Satoshi Nakamoto launched Bitcoin (BTC) in 2009 and thus his invention can be called a child of the 2008 financial crisis. Not for nothing referred Satoshi in the first block of the blockchain to this event. Now Bitcoin is facing the first major recession since its birth in response to fractional banking-induced instability in the financial system.

Unfortunately, we cannot compare the current declines with the March 2020 declines due to the global COVID-19 outbreak and subsequent lockdowns. At the time, the US Federal Reserve immediately intervened to save the market from its demise. Now the situation is different and the Federal Reserve is battling its highest inflation in 40 years and new bailouts are not an option for the time being. Long story short: no one is coming to save the markets.

America heads for recession

Officially, a recession requires two consecutive quarters of negative growth in Gross Domestic Product (GDP). While we’re not there yet, the Atlanta branch of the Federal Reserve expects at least a zero point for US GDP growth for the next quarter. The chart below clearly shows that the Federal Reserve’s leeway is shrinking.

They need to raise interest rates to tame extreme inflation, but not to the extent that they push the economy into recession. One major problem facing the US economy in this context is the level of gas prices. With a national average of $5, they are at their all-time high. That will help the Federal Reserve tame inflation as it means people have less to spend, but the question is at what price.

With interest rates rising, the interest rates on mortgages with a term of 30 years have also shot past the 2008 interest rates. This has a depressing effect on activity in the housing market, but so far the price declines have not been too bad. Homeowners have taken advantage of low interest rates in recent years by taking out new mortgages or refinancing at a low interest rate, causing house prices to go through the roof.

Interest rates are now going up and this is mainly reflected in activity. In the past year, activity in the housing market fell by 9.1 percent. High house prices and interest rates have exhausted the buying side of the market. It therefore seems only a matter of time before house prices start to fall as a result of the Federal Reserve’s policy.

The dance between inflation and unemployment

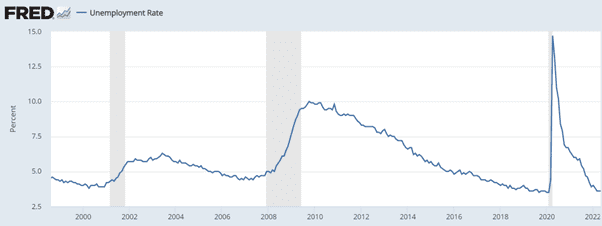

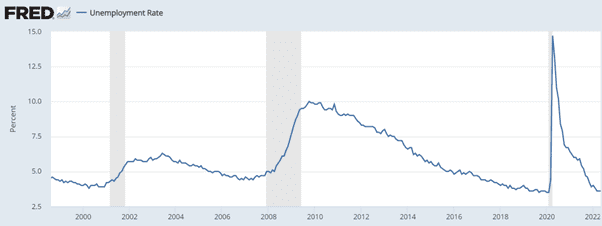

At the time of writing, the U.S. unemployment rate is hovering at 3.6 percent. In the past 25 years, unemployment has been only four times lower than it is today. That’s good news for the Federal Reserve, as it gives them a little leeway in fighting inflation. Combined with inflation of 8.6 percent, however, that leeway is smaller than you might think.

During the day the last FOMC meeting, where the Federal Reserve discusses their strategy, it again spoke of their strong desire to bring inflation back to 2 percent. This means that inflation should fall by 6.6 percent from its current level and at the same time unemployment should not exceed 4 percent. That shows how tricky the dance between inflation and unemployment is that the Federal Reserve faces.

