporate huge rewards systems, so consumers earn tax rewards for using their credit cards. Such reward systems do not exist in BNPL services.

But consumers are apparently willing to overcome these shortcomings and instead fall in love with the ‘irrelevant’ aspect, as the use and popularity of BNPL is soaring at present.

According to market research firm C + R Research, 51% of consumers used BNPL services in 2020, as the Covid-19 pandemic has forced people to turn to online shopping channels, where BNPL services are most prevalent. Consumers subsequently discovered BNPL’s services, fell in love with their accessibility and flexibility benefits, and use them wherever they can since.

And that’s what’s awesome about using BNPL: it’s sticky. About 38% of BNPL users surveyed by C + R Research said they expected BNPL’s services to eventually replace their credit cards.

In other words, BNPL’s services aren’t just a ‘Covid thing’ – they’re the future of how you and I pay for goods and services.

Will they completely replace credit cards? No of course not. But they will certainly one day become a very common and very popular way to pay for things. If 38% of consumers say today that they will replace their credit cards with BNPL, these services could represent 40%, 50% or more of the total transaction volume by 2030.

And that is why we are so excited about the BNPL industry.

Because, according to a Worldpay report, BNPL transactions represented only 2.1% of e-commerce transactions worldwide in 2020.

This delta between the current situation of the industry (approximately 2% penetration) and what it will be in 10 years (approximately 50% penetration) implies an economic opportunity of several hundreds of billions of dollars for the first investors.

Indeed, Bank of America sees the BNPL market develop 10X to 15X by 2025 to process nearly $ 1 trillion in transactions.

The advantage here is huge.

It is therefore not surprising that Square is going all-in and has just agreed to acquire the service provider BNPL. After payment for an incredible $ 29 billion.

Over the next few years, Square will be integrating Afterpay technology into all of its payment processors, online portals and all of its CashApp features. This means that tens of millions of new merchants and consumers will have access to BNPL’s services as a result of this acquisition – which, of course, will significantly accelerate the BNPL revolution.

Mark our words. We believe that Square’s acquisition of Afterpay will decrease as when the BNPL revolution has spread.

This means that now is the time to invest in BNPL shares.

That’s why, just a few days ago, I highlighted a tiny BNPL share in The daily 10X stock report – my ultra-exclusive research advisory service dedicated to selecting an explosive, hyper-growing stock, every day the stock market opens, with the potential to skyrocket 10X in value.

Yeah. You heard that right. A brand new 10X stock picking potential each day.

I started this service a little over a year ago – and in no time I have already tagged my readers nearly 100 triple-digit winners and 6 different stocks that climbed 10X or more in value.

I think the small BNPL stock that I just told subscribers about this week has a good chance of being our seventh 10X winner.

So… what are you waiting for? Click here and get the name of this potential 10X pick – and many more like it – right now.

At the time of publication, Luke Lango had (directly or indirectly) no position in any of the stocks mentioned in this article.

By learning about early investments in hypergrowth industries, Luke Lango puts you on the ground floor of world-changing megatrends. That’s how its 10X Daily Report has averaged a ridiculous 100% return on all recommendations since it launched last May. Click here to see how he does it.

–