In Ukraine, the Cabinet of Ministers has developed a bill that provides for an increase in the single tax. The innovation may affect individual entrepreneurs (FOPs) of the fourth group.

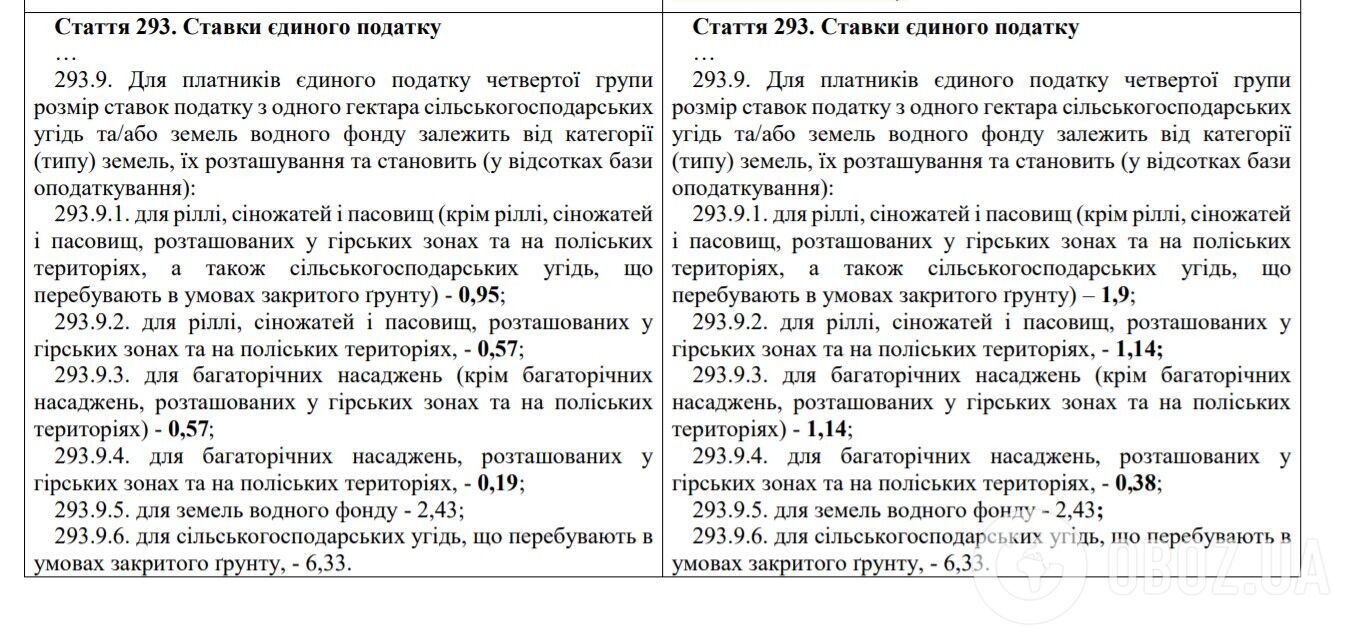

This is stated in OBOZREVATEL material… Individual entrepreneurs in the fourth group of the single tax (farmers) will have to pay more for each hectare. So, they plan to revise the following rates:

-

for arable land, hayfields and pastures – from 0.95 to 1.9;

-

for arable land, hayfields and pastures located in mountainous zones and in Polissya territories – from 0.57 to 1.14;

-

for perennial plantations (except for perennial plantations located in mountainous zones and in Polissya territories) – from 0.57 to 1.14;

-

for perennial plantations located in mountainous zones and in Polissya territories – from 0.19 to 0.38.

–

–

Iron ore rates will rise significantly. Under the new scale, the iron ore (iron ore) rent rate will depend on the CFR China iron ore price index with 62% iron content. The highest will be 16% (at a price above $ 180 / ton), then 14% (from $ 150 to $ 180 / ton), 12% (from $ 120 / ton to $ 150 / ton), 8% (from $ 85 to $ 120 / ton), 3 % (from $ 65 to $ 85 / ton) and, finally, 0.1% (below $ 65 / ton).

Moreover:

-

will be allowed carry out checkswhen there is information about violations in the turnover of fuel, it will be prohibited to reduce the cost of minerals (+3 billion);

-

will be transferred to manufacturers and importers payment of 5% excise tax on the maximum retail price of tobacco products (+1.9 billion UAH);

-

implement minimum tax per hectare of agricultural land (+10.3 billion);

-

limit VAT refunds for intermediaries in the sale of consumer goods (UAH +3 billion).

As reported OBOZREVATEL, December 1, 2020 The Verkhovna Rada voted the whole bill No. 4449-d, which postpones the mandatory use of cash registers for business for a year.

–