The US Federal Reserve raised its key interest rate sharply on Thursday and will also reduce its balance sheet, ie reduce the volume of securities it holds.

“The Fed made a serious mistake and started to tighten too late,” writes Tomáš Pfeiler, Cyrrus’s portfolio manager. According to him, the Fed has reduced its room for maneuver by postponing the decision and is now being forced to take drastic action, which could shake markets.

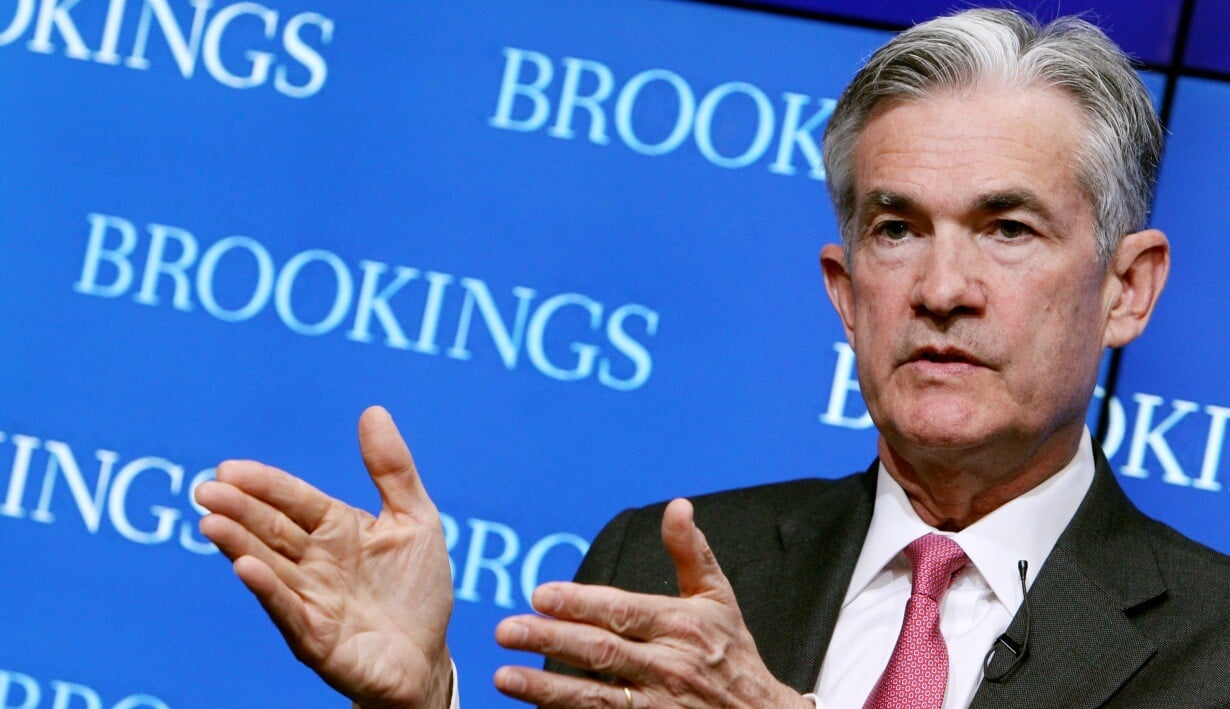

Fed chief Jerome Powell recognizes that he has spent much of his career in investment banking. In their carefully calibrated appearances at central bank press conferences, they always try to surprise the markets as little as possible. This art brought Powell to absolute perfection at the May meeting, when it announced a half-percentage point increase for the first time since 2000 – and yet the main US stock index, the S&P 500, nevertheless strengthened by three percent.

At the last meeting, however, a number of very important things were mentioned that are not at all positive for the further direction of the markets. In addition to raising interest rates, the Fed will start reducing its balance sheet. It will run for three months in test operation at a rate of $ 47.5 billion per month, and the volume of the maximum monthly reduction will double to 95 billion since September.

–

In addition, the US Federal Reserve is likely to repeat the rate hike by half a percentage point at at least two subsequent meetings. However, all these events were covered by one note: central bankers will not increase rates by 0.75 percentage points at their next meetings.

What does this information tell us? The Fed does not plan to turn inflation at all costs. It also takes into account other factors, including asset price developments. This will logically please investors – at least in the short term. The governor also set an optimistic tone on inflation. According to him, it will soon culminate and gradually begin to fade.

The possibility of a smooth economic landing without the need to start a recession thus remains at stake. So should investors stay calm?

We certainly cannot consider the overall tone of the meeting to be dovish. Jerome Powell mentioned that in the event of persistent inflationary pressures, the Fed will go with interest rates above the level of neutral rates. This means a value that already stifles economic performance.

The announced balance reduction remains largely unknown. It is difficult to find a historical precedent for the rate of balance sheet reduction announced by the Fed.

It was the record increase in the Fed’s balance sheet that helped drive stock markets to a maximum during the covid crisis. The balance sheet has swelled from $ 4.2 trillion to the current nine trillion since March 2020, which, intuitively, had to be reflected in the prices of all financial assets.

Gradually reducing the balance sheet can send asset prices down. Recall that when the central bank began to shrink its portfolio in 2017, the reduction first took place at a rate of ten billion per month.

When the pace of decline reached 50 billion a month at the end of 2018, the Fed had to stop it as funding conditions tightened sharply. Stock exchanges experienced a brutal slump during December 2018.

At the moment, it is clear that the monetary authorities have made serious mistakes and are late in tightening their policies. The purchases of assets were to be completed during the second half of last year, and the first increase in interest was to take place by the end of 2021 at the latest.

The Fed is shrinking its room for maneuver by postponing the decision. He is now practically forced to take more drastic action, which can have more destabilizing effects on the entire financial market.

Although the bourgeoisie is now betting that rates will rise to 2.75 percent by the end of the year, expectations may change – especially at a time when the Russo-Ukrainian war or the zero-tolerance policy on coid in China are exacerbating inflationary pressures.

There is thus a high probability that the Fed will move rates to a much more restrictive zone this year. Some economists estimate that interest rates will be between four and five percent at the end of the year.

They are not yet ready for such a tightening of stock market policy. The current hawkish turnover and accompanying growth in bond yields turned out to be negative for equities as the indices fell from last year’s highs.

Shares of young technology companies are particularly vulnerable to higher rates. The index of dynamic technology companies, whose operations are now at a loss but with a significant growth prospects, has fallen by 40 percent since the beginning of the year. Ark Innovation is losing almost forty-five percent this year well-known investor Cathie Wood.

Over the past year, retail investors have fallen into the mistaken belief that stocks can only go up. Due to the extremely generous central bankers, they used to shop after almost the slightest slump. However, sobriety follows this year. After an excellent year in 2021, investors can realize that the policy of central banks also has its downside.

–

–

;Resize=(1200,627)&impolicy=perceptual&quality=medium&hash=9be512c94ca60a4bc95977c21e25403e46731c6817f03cc4ceab045a6cfeb85c)