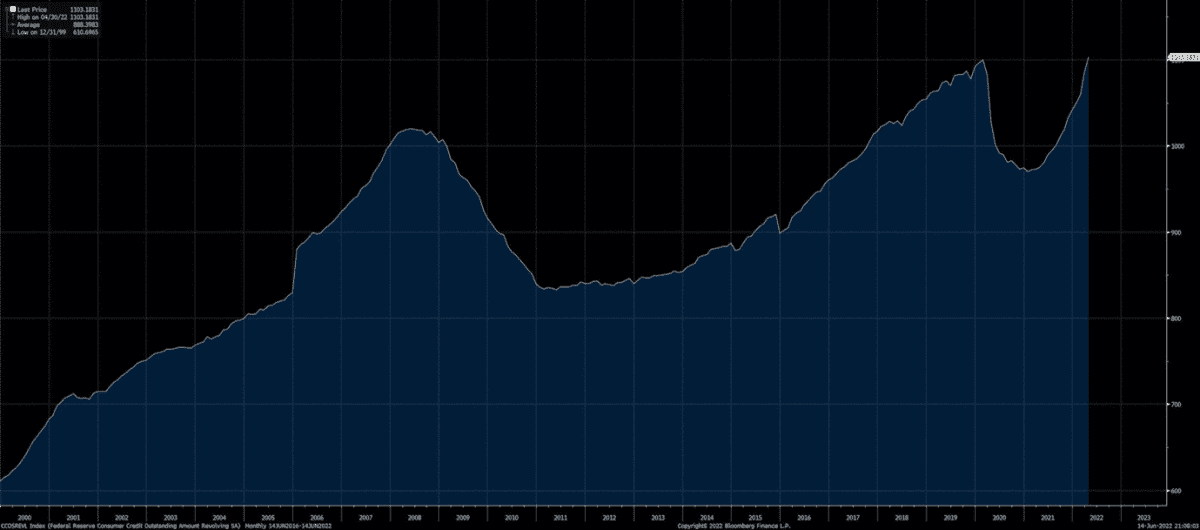

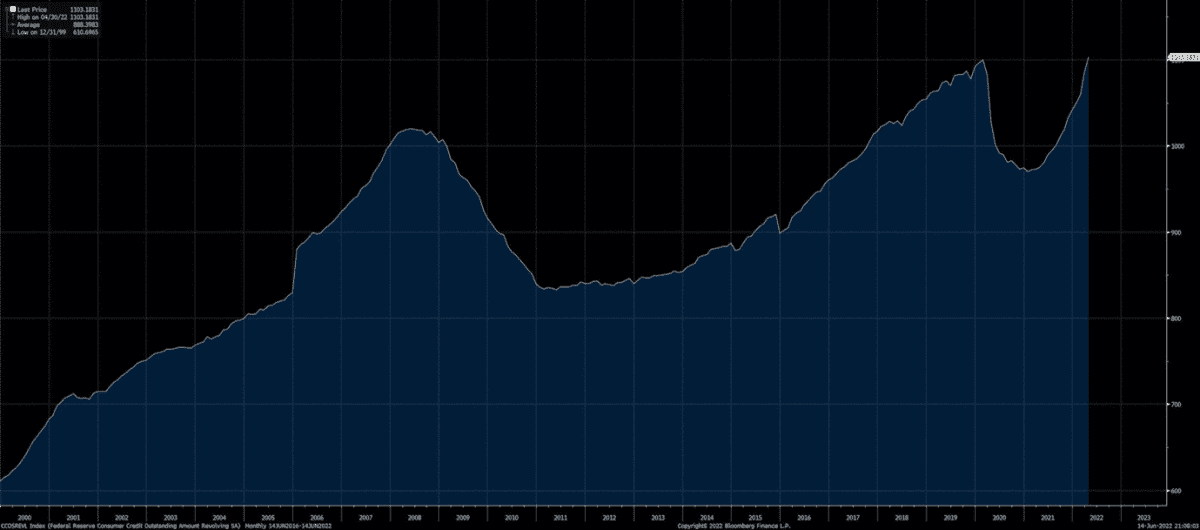

In addition to the problems described above, the extent to which private individuals live on credit has also exploded. That is a pattern that we observed in 2008 and 2020 before the proverbial frenzy broke out. The problem with that is that, despite high inflation, the dollar is stronger than ever. That fact makes it more expensive to maintain (pay off or refinance) that growing mountain of debt. Especially since private individuals often pay a high interest rate and are currently dealing with high inflation (including gas prices).

Risk of global debt crisis

We’re over 600 words on, but we’re still not done discussing all the major financial bears on the road. The value of the government debts of countries from so-called emerging economies has also been hit hard. This leads to higher financing costs for countries that are not very stable in themselves. It is quite possible that some countries will soon no longer be able to meet their obligations and thus pull others along with them. The countries that are in trouble have obtained their funds from other countries.

In addition, there is currently the problem that financing costs for companies are on the rise. Even the spread between interest rates at the Federal Reserve and market rates for companies is widening. Credit buyers are willing to take less risk than usual due to uncertain macroeconomic conditions. An increase in the financing costs of companies is at the expense of their profitability, which in turn can be problematic for unemployment. To cut a long story short, there’s a good chance we’re in for a recession.

The big question

The first major recession in Bitcoin’s life is just around the corner and the big question is how deep do we go and how long it will last. To answer those questions, it is important to keep a close eye on the Federal Reserve. After all, they are the ones who play with fire and control the fate of the global economy.

How bitcoin will fare in this climate is a difficult question to answer. Many analysts feel that we have bottomed out. What we have seen a number of times in the past is that bitcoin reaches the bottom for the traditional financial markets and then rebounds faster. We are now entering a period where you have to be very careful, but these are generally the times when great abilities can be built. To do this, you have to bet on the right financial assets at the right time. However, a near-term recovery of bitcoin does not seem likely given the macroeconomic thunderclouds.

Disclaimer: The opinions and statements shared in this column are the author’s only and do not necessarily reflect or represent the opinions and views of Crypto Insiders.

–