With the warning: we are not declaring victory over inflation

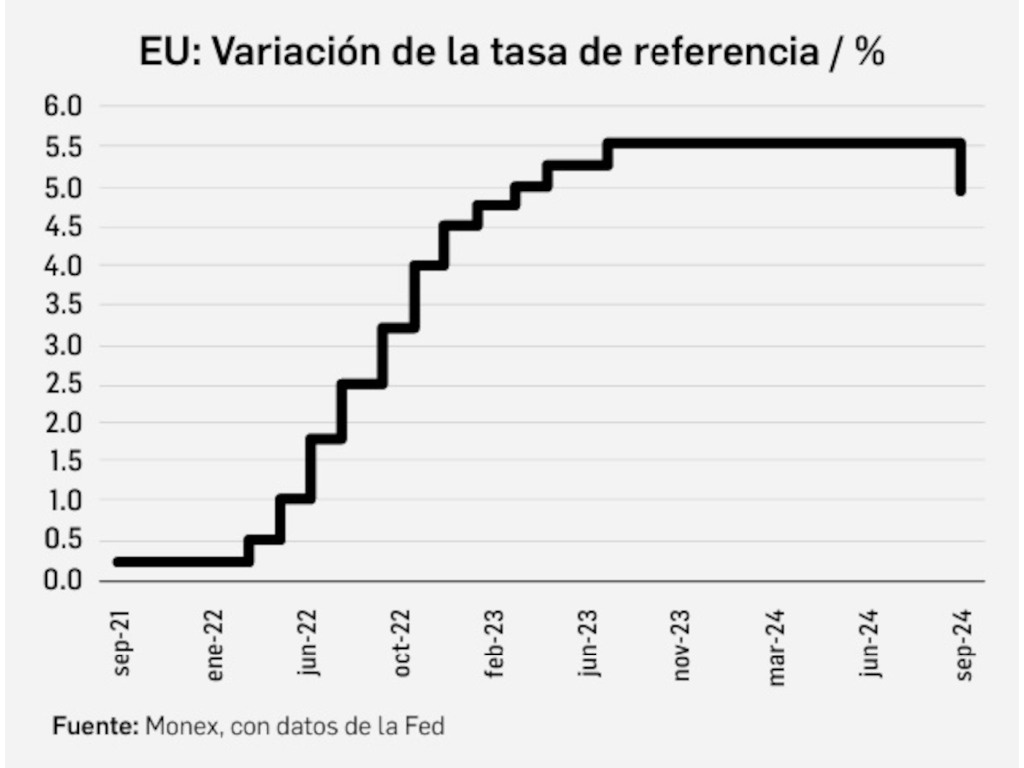

the US central bank decided to cut by 0.5 percentage points the range of the federal funds rate, which determines the cost of credit at which companies and people are financed, to place it between 4.75 and 5 percent.

After eight consecutive monetary policy meetings with the highest rate in two decades, the Federal Open Market Committee (FOMC) of the Federal Reserve (Fed) decided yesterday to move its reference rates lower, the first cut since 2020, which seeks to prevent the cooling of the labor market from turning into a deeper freeze.

Although the monetary decision was not unanimous, since one member voted for a cut of 0.25 percentage points, the Fed announced that rates could remain below 4.5 percent by the end of the year, since it will not opt for a more daring path. in the rate cut cycle.

The committee has gained greater confidence that inflation is moving sustainably toward 2 percent, and judges that the risks of achieving its employment and inflation goals are roughly in balance.

highlighted the monetary authority in its economic policy statement.

The US central bank was not the first monetary authority in industrialized countries to cut interest rates, but it is the signal that its peers in the United Kingdom, the eurozone and Canada were waiting for, which had already taken a first step. Other countries, such as Mexico, India and South Korea, were essentially waiting on the size of the Fed’s move.

The Bank of Mexico (BdeM), which will have its monetary policy meeting on the 26th, will take into account the position that the Fed has revealed to include it in its analysis and monetary decision-making. So far, the analyst consensus expects a decrease of 0.25 percentage points.

In a press conference, Jerome Powell, president of the Fed, declared that with the monetary movement they are not declaring victory over inflation; In addition to guaranteeing that the monetary authority did not take long to lower rates, as the market considers it, so No one should look at today’s decision (the cut of half a percentage point) and think that this will be the pace (of lower rates)

.

High interest rates seek to control inflation by discouraging borrowing and spending, allowing supply and demand to balance.

More unemployment, less inflation

The Fed said in its statement that US economic activity has continued to expand at a solid pace, although work has slowed, and the unemployment rate has increased but remains low. Inflation has moved further toward the FOMC’s 2 percent target, but remains somewhat elevated.

Gross domestic product (GDP) growth estimates for 2024 were lowered from 2.1 to 2 percent; and for 2025 and 2026 they remained unchanged at 2 percent.

The inflation forecast was revised downward from 2.6 to 2.3 percent for 2024; from 2.3 to 2.1 percent by 2025 and the goal of 2 percent will be reached in 2026.

The FOMC still estimates rate cuts of an additional 0.5 to 0.75 percentage points, which would bring the rate to a range of 4.25-4.5 percent by the end of 2024, and 3-3.25 percent next year.

During 2024, it is anticipated that the federal funds rate will continue to adjust. Of the 19 members of the committee they estimate a cumulative cut of 0.5 percentage points; seven see a 0.25 point cut; two do not anticipate additional cuts and one foresees a cumulative cut of 0.75 percentage points.

#Fed #surprises #halfpoint #cut #interest #rate

– 2024-09-28 12:08:13