Key insights

- The high proportion of private companies in Walmart suggests that key decisions are influenced by shareholders from the general public

- The 3 largest shareholders own 50% of the company

- Insiders have recently sold

Any investor in Walmart Inc. (NYSE:WMT) should be aware of the most powerful shareholder groups. We see that private companies own the lion’s share of the company at 45%. This means that this group benefits the most when the stock rises (or loses the most when it falls).

In contrast, institutional shareholders hold 35%. As a company grows, institutions typically increase their shareholding. Conversely, insiders often decrease their shareholding over time.

Let’s start with the graphic below to take a closer look at each type of Walmart owner.

Check out our latest analysis for Walmart

NYSE:WMT Shareholding Breakdown August 7, 2024

What does the institutional shareholder say about Walmart?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they are often more enthusiastic about a stock once it is included in a major index. We would expect most companies to have some institutions on the list, especially if they are growing.

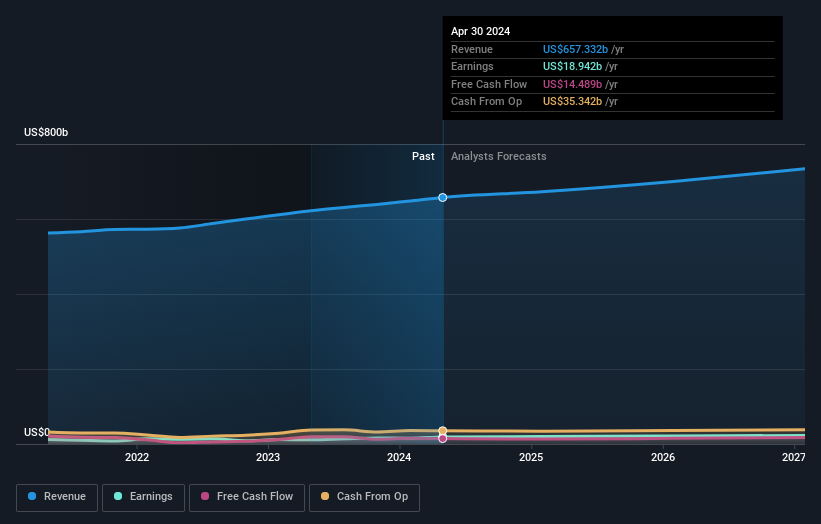

As we can see, Walmart has institutional investors that hold a large portion of the company’s shares. This may indicate that the company enjoys a certain level of credibility in the investment community. However, it is wise not to rely on the supposed endorsement of institutional investors. Even they are wrong sometimes. When multiple institutions own a stock, there is always a risk that they are engaging in a “crowded trade.” If such a trade goes wrong, multiple parties may be competing to sell shares quickly. This risk is higher for a company with no history of growth. Below is a breakdown of Walmart’s historical earnings and revenue, but keep in mind that there is always more.

Hedge funds don’t own a lot of Walmart stock. Walton Enterprises, LLC is currently the largest shareholder with 37% of the shares outstanding. The second and third largest shareholders hold 7.9% and 5.1% of the shares outstanding, respectively.

After further research, we found that the top 3 shareholders together control more than half of the company’s shares, meaning they have significant influence on the company’s decisions.

While studying institutional ownership of a company can add value to your research, it is also a good practice to check analyst recommendations to get a better understanding of a stock’s expected performance. Since the stock is covered by many analysts, you can easily check out growth projections.

Insider ownership of Walmart

While the exact definition of an insider can be subjective, almost everyone considers board members to be insiders. Company management runs the company, but the CEO is accountable to the board, even if he or she is a member of the board.

In general, I think insider ownership is a good thing. However, in some cases it makes it more difficult for other shareholders to hold the board accountable for decisions.

According to our information, insiders own less than 1% of Walmart Inc. However, they may be indirectly involved through a corporate structure that we have not captured. Since this is a very large company, it would be surprising if insiders owned a large portion of the company. Although their ownership is less than 1%, we can see that the board members collectively own $4.8 billion worth of shares (at current prices). Recent buying and selling is arguably just as important to look at. You can click here to see if insiders have been buying or selling.

General public property

The general public – including retail investors – owns 19% of the company’s shares and therefore cannot be ignored. While this group may not necessarily call the shots, they can have a real influence on how the company is run.

Private companies as owners

According to our data, private companies own 45% of the company’s shares. Private companies can be affiliates. Sometimes insiders have an interest in a public company not in their individual capacity but through an ownership interest in a private company. While it’s difficult to draw general conclusions from this, it’s worth noting that this is an area for further investigation.

Next Steps:

While it is worth considering the different groups that own a company, there are other factors that are even more important. Take risks, for example. Every company has some, and we have 2 warning signs for Walmart that you should know.

At long last the future is most important. You can use this free Get the analyst forecast report for the company.

Note: The figures in this article have been calculated using the last twelve months’ data, which refers to the twelve-month period ending on the last day of the month in which the financial report is dated. This may not match the figures in the annual report for the full year.

Valuation is complex, but we are here to simplify it.

Find out if Walmart is undervalued or overvalued with our detailed analysis that Fair value estimates, potential risks, dividends, insider trading and the company’s financial condition contains .

Access to free analysis

Do you have feedback on this article? Do you have concerns about the content? Please contact directly to us. You can also send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment based solely on historical data and analyst forecasts, using an unbiased methodology. Our articles are not intended as financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Please note that our analysis may not take into account the latest price-sensitive company news or qualitative material. Simply Wall St has no position in the stocks mentioned.

Do you have feedback on this article? Are you concerned about the content? Contact us directly. Alternatively, you can send an email to [email protected] .