On the eve of Fed Chairman Jerome Powell’s remarks, the US stock market moved higher after fluctuating flat on Thursday (4th). Before the deadline, the Dow Jones Industrial Average rose 133 points or 0.43%, the Nasdaq Index rose 0.42%, the S&P 500 Index rose 0.39%, and the fee rose 0.06%.

Fed Chairman Bauer will speak at 1 am Taipei time. The market expects that Bauer will reiterate the Fed’s determination to achieve employment and inflation targets, so as to reassure the bond market and avoid continued high yields.

Prior to Bauer’s remarks, the 10-year U.S. Treasury yield continued to rise to 1.474%. It soared to a one-year high of 1.614% last Monday, triggering a wave of market selling.

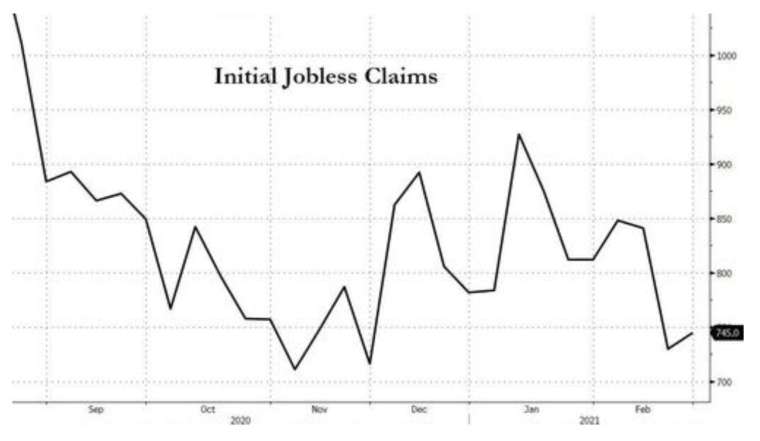

In terms of the job market, the US Department of Labor announced that the number of people receiving unemployment benefits at the beginning of last week was 745,000, which was higher than the revised value of 736,000, but slightly better than expected.

In order to make 1.9 trillionU.S. dollarThe stimulus bill passed the Senate smoothly. There were reports that Biden seemed willing to compromise and supported the increase of 1,400. U.S. dollarThe threshold for the bail-out payment is used to obtain the support of the centrists. The Senate is expected to debate the stimulus bill on Thursday.

In the energy market, Brent crude oil and WTI crude oil both rose nearly 2%. The Organization of Petroleum Exporting Countries and other oil-producing countries (OPEC+) will meet on Thursday to decide whether to end or continue the production cut policy.

As of 22 o’clock on Thursday (4th) Taipei time:

- The Dow Jones Index rose by 133.42 points, or 0.43%, to 31403.51 points temporarily

- Nasdaq rose 54.17 points, or 0.42%, to 13051.92 points temporarily

- The S&P 500 Index rose 15.01 points, or 0.39%, to 3,834.73 points temporarily

- Fees and a half rose by 1.85 points or 0.06%, temporarily reported at 297.43 points

- TSMC ADR rose 0.04% to 122.94 per share U.S. dollar

- The 10-year U.S. Treasury yield rose to 1.474%

- New York light crude oil rose 1.83% to 62.40 per barrel U.S. dollar

- Brent crude oil rose 1.89% to 65.28 per barrel U.S. dollar

- Gold fell 0.16% to 1713.00 per ounce U.S. dollar

- U.S. dollarThe index rose 0.21% to 91.13 points

Focus stocks:

Apple (AAPL-US) Rose 0.63% to 166.83 in early trading U.S. dollar。

British regulators announced a formal investigation into Apple’s anti-competitive behavior and non-equity clauses. Apple’s own app store, App Store, has been accused of imposing unequal terms on App developers and having a dominant position in app distribution, threatening to violate fair competition.

Okta (OKTA-US) Fell 6.56% in early trading to 225.39 U.S. dollar。

Okta, a provider of user identity management softwareU.S. dollarThe all-stock acquisition of peer Auth0 has spawned the largest software industry M&A case so far this year. The transaction is expected to be completed in the second quarter of this year.

Marvell Technology(MRVL-US) Fell 5.77% in early trading to 42.93 U.S. dollar。

Marvell announced the Q4 financial report for the 2021 fiscal year after the US stock market on Wednesday, with annual revenue increasing by 11.2% to 798 millionU.S. dollar, Non-GAAP EPS increased 71% year-on-year to 29 cents, both in line with analyst expectations. However, the company expects that the chip shortage may continue until fiscal year 2022.

Today’s key economic data:

- The United States (2/27) reported 745,000 unemployment benefits at the beginning of last week, which is expected to be 750,000. The previous value was adjusted from 730,000 to 736,000.

- The United States (2/20) reported 4.295 million unemployment benefits last week, which is expected to be 4.3 million, and the previous value was 4.419 million

- At 23:00 Taipei time, the monthly increase rate of US factory orders in January will be announced, which is expected to be 1.0%, and the previous value is 1.1%.

- At 23:00 Taipei time, the final value of the monthly growth rate of durable goods orders in the United States in January will be announced, the previous value was 3.4%

Wall Street analysis:

Hugh Gimber, strategist at JP Morgan Asset Management, believes that Ball’s comments today are very important. In the past few weeks, the stock market has been undermined by the upward momentum in real yields and has put the Fed in a difficult situation.

Esty Dwek, head of global market strategy at Natixis Investment Managers, said that 1.9 trillionU.S. dollarThe stimulus bill can lead to consumption, which means that corporate earnings are expected to increase and support the stock market. She predicts that as investors withdraw from highly valued technology stocks, cyclical stocks such as banks will benefit from it.

OCBC Bank analyst Howie Lee said that if the Federal Reserve really wants to keep the low rate low, the market needs more than just “sniffing”. If the Fed remains silent, bond yields will continue to rise, and the yield curve will continue to remain steep.

–

/cloudfront-eu-central-1.images.arcpublishing.com/prisa/YEHG2OTM3HO2DHYUAC2JVXVKBU.jpg)