New applicants government bonds for citizens he no longer has to go to the branch in person banks and pay 250 crowns for the initial registration. But it has a catch: The road and the fee to avoid only the owners state eCitizens with activated chip.

Since the end of 2018, when the Minister of Finance Alena Schillerová s bonds following the example of Miroslav Kalousek, new applicants had to come to one of the selected bank branches – currently the state cooperates with Česká spořitelna a ČSOB. At the same time, bonds can only be ordered in a fraction of their branches.

Right at the beginning, new applicants lost 250 crowns on the “entry fee” for submitting an application for subscription through a distributor. Especially when buying a smaller number of bonds, this significantly reduced their actual yield in practice.

The fee could be avoided only by those who had previously had electronic access to asset management. However, this online bond administration could not be established without a personal visit to a selected bank branch. When the newcomer ordered the bonds there directly, he paid the mentioned 250 crowns. If he was only interested in setting up online access, the fee was 500 crowns. The state then sent them access data by post and on their mobile phones.

Only those who have in the past government bonds for citizens they shopped and thus have electronic access, they could buy other bonds fully online – without visiting a branch and free of charge.

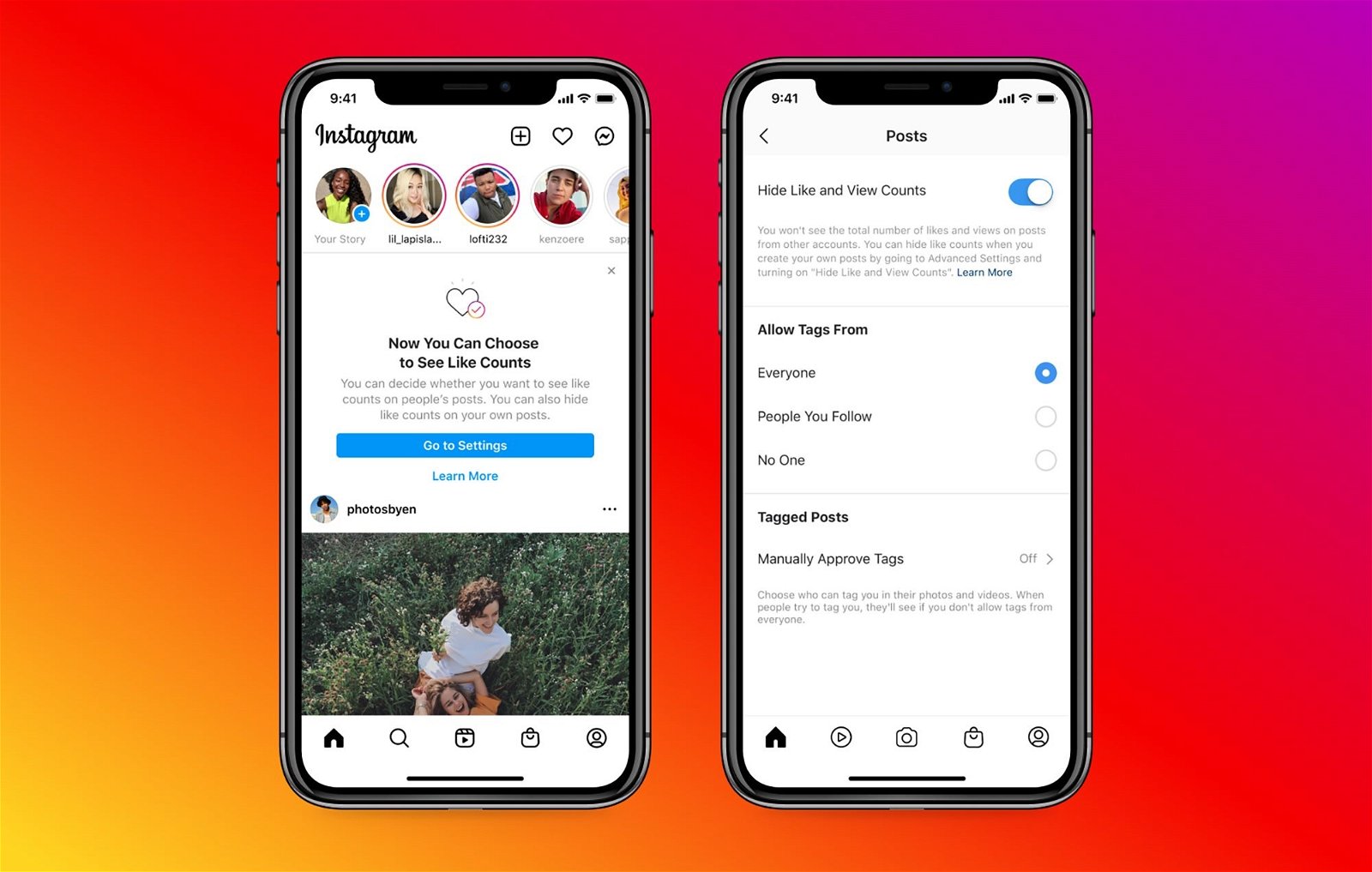

The Ministry of Finance announced today that new applicants can also set up electronic access fully online. However, they need a “means with a high level of guarantee” – typically an identity card (e-Citizen) with an activated contact electronic chip. Conditions for high level also meets the solution from První certifikační autorita, the MojeID service was also recently accredited in a variant with a special hardware key.

A medium level of warranty called “substantial” – typically bank identity – it is not enough to open a bond account. This is despite the fact that it is the banking identity that people use to manage their savings in the bank, to go online filing a tax return etc.

Why is the ministry stricter than the banks? “The requirement to use electronic identification at a high level in the initial identification of a new client when opening an asset account stems directly from the Anti-Money Laundering Act (AML). It will be possible to use a bank identity for the subsequent management of the asset account, including the purchase of government bonds. Of course, the current owners of the Bond of the Republic will also be able to use it, “explained Šimon Blecha from the Office’s press department to the Poney.cz website.

The ministry is still planning a slight improvement, but it will not make it any easier for those interested. “By the end of 2021, we also anticipate the possibility of opening an asset account for identity holders only at a significant level or even for those interested without an electronic identity. However, in accordance with the requirements of the AML Act, such an applicant will need to undergo a physical identification. In practice, this will mean one visit to the Czech Point branch, which will further expand the distribution network of government bonds for citizens, ”explains Blecha.

The Office did not explain why a new applicant with a bank identity could not verify his identity remotely – by paying for bonds from a verified bank account, similar to what is common when opening an account with another bank.

The minimum amount of one order remains 1000 pieces (ie 1000 crowns), the maximum number has risen since this spring to 50 million from the previous five million for each type of bond within one issue.

People are clearly most interested in the anti-inflationary option. Although it will not add 0.5 percentage point above the rise in consumer prices as of this year, “Only” will cover inflation, on the other hand, revenues are newly exempt from 15% withholding tax.