In his best times, Juan Esteban Saldarriaga came to participate in professional cycling competitions and pedaled for European teams. But a health complication forced him to give up his bicycles and he had to think of another life project.

He made quick decisions, enrolled in college and trained in management engineering. A few years later —and after several trips— he had the idea of bringing to Colombia a financial model that was gaining momentum in the world and was still unknown in the country.

Thus, this paisa became one of the Colombian pioneers of the financial technology (fintech). In fact, today he is a member of the board of directors of Colombia Fintech, an association of platforms that provide financial services using technology. Without imagining it, he was opening the doors to a business that has become direct competition for informal loans, better known as “daily pay” or “drop by drop.”

–

One idea, two results

According to the narration by Juan Esteban, when it occurred to him to import the model of the fintechhis goal was to “open the way for digital credits.”

That first push led to the launch of Rapicredit in 2013, a platform that grants small loans almost instantaneously and without the paperwork that traditional banks usually require.

“As a result of that first experience at Rapicredit, where some 100,000 credit applications were being processed per month, we realized that people needed larger amounts and longer terms,” he said.

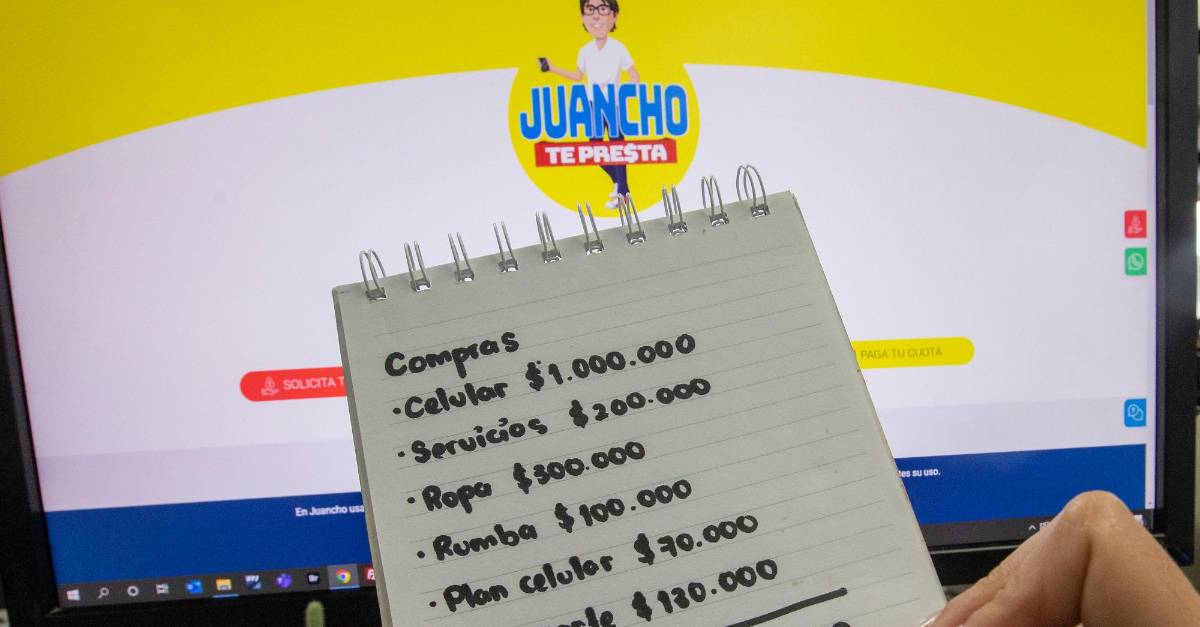

“There —he added— the concept of Juancho Te Presta was born, which aims to grant credits with a real purpose, for example, to acquire durable goods”.

With his undertaking, he not only put Colombia on the global market map fintechbut rather, spontaneously, launched an offer that counterbalances the “drop by drop”, with a product very focused on unbanked people and without a strong credit history.

To start with the loans, as explained by the businessman, the fintech It was capitalized with its own equity and with funding from angel investors, those who bet on emerging businesses, especially if they have a good projection.

As the platform has grown, more investors have come. In fact, it recently raised US$550,000 that will be used to strengthen the credit supply.

–

women pay better

Three years after starting operations, Juancho Te Presta has disbursed US$6 million in loans to 15,000 users. “60% are women and a third of them are heads of households,” stressed the businessman.

“We start from the premise that women are much better at managing loans than men, history has shown it, that’s why we give them better conditions,” he said.

Faced with the behavior of its users, he said that “they pay well, in general customers in Colombia take care of the credit because they are willing to work to continue having that financial help”, and affirmed that people are increasingly aware of this type as an alternative and the “daily pay” is being discouraged.

–

some perspectives

Thanks to an alliance that the platform achieved with Alma (an American firm that offers financing to companies with a positive social impact), Juancho Te Presta will have a US$10 million line open to irrigate among clients.

On the other hand, the founder revealed that some alliances with traditional entities are being worked on to increase loans.

– –